From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Shows Positive Trends Amid Import Shifts and Rising Scrap Exports

Europe’s steel market presents a mixed landscape of increased import activity and rising scrap exports, contributing to an overall positive, but complex, environment. Ukraine’s surge in long rolled product imports, as highlighted in “Ukraine increased imports of long rolled products by 63% y/y in January-June” and “In January-June, Ukraine increased imports of long rolled products by 63%,” coupled with the persistence of Russian steel imports into the EU, per “EU imported 2.57 million tons of iron and steel products from Russia in January-May,” underscore significant shifts in regional supply dynamics. The increase in Ukrainian scrap exports detailed in “Scrap exports from Ukraine reached 47.7 thousand tons in June” and “Scrap exports from Ukraine have increased by 63.4% since the beginning of the year.%” also impact steel production in the region. Satellite-observed activity levels do not show an immediate direct correlation to these news events.

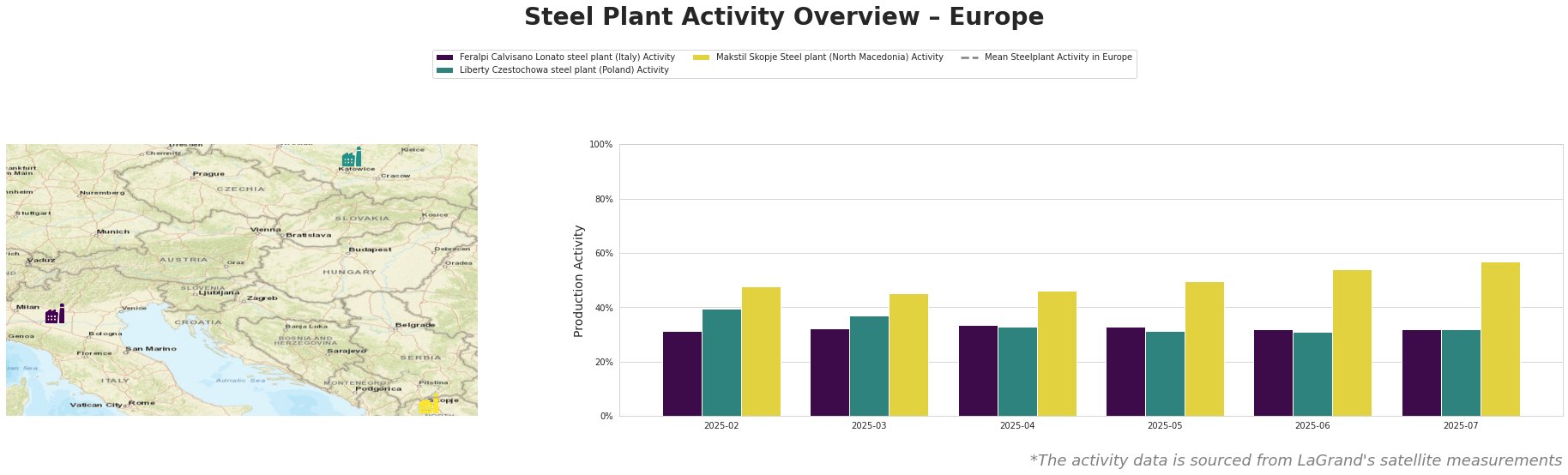

Activity levels across the three observed steel plants showed varying trends. The mean activity level in Europe is not usable due to incorrect values in the data. Feralpi Calvisano Lonato steel plant in Italy, an EAF-based producer of semi-finished products with a capacity of 600 ttpa, demonstrated relatively stable activity, fluctuating slightly from 31% in February to 33% in April and May, before settling back to 32% in June and July. Liberty Czestochowa steel plant in Poland, also an EAF-based plant producing semi-finished products (plate) with a capacity of 840 ttpa, experienced a gradual decrease from 40% in February to 31% in May, then showed a slight recovery to 32% in July. Makstil Skopje Steel plant in North Macedonia, an EAF-based producer of semi-finished products (slab) with a capacity of 550 ttpa, exhibited a consistently increasing trend, rising from 48% in February to 57% in July. No direct connection between the observed satellite data and the news articles could be established.

Feralpi Calvisano Lonato steel plant: This Italian plant, focused on billet production using EAF technology, showed stable activity levels between February and July 2025. While the news highlights increased import pressure in Ukraine and continued Russian steel imports into the EU, no direct impact on Feralpi’s activity is evident from the satellite data.

Liberty Czestochowa steel plant: The Polish plant, equipped with an EAF and producing steel plate, saw a slight decrease in activity from February to May, followed by a minor increase. Again, no clear link between the observed activity and the reported increase in imports from Ukraine or the ongoing imports from Russia can be directly established.

Makstil Skopje Steel plant: This North Macedonian plant, specializing in slab production via EAF, showed a consistent increase in activity levels over the observed period. Similar to the other plants, there’s no immediately apparent connection between the increased activity at Makstil and the import/export trends highlighted in the news articles.

The continued increase in Ukrainian scrap exports, as reported in “Scrap exports from Ukraine reached 47.7 thousand tons in June” and “Scrap exports from Ukraine have increased by 63.4% since the beginning of the year.%“, highlights a potential risk to scrap availability for EAF steelmakers in Europe. While the observed plant activity levels don’t currently reflect this, the trend warrants close monitoring.

Given the observed market dynamics, steel buyers and analysts should:

- Closely monitor scrap prices and availability: The surge in Ukrainian scrap exports, especially to Poland, could tighten supply and increase costs for EAF-based steelmakers in the region, potentially impacting their production costs.

- Evaluate alternative sourcing strategies: With increased import penetration from Turkey and China into Ukraine, as noted in “Ukraine increased imports of long rolled products by 63% y/y in January-June” and “In January-June, Ukraine increased imports of long rolled products by 63%,” and the ongoing presence of Russian steel in the EU market (“EU imported 2.57 million tons of iron and steel products from Russia in January-May“), buyers should assess these regions as potential alternative sources, considering geopolitical risks and trade regulations.

- Engage in proactive contract negotiations: Given the potential for increased scrap costs, buyers should proactively engage with steel suppliers, especially those relying on EAF technology, to understand their raw material sourcing strategies and negotiate contract terms that account for potential price volatility.