From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Price Hikes Amid Declining Imports

Recent developments in the European steel market indicate a neutral sentiment, influenced by rising prices and unstable plant activity levels. The core issue stems from the effect of the Carbon Border Adjustment Mechanism (CBAM), which is reducing import pressure and leading to increased domestic production costs. Articles titled “Polish long steel prices keep climbing amid higher costs, less pressure from import“ and “Prices for Polish rolled products continue to rise amid higher costs and less import pressure” detail this situation and its direct impact on market dynamics and pricing.

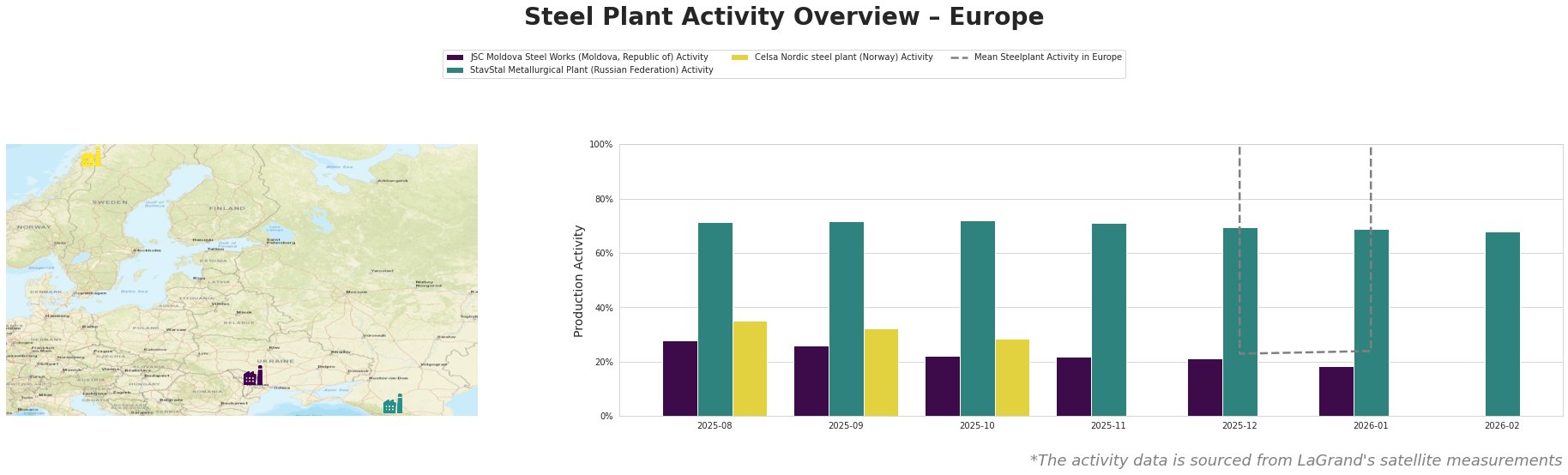

Measured Activity Overview

The activity levels across the plants have shown a downturn recently. Notably, JSC Moldova Steel Works has plummeted from 28% in August to 18% in January 2026, reflecting potential supply constraints exacerbated by the increase in prices mentioned in the news articles. The StavStal Metallurgical Plant has remained more stable, declining slightly from 72% to 68% during the same period, indicating resilience in activity levels amid the ongoing price hikes. Celsa Nordic has had limited data but has generally been stable compared to the mean activity.

The decline in JSC Moldova’s activity coincides with the sentiments in the articles focused on steel price increases, particularly due to escalated raw material costs and import pressures tied to the CBAM implementation.

Evaluated Market Implications

There are evident supply disruptions anticipated from JSC Moldova Steel Works, given its dramatic decline in activity (10% from October to January) likely tied to the adverse cost implications of increased feedstock prices and import limitations as discussed in the news articles.

Recommended Actions for Steel Buyers:

1. Prioritize Procurement from Stable Sources: With the StavStal Metallurgical Plant maintaining a steady output, buyers should consider increasing orders. The reliability of this plant may mitigate supply risks as other plants face declines.

2. Monitor Pricing Strategies: As prices continue to climb due to heightened production costs and reduced imports, procurement strategies should focus on securing contracts before reaching peak pricing levels, especially for rebar and wire rod, which have increased substantially in both Poland and Northern Europe.

The prevailing market conditions underscore the necessity for strategic buying decisions to navigate expected volatility effectively.