From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Positive Sentiment Amidst Price Fluctuations and CBAM Uncertainty

In Europe, the steel market is displaying a positive sentiment driven by increasing demand and rising prices, particularly in Italy. Significant changes in activity levels have been observed in steel plants across the region, as highlighted in the articles “Italian plate prices rise amid improved order intakes” and “European heavy plate prices rise on CBAM cost support; slab import dynamics raise concerns”, both indicating enhanced order intakes contributing to extended lead times and adjustments in pricing strategies. While there are underlying concerns regarding the impact of the Carbon Border Adjustment Mechanism (CBAM) as discussed in “CBAM expectations weaken purchasing decisions in the steel market”, producers remain optimistic about potential cost implications leading into 2026.

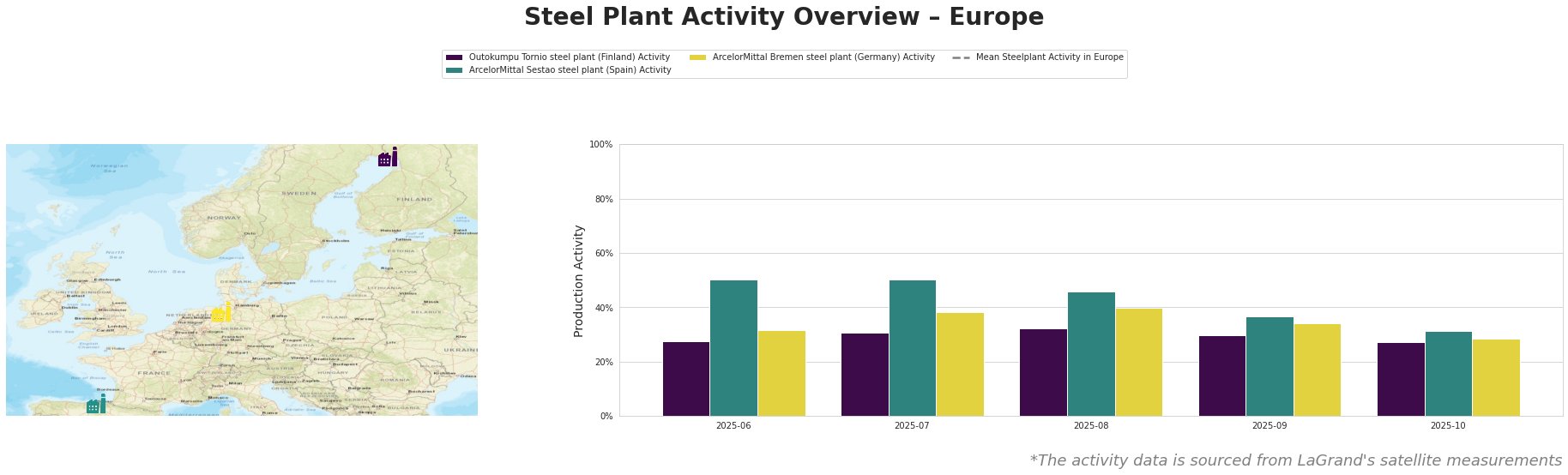

Activity levels for European steel plants have shown notable variation. Outokumpu Tornio’s activity has remained relatively stable at 27% over the past few months, correlating with stable market activity but raising questions due to potentially lower competitiveness as observed in “European plate market holds as CBAM concerns cloud import activity; slab dips on thin bookings”. Meanwhile, ArcelorMittal Sestao peaked at 50% in both June and July but has since dipped to 46% in August, likely linked to cautious purchasing post-CBAM announcements, as discussed in “EU HRC market steady as buyers step back, CBAM verification concerns mount”. ArcelorMittal Bremen has tracked similarly, with a peak at 38% before a decrease, indicating a decline in demand or strategic stock management aligned with the market’s cautious behavior.

The Outokumpu Tornio steel plant, located in Finland, has maintained steady activity levels around 27%. Its performance relies on electric arc furnace (EAF) technology, producing hot and cold rolled coils primarily for the automotive and construction sectors. Given the plant’s consistent output, it reflects market stability despite the overall uncertainties voiced in the articles, particularly regarding CBAM implications.

ArcelorMittal Sestao in Spain has also shown stability with increased activity observed earlier in the year, reflecting the rising demand for hot rolled coils. However, its reduction to 46% aligns directly with the recent hesitance indicated in the news regarding CBAM-related purchasing delays as noted in “CBAM expectations weaken purchasing decisions in the steel market.”

The ArcelorMittal Bremen plant, representing a more traditional integrated processing system, shows notable activity fluctuations mirroring market demands influenced by the articles. This indicates its role as a key player in the region’s supply chain, directly affected by market apprehensions surrounding verification processes linked to CBAM.

Recent market conditions indicate potential supply disruptions, most notably in Italian plate production stemming from delays in slab imports as forewarned in “European heavy plate prices rise on CBAM cost support; slab import dynamics raise concerns.” Steel procurement professionals should consider advancing purchasing strategies to secure stock, particularly for products in high demand or facing imminent price hikes. Purchasing in advance, especially for January and February deliveries, could mitigate risks associated with the current price dynamics and supply uncertainties.

Furthermore, attention should be given to evaluating orders based on the ongoing developments around the CBAM. Buyers might strategically delay non-essential inventory build-ups until clearer frameworks and verified emission data are established, highlighting the importance of flexibility in procurement strategies amid evolving regulatory landscapes.