From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Reacts Positively Amidst Stable Plant Activity & Coking Coal Supply

Europe’s steel market shows positive sentiment driven by stable steel plant activity, while concerns arise about coking coal supply. Plant activity levels have remained relatively stable over the past months. The activity is seemingly unaffected by the coal exploration decline in Australia, as described in “Australia’s Qld coal exploration falls for fifth time“, because QCoal can still continue operating its Northern Hub and Byerwen complexes in Queensland, as reported in “Australia’s QCoal to keep producing after mine closure“, ensuring a continued supply of coking coal required for steel production. However, no direct relationships between the provided news articles and specific European steel plant activity changes can be definitively established based on the available data.

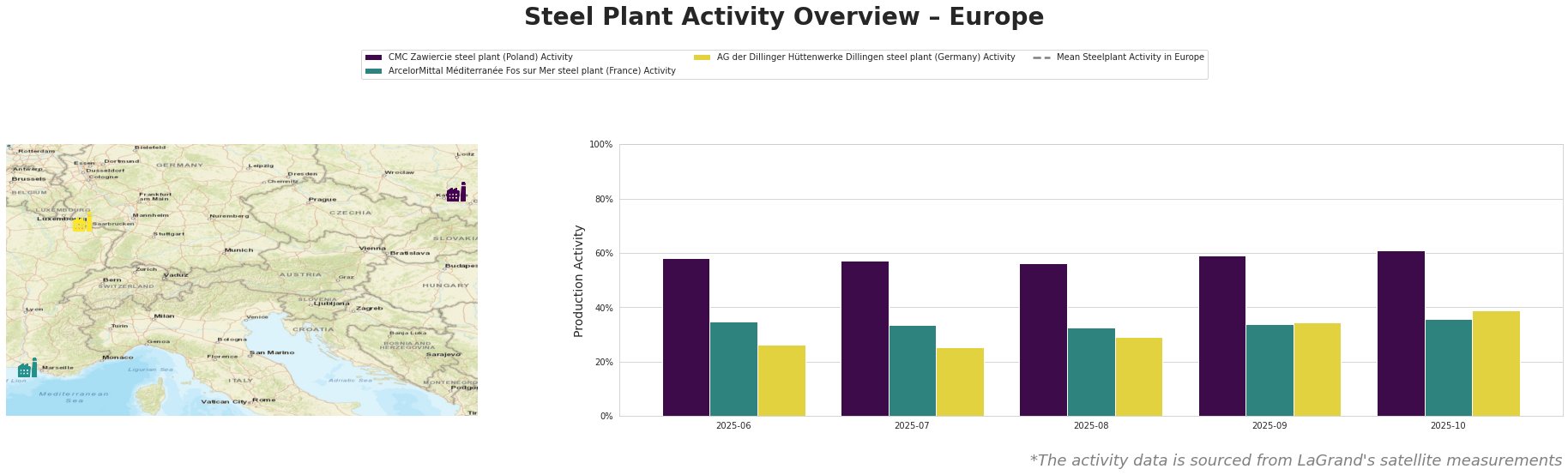

The mean steel plant activity in Europe fluctuated, showing a peak in July and August and a decrease in October.

CMC Zawiercie, a Polish steel plant relying on EAF technology with a crude steel capacity of 1.7 million tonnes per annum, experienced a gradual increase in activity from 58% in June to 61% in October. This rise occurred independently of the decline in coal exploration in Australia described in “Australia’s Qld coal exploration falls for fifth time“, as this plant does not rely on coal-based steelmaking processes.

ArcelorMittal Méditerranée Fos sur Mer, France, an integrated BF-BOF steel plant with a crude steel capacity of 4 million tonnes per annum, saw activity levels increase slightly from 35% in June to 36% in October. While “Australia’s QCoal to keep producing after mine closure” indicates continued coking coal availability, the plant’s moderate activity increase does not show a direct, proportional relationship with those developments. The plant has 2 BOF that are to be shut down by 2030 which is independent from the observed activity levels and news development.

AG der Dillinger Hüttenwerke Dillingen, a German integrated BF-BOF steel plant, with a crude steel capacity of 2.76 million tonnes per annum, exhibited the most significant activity increase among the observed plants, rising from 26% in June to 39% in October. The increase in plant activity is not immediately relatable with the developments in coal supply as described in “Australia’s QCoal to keep producing after mine closure“.

The continued coking coal production by QCoal, as reported in “Australia’s QCoal to keep producing after mine closure“, appears to alleviate immediate concerns about coking coal supply disruptions for European steelmakers, particularly those relying on BF-BOF processes. The price fluctuations can cause uncertainty for the industry, as discussed in “Australia’s Qld coal exploration falls for fifth time“. Given the continued coking coal production, buyers should negotiate contracts with suppliers.