From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Strengthens: Production Gains in Spain, Poland, and Italy Signal Positive Outlook

Europe’s steel market presents a mixed picture, with increasing production in some nations contrasting with declines elsewhere. The positive trend is highlighted by the news articles “Spain increased steel production by 6.1% y/y in January-April“, “Poland increased steel production by 3.9% y/y in January-April” and “Steel production in Italy continues to grow“. Simultaneously, the article “Austria reduced steel production by 6% y/y in January-April” and “Austria crude steel production decreases” indicates contractions influenced by high production costs. While the news suggests diverging trajectories, it is challenging to directly relate the overall figures to the activity levels observed from satellite imagery.

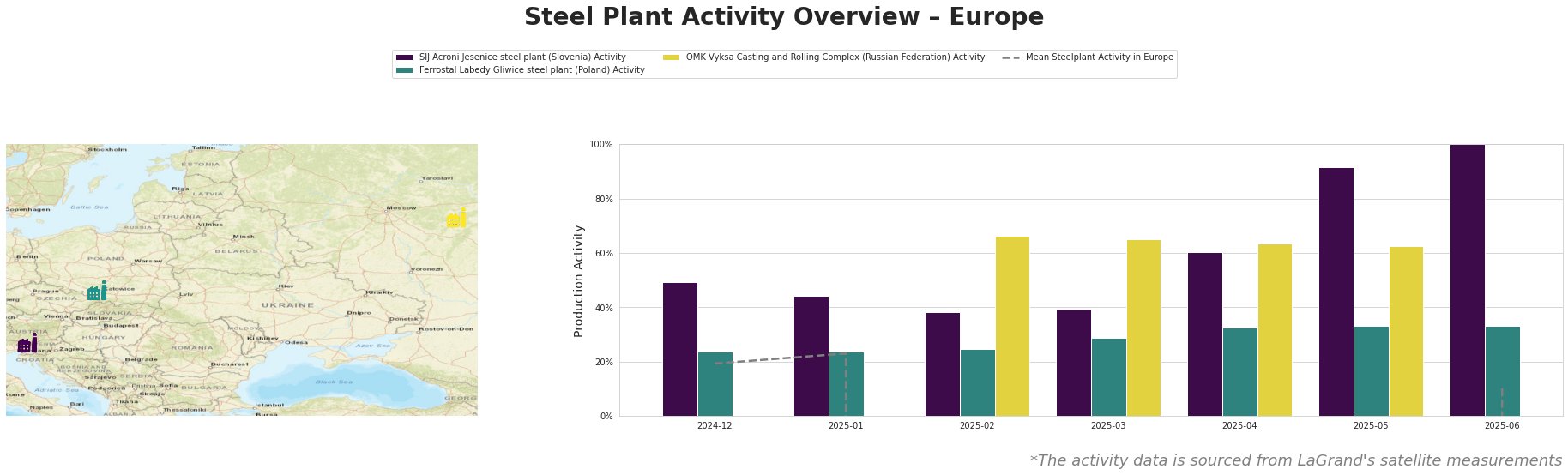

Here’s a summary of recent monthly activity trends:

*Negative values should be interpereted as data errors.

The data presents a mean activity level, however large negative values for some time points are making interpretation of the mean activity levels very difficult.

SIJ Acroni Jesenice steel plant: This Slovenian plant, with an EAF-based crude steel capacity of 726,000 tons, produces flat rolled steel products. Satellite data shows a steady increase in activity from 44% in January 2025 to a peak of 100% in June 2025. This notable surge in activity does not directly correlate with any of the provided news articles, hence no explicit connection can be established.

Ferrostal Labedy Gliwice steel plant: Located in Poland, this EAF-based plant has a capacity of 500,000 tons and focuses on hot-rolled products and bars. Satellite data indicates a relatively stable activity level, fluctuating between 24% and 33% from December 2024 to June 2025. While the news article “Poland increased steel production by 3.9% y/y in January-April” reports overall gains in Polish steel production, no direct link can be definitively established between the nationwide figures and activity levels at this specific plant.

OMK Vyksa Casting and Rolling Complex: With a 1.25 million ton EAF capacity, this Russian plant produces hot-rolled flat products for pipelines. Satellite-observed activity gradually decreased from 66% in February 2025 to 62% in May 2025. As this plant is not located in Europe, there are no directly named news articles provided in the dataset for comparison.

Based on the “Spain increased steel production by 6.1% y/y in January-April” article and the “UNESID: Spanish steel output up 13.3 percent in Mar from Feb” article, Spanish steel production shows strong growth. The growth is also reflected by the rising scrap recycling in Spain. Italy demonstrates similar, but smaller growth. Given the increased production in Spain and Italy, steel buyers should consider:

* Prioritizing Spanish and Italian suppliers: Procurement from these regions may offer more secure supply lines due to increased domestic production, mitigating the risk of potential supply disruptions.

The “Austria reduced steel production by 6% y/y in January-April” and “Austria crude steel production decreases” article, however, indicates production cuts. As a mitigation action, buyers should:

* Diversify sourcing: Reduce reliance on Austrian steel suppliers to avoid potential disruptions linked to production decreases. Consider alternative suppliers in Spain, Poland, or Italy, where production is on the rise.