From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Resilience Amidst Geopolitical Shifts: Plant Activity Holds Steady

European steel markets demonstrate surprising stability despite geopolitical uncertainties, with steel plant activity remaining robust according to recent satellite data. This contrasts with potential trade tensions highlighted in news reports such as “Washington-Besuch: Merz bei Donald Trump – diese fünf Fallstricke lauern auf ihn” and “Mercedes-Chef Källenius über Trump und Merz: „Am meisten investieren wir in Deutschland““, which discuss potential trade challenges and the German auto industry’s efforts to navigate them. While these articles indicate potential future volatility, direct links to immediate, observable shifts in steel plant activity cannot be explicitly established from the provided data.

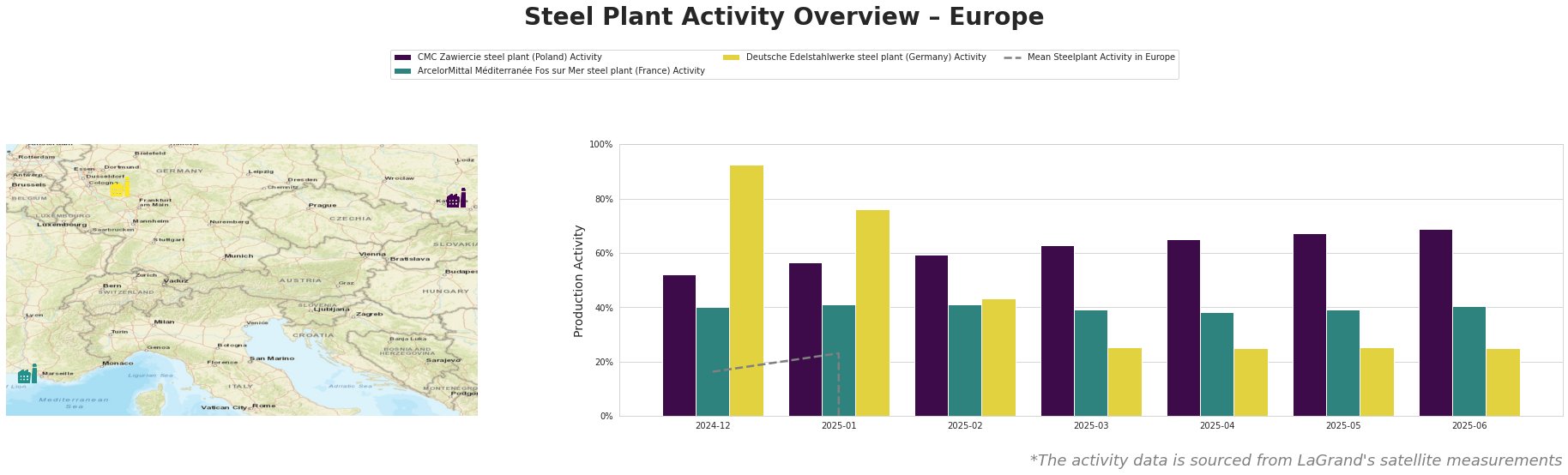

Recent monthly activity trends across key European steel plants are shown below:

Note: The “Mean Steelplant Activity in Europe” shows unrealistically large negative values due to data issues. This prevents meaningful comparison with individual plant activities.

CMC Zawiercie steel plant (Poland): This plant, relying on electric arc furnaces (EAF) with a 1.7 million tonne crude steel capacity, has exhibited a steady upward trend in activity. The plant’s activity has increased from 52% in December 2024 to 69% in June 2025. This suggests continued strong demand for its products across the automotive, construction, and energy sectors. The observed activity increase could signal a proactive response to potential future trade uncertainties discussed in “Washington-Besuch: Merz bei Donald Trump – Ukraine, Handelspolitik und die Gefahr der offenen Provokation“, although a direct causal link cannot be established.

ArcelorMittal Méditerranée Fos sur Mer steel plant (France): A fully integrated BF-BOF plant with a 4 million tonne capacity, this plant shows stable activity levels, fluctuating slightly between 38% and 41% over the observed period. This relative stability, especially given that the plant is slated to shut down BOF production by 2030, may indicate a strategic balance between current production and planned transition activities. No direct connection can be established between these stable activity levels and the news articles provided.

Deutsche Edelstahlwerke steel plant (Germany): This EAF-based plant with a 600,000-tonne capacity shows a notable decline in activity from 93% in December 2024 to a stable 25% from March to June 2025. This significant drop could indicate operational adjustments, maintenance, or a strategic shift in production focus. The news article “Mercedes-Chef Källenius über Trump und Merz: „Am meisten investieren wir in Deutschland“” discusses challenges in the German economy, but a direct link between these challenges and the observed drop in plant activity cannot be conclusively established from the provided information.

Evaluated Market Implications:

Given the stable to increasing activity at CMC Zawiercie, and the stable output at ArcelorMittal Méditerranée, concerns about immediate supply disruptions in Europe are not supported by the satellite data. However, the significant decrease at Deutsche Edelstahlwerke warrants attention.

Recommended Procurement Actions:

- For buyers relying on Deutsche Edelstahlwerke: Immediately engage with the supplier to understand the reasons behind the activity reduction and assess potential impacts on supply timelines and contract fulfillment. Explore alternative sources for specialized steel products if disruptions are anticipated.

- For buyers in general: While immediate disruptions are not broadly indicated, continuously monitor geopolitical developments discussed in “Washington-Besuch: Merz bei Donald Trump – diese fünf Fallstricke lauern auf ihn” for potential future trade policy impacts. Diversify supply chains where possible to mitigate risks associated with policy changes.

- Market Analysts: Closely monitor Deutsche Edelstahlwerke’s future activity and communications for clear insights into the reasons behind the recent drop. Further investigate potential implications across Germany’s specialized steel market segment. Track sentiment and statements reported in articles similar to “Merz und Trump: ++ Am Anfang setzt der US-Präsident eine Spitze gegen Merkel – dann gerät der Kanzler zur Nebensache ++ Liveticker” to anticipate policy shifts.