From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Positive Outlook Amid Innovations and Sustainable Investments

In Europe, the sentiment for the steel market is very positive as demonstrated by the recent launch of Tata Steel Nederland’s new packaging steel production line, as reported in “Tata Nederland opens packaging steel production line“ and “Tata Nederland opens a packaging steel production line.” This initiative utilizes advanced, sustainable technologies which have been linked to a significant uptick in plant activity.

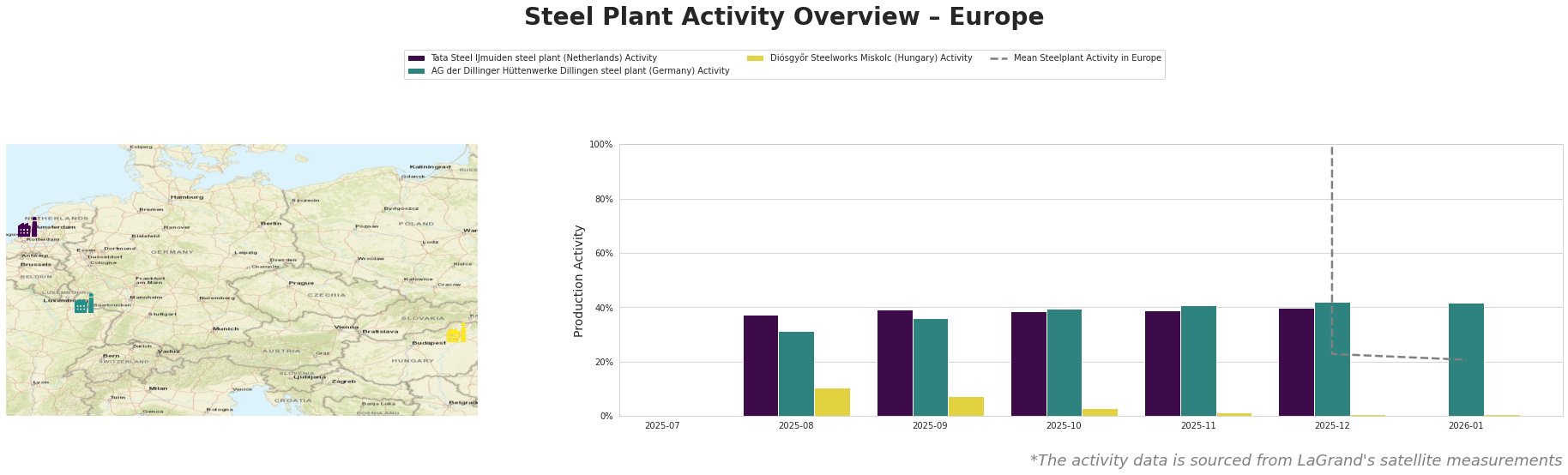

Measured Activity Overview

The recent activity data reveals that Tata Steel IJmuiden transitioned from 31% in August to 40% in December 2025, showing a strong recovery in the last quarter, which correlates with the boosted production capabilities outlined in the cited news articles. In contrast, AG der Dillinger Hüttenwerke Dillingen maintained a higher activity level than Tata but showed a slight downward trend in December, highlighting their stable production while facing competitive pressures. Diósgyőr Steelworks faced consistent low activity, reaching 1% by December, indicating minimal operational efficiency and possibly necessitating review.

Plant Insights

Tata Steel IJmuiden in North Holland has a crude steel capacity of 7.5 million tons and is focused on integrated production. The satellite data shows an activity spike to 40% in December, likely influenced by the launch of the new packaging steel line, as per “Tata Nederland opens packaging steel production line.” This innovation in sustainable manufacturing should bolster market presence and appeal to environmentally conscious clients.

AG der Dillinger Hüttenwerke in Saarland, with a production capacity of 2.76 million tons, recorded activity at 42% in December. The plant produces a wide variety of specialized steels across sectors like automotive and energy and has consistency amid tight competition, although a recent slight decrease could indicate a need for operational improvements to sustain this momentum.

Diósgyőr Steelworks has a much lower capacity at 0.55 million tons, and its ongoing struggle with activity levels (remaining at 1% by January 2026) suggests operational inefficiencies or a shift in market demand, although no direct ties to the recent news articles were found.

Evaluated Market Implications

The positive developments at Tata Steel imply supply chain optimization opportunities for buyers focusing on sustainable packaging solutions. With Tata’s innovations, there could be increased availability of competitively priced products driven by reduced costs and efficient production processes.

Supply disruptions could arise from Diósgyőr Steelworks‘ persistent low activity. Buyers may want to diversify sourcing away from this facility given its uncertainties. Conversely, engaging with AG der Dillinger Hüttenwerke could yield high-quality specialty products, but analysts should monitor production trends closely to predict future capacity shifts.

For procurement professionals, the focus should be on establishing partnerships with Tata Steel as they ramp up production of sustainable steel products, which are anticipated to meet rising regulatory standards and market demands.