From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Rebar Prices Soften Amidst Production Adjustments

European steel markets are experiencing a period of cautious stability as summer holidays conclude, with regional price variations and production adjustments observed. The price fluctuations, production changes, and demand patterns highlighted across Europe are reflected in satellite observations, to varying degrees, across observed plants. “Rebar prices in Italy narrow downward upon market return from holiday,” showing a slight decrease in Italian rebar prices, and “Polish rebar prices drop further on muted demand,” which reveals production cuts, indicate a complex interplay of regional factors. “The HRC market in the EU remains weak, mills expects growth in September” signals anticipated recovery, adding to the nuanced outlook.

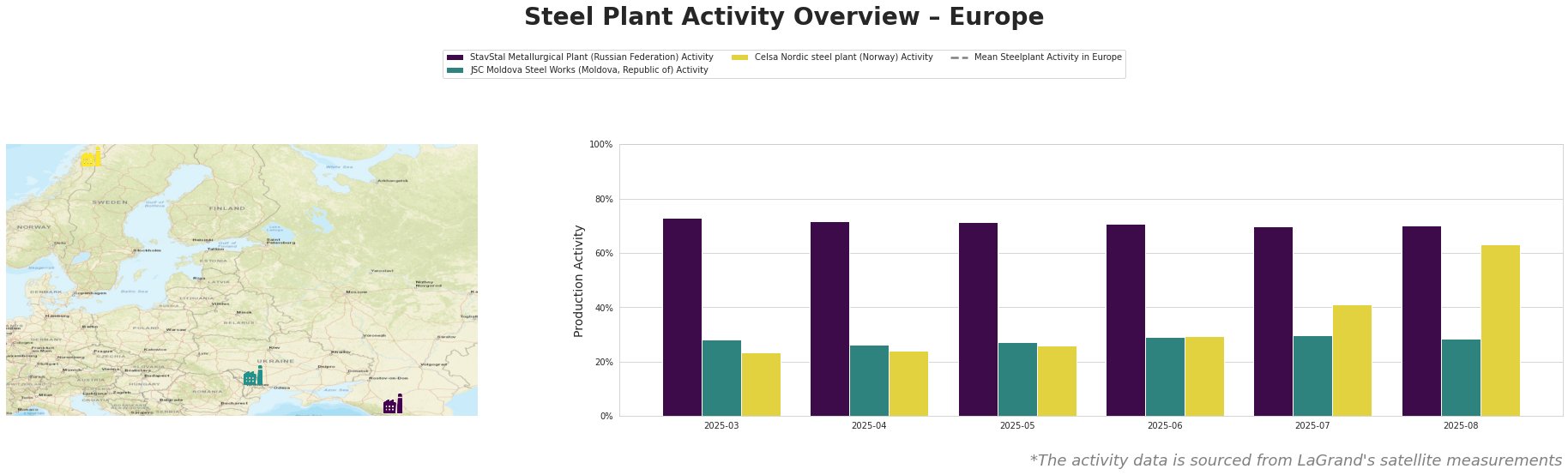

Measured Activity Overview

The satellite data reveals relatively stable activity at StavStal. JSC Moldova Steel Works shows a slight upward trend until July, then experiences a slight drop in August. Celsa Nordic shows significant growth. The mean steel plant activity appears to be consistently negative, which is a data anomaly and should not be interpreted as an actual activity level.

StavStal Metallurgical Plant, a 500ktpa EAF-based producer of rebar and wire rod located in Russia, has maintained a relatively steady activity level, hovering around 70-73% over the observed period. The slight decrease from 73% in March to 70% in August does not have a direct explicit connection to the provided news articles related to the European market.

JSC Moldova Steel Works, an EAF-based plant with a 1000ktpa capacity in Transnistria, showed a gradual increase in activity from 28% in March to 30% in July, followed by a slight dip to 29% in August. While “Romanian longs prices stable, import negotiations with Turkey continue” touches on regional dynamics, a direct relationship to the JSC Moldova Steel Works activity level cannot be explicitly established. The plant produces rebar and wire rod, similar to products affected by price changes noted in the news.

Celsa Nordic steel plant, a 700ktpa EAF-based rebar and wire rod producer in Norway, exhibited a notable increase in activity, rising from 23% in March to 63% in August. This increase might correlate with the expected rise in Northern European market activity mentioned in “Rebar prices in Italy narrow downward upon market return from holiday”, but a direct connection cannot be conclusively made.

Evaluated Market Implications

Based on the reports of weakening rebar prices in Poland (“Prices for Polish rebar continue to decline due to weak demand“), coupled with the production cuts enacted by Polish mills to try and avoid further price declines, steel buyers should consider the possibility of supply disruption of rebar and related long steel products originating in or passing through Poland. While the Celsa Nordic activity increases suggest a potential offset, its specific product mix and logistical capabilities relative to the Polish market should be carefully assessed.

Recommended Procurement Actions:

- Monitor Polish rebar suppliers closely: Due to the reported production cuts, closely monitor order fulfillment and delivery timelines from Polish suppliers.

- Diversify rebar sourcing: Given the price volatility and potential supply disruptions in Poland, explore alternative rebar sources, considering import options from Germany and Ukraine as mentioned in “Polish rebar prices drop further on muted demand”, while factoring in potential logistical constraints and lead times.

- Evaluate Norwegian supply potential: Due to the increased activity observed at the Celsa Nordic steel plant, assess this plant’s capacity to supply additional rebar and wire rod to offset potential shortfalls from Polish producers, particularly if located in Northern Europe.

- Monitor scrap prices: “Prices for Polish rebar continue to decline due to weak demand” suggests that an increase in scrap prices in September may lead to increased rebar prices. Closely monitor any scrap price fluctuations for potential cost impacts.