From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Sentiment Remains Neutral Amid Production Fluctuations

In Europe, the steel market sentiment is currently neutral, influenced by significant operational disruptions and maintenance activities across key plants. Notably, Zaporizhstal temporarily suspended production due to complete power outage amidst heavy shelling in Ukraine, which directly correlates with observed changes in activity. Following these events, the plant has since resumed operations on December 24, 2025, as noted in the article titled Zaporizhstal has resumed operations – spokesperson for the Zaporizhzhia Regional State Administration.

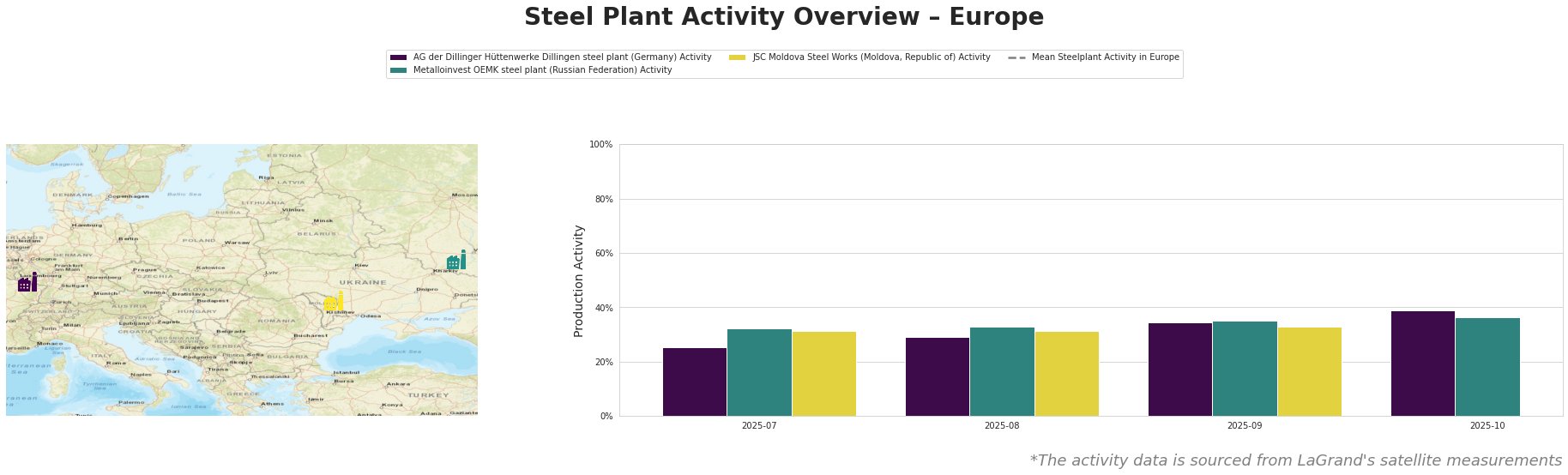

The observed data indicates a declining trend in the mean activity levels across Europe, with a significant drop from July’s 40.78% to October’s 27.18%. Notably, AG der Dillinger Hüttenwerke Dillingen saw a rise to 39% in October, contrasting with other plants which displayed more stable or declining figures. The stable performance at Dillinger can be linked to unaffected operations, while Metalloinvest OEMK and JSC Moldova Steel Works also maintained relatively steady output during this period.

AG der Dillinger Hüttenwerke Dillingen, located in Saarland, primarily produces rolled and semi-finished steel products through an integrated BF process, maintaining production at 39% in October 2025. This alignment with stable European standards suggests resilience amidst regional volatility. In contrast, the Metalloinvest OEMK plant, a major DRI/EAF producer in Belgorod, recorded only slight activity fluctuations, maintaining an output of 36% in October. Despite this, no significant disruptions were reported, indicating a stable operational outlook.

The JSC Moldova Steel Works, using EAF technology, maintains activity levels around 31%, exhibiting consistency amidst regional uncertainties. However, noted disruptions affecting Zaporizhstal could introduce volatility in Eastern European supply chains.

The uncertainty regarding power supply stability in Ukraine may lead to potential supply disruptions for steel buyers relying on Zaporizhstal. For procurement professionals, it is advisable to monitor developments closely corresponding to ongoing conflicts and prepare for alternative sourcing options, particularly from resilient plants like AG der Dillinger Hüttenwerke Dillingen and Metalloinvest OEMK. Additionally, the completion of maintenance at Central Mining may create temporary impacts on pellet availability, suggesting timely procurement actions are essential to mitigate risks associated with fluctuating supply dynamics.