From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Strengthens Amid Coking Coal Supply Boost, Plant Activity Up

Europe’s steel market shows positive momentum, driven by increased coking coal supply from Poland and resilient steel plant activity. The observed activity aligns with reports of increased coking coal output, such as “Poland’s JSW to increase coking coal output with new longwalls” and “Poland’s JSW launches a new longwall at the Pniówek mine with reserves of 840,000 tons“. While Australia’s Gladstone port coal exports drop in FY25 reports declines in coal exports globally, European steel production is bolstered by domestic supply increases, with Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices expecting increased met coal exports.

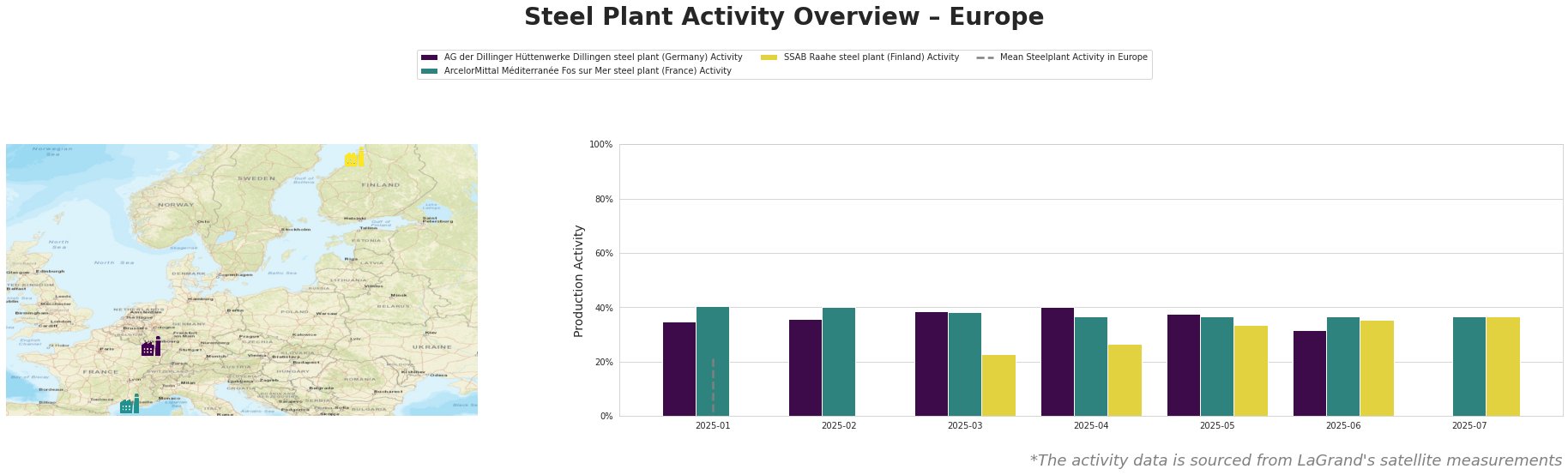

The mean steel plant activity in Europe is hard to establish from the activity measurements, due to the inconsistent data.

AG der Dillinger Hüttenwerke Dillingen steel plant, a major integrated steel plant in Germany with a crude steel capacity of 2.76 million tonnes per annum (ttpa) utilizing BOF technology, shows a fluctuating activity level. The activity peaked in April at 40% before declining to 32% in June. The drop in June cannot be explicitly linked to the provided news articles.

ArcelorMittal Méditerranée Fos sur Mer, a 4 million ttpa BOF-based integrated steel plant in France, exhibits a relatively stable activity level, hovering around 37%-41% from January to July. No significant deviations are observed during the reported period, and there’s no direct linkage to the provided news articles.

SSAB Raahe steel plant in Finland, producing 2.6 million ttpa via the BOF route, demonstrates increasing activity from March (23%) to July (37%). The rise might be driven by increased demand and improved coking coal availability, but this cannot be directly linked to the provided news articles.

The Polish coking coal producer JSW, as reported in “Poland’s JSW to increase coking coal output with new longwalls” and “Poland’s JSW launches a new longwall at the Pniówek mine with reserves of 840,000 tons” is boosting its output, and this may reduce dependence on imported coal.

Given the increase in coking coal supply from JSW and steady steel plant activity in Europe, procurement professionals should:

- Prioritize securing coking coal contracts with JSW to capitalize on increased domestic supply and potentially mitigate risks associated with global trade uncertainties highlighted in “Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices“. This diversifies the supply chain and potentially reduces costs.

- Closely monitor global met coal pricing trends, especially considering the anticipated softening of prices outlined in “Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices“. Negotiate contract terms that allow for price adjustments based on benchmark indices.