From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Strong Despite Ukrainian Export Shifts: Activity Trends Mixed, Procurement Strategies Evolving

Europe’s steel market demonstrates overall strength, tempered by notable shifts in Ukrainian exports and mixed activity levels across key regional steel plants. The news article “Flat steel exports from Ukraine exceeded 1.1 million tons in January-August” highlights a slight decrease in Ukrainian flat steel exports, while “Ukraine increased its exports of long rolled products by 44.4% y/y in January-August” indicates a significant increase in long rolled exports. The activity changes observed at the three steel plants cannot be directly linked to the news articles.

European Steel Plant Activity – 2025

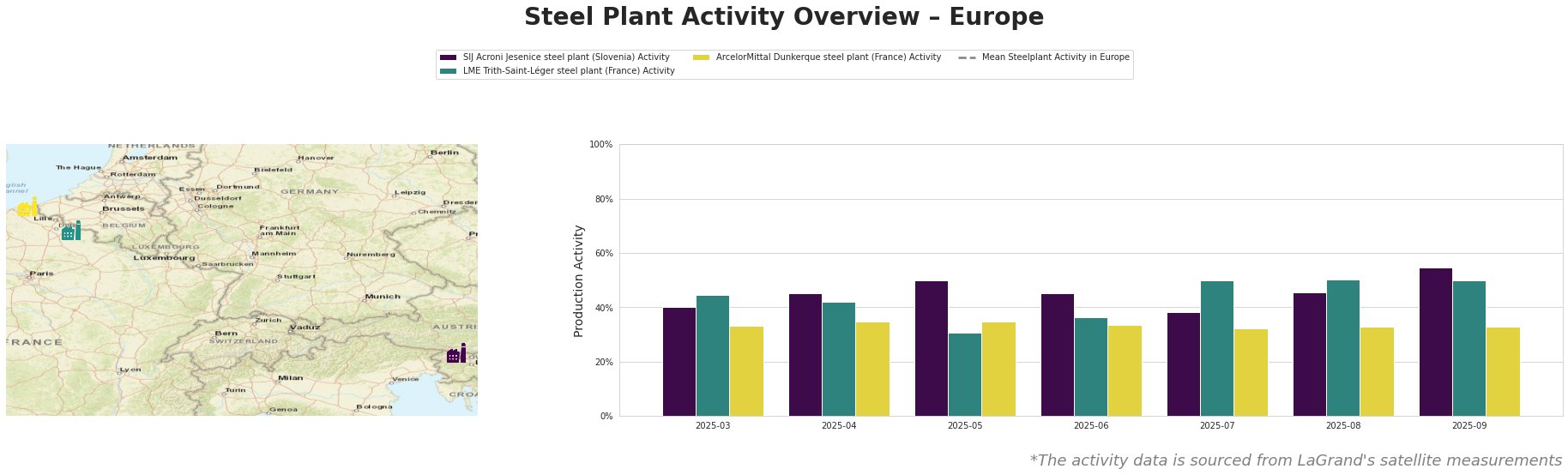

Overall, the “Mean Steelplant Activity in Europe” fluctuated throughout the observed period, ranging from a low in April to peaks in March, May, July and August. The individual plant activities show more specific trends.

SIJ Acroni Jesenice steel plant (Slovenia), an EAF-based producer of flat and long rolled products, saw its activity fluctuate, with a notable peak at 55% in September 2025 and a low of 38% in July 2025. The observed fluctuations at SIJ Acroni Jesenice steel plant cannot be directly linked to any of the provided news articles regarding Ukrainian steel exports.

LME Trith-Saint-Léger steel plant (France), an EAF-based producer of slabs and hot rolled coil, experienced a low of 31% in May 2025, followed by a rise to 50% in July and August 2025, maintaining this level through September 2025. These variations cannot be directly linked to any of the provided news articles regarding Ukrainian steel exports.

ArcelorMittal Dunkerque steel plant (France), an integrated BF-BOF producer of slabs and hot rolled coil, exhibited relatively stable activity, ranging narrowly between 32% and 35% throughout the observation period. This plant consistently operated below the mean European steel plant activity. The relatively stable activity levels at ArcelorMittal Dunkerque steel plant cannot be directly linked to any of the provided news articles regarding Ukrainian steel exports.

Evaluated Market Implications

Based on the news articles, the shift in Ukrainian exports could lead to increased price competition in certain product segments (e.g., long rolled products) within the European market, as highlighted by “Ukraine increased imports of long rolled products by 48% y/y in January-August“. While overall European steel plant activity remains relatively stable, the shift in focus of Ukrainian steel exports needs to be watched carefully.

Recommended Procurement Actions:

* Monitor Long Rolled Steel Pricing: Given the increase in Ukrainian long rolled steel exports reported in “Ukraine increased its exports of long rolled products by 44.4% y/y in January-August” coupled with “Ukraine increased imports of long rolled products by 48% y/y in January-August“, procurement professionals should closely monitor pricing trends for long rolled products, particularly in Poland, Romania, and Moldova.

* Diversify Flat Steel Sourcing: Considering the slight decrease in Ukrainian flat steel exports reported in “Flat steel exports from Ukraine exceeded 1.1 million tons in January-August“, and the increase of Turkish steel exports to Ukraine as stated in “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August“, buyers who rely heavily on Ukrainian flat steel should consider diversifying their sources to mitigate potential supply disruptions and protect against reliance on single country imports.