From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Rising Prices Amid Plant Activity Declines

In Europe, the steel market sentiment remains Neutral as production activity shows varied trends, closely related to recent news highlighting price increases. Articles titled “Polish long steel prices keep climbing amid higher costs, less pressure from import“ and “Growing costs push European domestic rebar prices higher“ reveal that rising production costs and less import pressure are driving domestic price hikes, particularly in Poland and across Europe, while satellite data indicates a decline in activity at key steel plants.

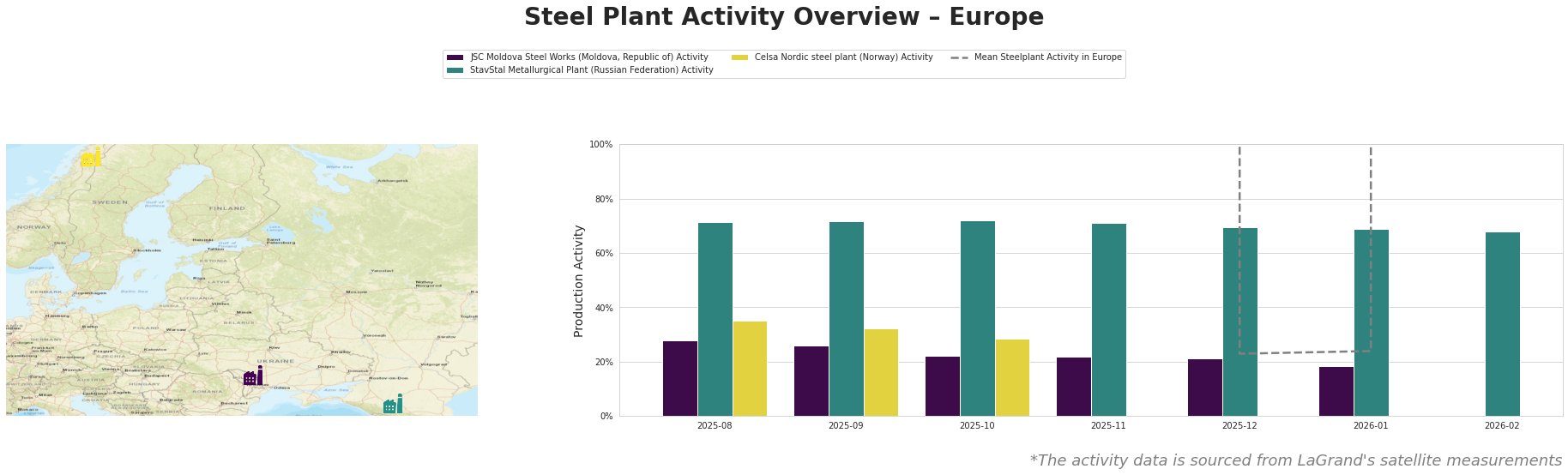

The JSC Moldova Steel Works has seen a notable decline in activity from 28% in August to 18% by January 2026, with no direct correlation to the articles provided. Conversely, StavStal Metallurgical Plant maintained stable output levels, fluctuating around 71% activity, though there’s no clear linkage to the news articles. The Celsa Nordic steel plant showed a gradual activity decrease from 35% to 29%, reflecting broader trends in the market, but again lacks a direct relationship to the recent news coverage.

The recent price increases of rebar in Poland—now ranging from 2,650 to 2,700 zloty as per “Polish long steel prices keep climbing amid higher costs, less pressure from import”—align with the drop in activity at JSC Moldova Steel Works, indicating potential strain on supply due to reduced output. Similarly, increased prices across Europe suggest a tightening market, as reported in “Growing costs push European domestic rebar prices higher”.

Given the observed activity declines, steel buyers should prepare for potential supply disruptions, particularly from the JSC Moldova Steel Works, which is critical for fulfilling regional demands. Analysts should consider locking in prices now for impending deliveries, especially for rebar and long steel products, as continued production costs from scrap and energy are likely to sustain upward pricing pressure. Recommended procurement actions include seeking contracts with stable producers like StavStal to mitigate risks related to price volatility and potential shortages influenced by the evolving market dynamics.