From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Strong Recovery Driven by Ukraine and Turkey Developments

Recent observations indicate a very positive sentiment in the European steel market, largely influenced by alterations in iron ore and pig iron supply. The articles titled “Ukraine reduced iron ore exports by 4.9% y/y in January-November” and “Turkey more than doubled its imports of pig iron from Russia in January-October” highlight significant disruptions and shifts in sourcing that could impact European steel supply dynamics.

In 2025, Ukraine’s iron ore exports decreased significantly, as evidenced in “Ukraine remains among the top five suppliers of agricultural products to Turkey”, with exports halving while demand surged from the U.S. and the EU for pig iron, primarily documented in “Ukraine exported 1.73 million tons of pig iron in January-November”. However, satellite data shows increased activity at Turkish steel plants, likely correlating with the rise in imports from Russia, confirming a robust operational environment despite geopolitical tensions.

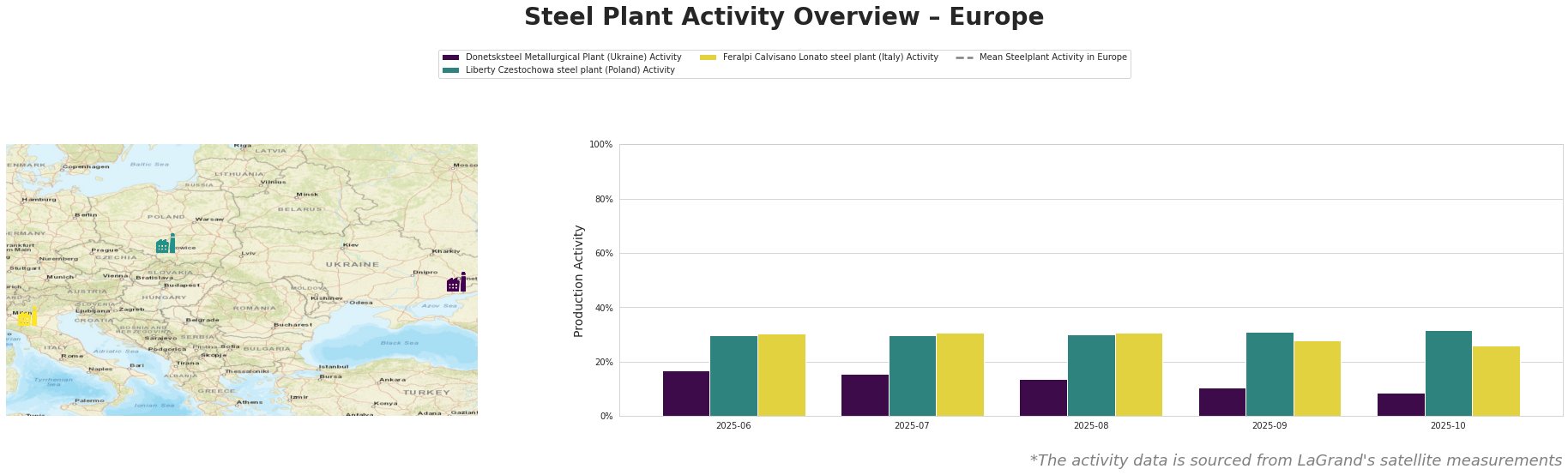

The Donetsksteel Metallurgical Plant in Ukraine recorded no operational activity from June to October 2025, lingering at 0%, which aligns with the overall drop in iron ore exports as highlighted in “Ukraine reduced semi-finished exports by 30.5% y/y in January-November”. The plant’s inability to restart operations directly affects supply chains in the region.

In contrast, the Liberty Czestochowa Steel Plant maintained activity levels around 30-32% during this period, suggesting stability, though limited potential for growth as indicated by recent market reports. Despite this, the operational framework remains intact to cater to continuously high demand, as discussed in “Turkey’s pig iron imports increased significantly”.

Activity at Feralpi Calvisano Lonato showed a decline from 31% to 26% from September to October, with its EAF-oriented production strategy focusing on semi-finished goods. This slight dip does not denote immediate concern but warrants monitoring in alignment with market conditions indicated by the demand for finished products.

Evaluated Market Implications: Prospective supply disruptions are notable, particularly from the Donetsk region, where ongoing geopolitical strife could potentially further throttle exports. Steel procurement professionals should actively monitor developments surrounding Ukrainian exports and Turkish steel production dynamics, as secure sourcing will increasingly pivot towards countries that maintain robust supply chains, such as Turkey. Furthermore, leveraging the identified supply shifts may afford procurement professionals opportunities to secure advantageous pricing and contracts ahead of anticipated market fluctuations.