From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Report: Positive Growth Driven by Investment in Electric Steel Production

Europe’s steel market is currently experiencing positive momentum, closely linked to significant developments in steel production capabilities. Notably, the articles “ArcelorMittal launches new €500 million electric steel production line in France,” and “ArcelorMittal France to launch new electrical steel production line by end of 2025,” reveal that ArcelorMittal is expanding its operations in France with a €500 million investment aimed at producing 155,000 tons of electric steel annually for the automotive and industrial sectors. This expansion is expected to boost activity levels at ArcelorMittal’s facility and enhance European supply chains. Concurrently, the challenges faced in Spain, as reported in “ArcelorMittal in Spain upgrades Coating Line, troubled BF Launch,” point towards a temporary stabilization of production at their Gijón plant, which could impact supply in the short term.

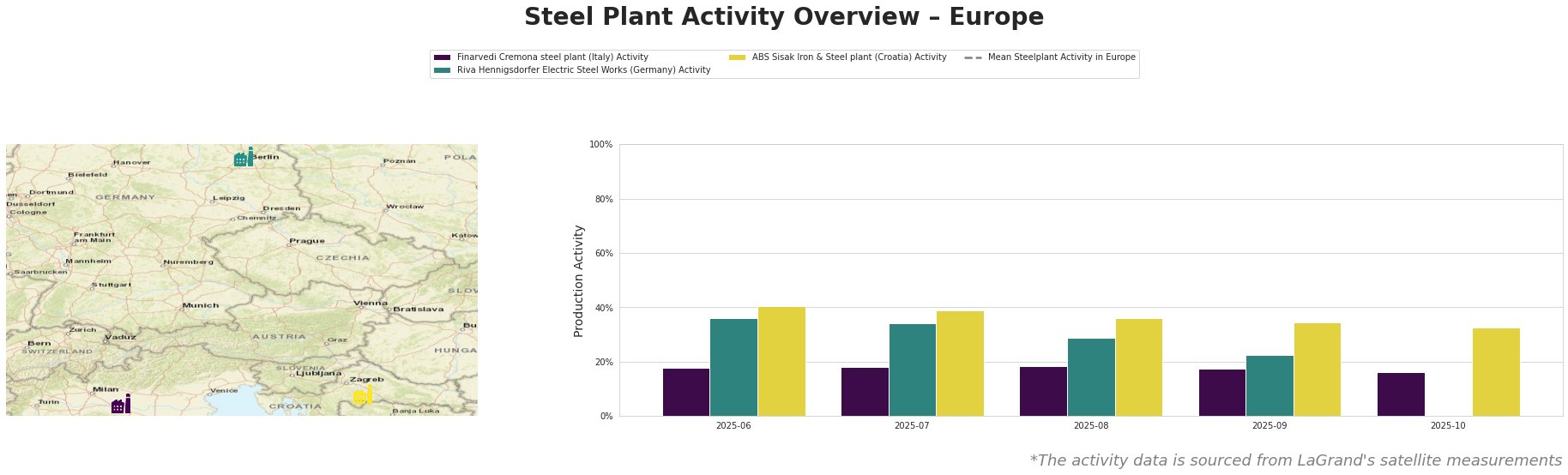

In recent months, the measured activity of the Finarvedi Cremona steel plant has seen a slight decline, decreasing from 18.0% in June to 16.0% in October. This stagnation does not appear to be directly linked to any recent news articles. In contrast, the Riva Hennigsdorfer Electric Steel Works reported a steady activity decrease from 36.0% in June to 22.0% in September but showed slight resilience by stabilizing activity at 29.0% in August. Meanwhile, the ABS Sisak Iron & Steel plant remained more stable, fluctuating gently around the upper 30s in its activity percentage, yet no direct connection to news developments was established.

Finarvedi Cremona focuses on electric steel production, specifically using Electric Arc Furnaces (EAF) to produce hot rolled coils and galvanized products tailored for the automotive sector. The plant’s activity decline may reflect general market conditions but lacks a specific correlating news event. Conversely, Riva Hennigsdorfer, also employing EAF technology for steel billets and rebar, experienced marked volatility in its operational capacity, reflecting instability possibly associated with regional production challenges, yet no direct relationship to recent news was established.

The ABS Sisak plant, leveraging similar electric steel methods, has maintained stable activity levels albeit without recent actionable news links.

Considering the ongoing investments in electric steel facilities, particularly by ArcelorMittal, steel buyers are advised to recalibrate procurement strategies to secure future supplies, especially of electric steel, which is expected to see demand spikes in alignment with EU electrification trends. It’s critical for buyers to monitor the operational stability of plants experiencing fluctuations, particularly Riva Hennigsdorfer and to consider securing contracts ahead of expected delays linked to the Gijón blast furnace launch issues. In summary, engaging with facilities linked directly to electric steel production is recommended for optimizing future supply chains amid potential disruptions.