From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Positive Trends Highlighted by Strategic Investments and Plant Activity

Europe’s steel market sentiment is notably Very Positive, driven by significant investments and operational advancements. Notably, “Triple-S Steel Holdings makes major investment in European steel distributor“ and “SSAB expands Strenx network in the Netherlands“ highlight strategic actions expected to boost productivity and capacity within the region’s steel landscape.

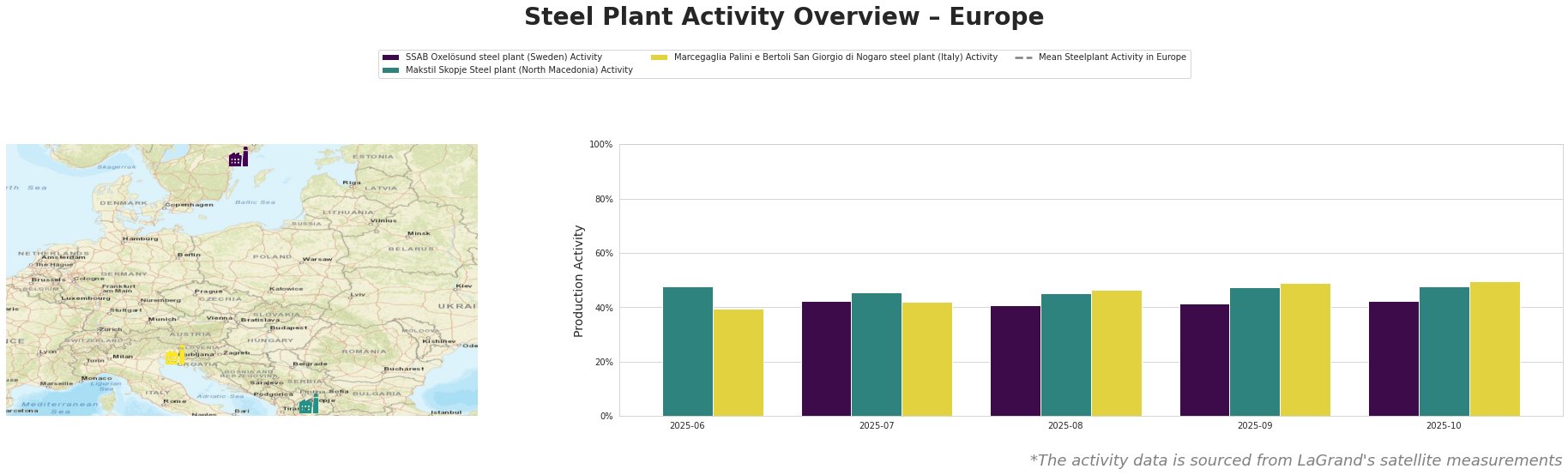

The investment by Triple-S Steel in Zimmer Staal indicates a confidence in enhancing operational capabilities, which correlates with the uptick in activity at plants such as the SSAB Oxelösund, with an activity level of 42% in July 2025, consistent through August. In contrast, activity levels at the Makstil Skopje plant are markedly lower, showing a gradual decline from 48% in July to 45% in August. The Marcegaglia San Giorgio di Nogaro plant displays stability, maintaining a level of 50% throughout this period, despite the overall mean activity in Europe dropping sharply to 27% by October 2025.

SSAB Oxelösund Steel Plant

The SSAB Oxelösund plant in Sweden, with a crude steel capacity of 1,500 KTPA and a commitment to high-strength materials like Strenx, has maintained activity levels around 42% through mid-2025. Notably, the “SSAB expands Strenx network in the Netherlands” article complements this stability as the expanded network aims for enhanced market outreach, suggesting increased demand for high-strength steel components. While activity has not significantly fluctuated, the investment in operational improvements could further ensure resilience.

Makstil Skopje Steel Plant

The Makstil Skopje plant in North Macedonia, with a capacity of 550 KTPA produced primarily through electric arc technology, showcases a sliding trend, with activity dropping from 48% in July to 45% in August. No direct correlations to current market activities or news articles were established. This decline could signify challenges in maintaining operational fluidity amidst broader market shifts.

Marcegaglia Palini e Bertoli San Giorgio di Nogaro Steel Plant

The Marcegaglia plant operates at a capacity of 600 KTPA and remains at a high activity level of 50%, indicating robust operational stability, fully capitalizing on the infrastructural boom in Europe. Despite this steady position, it aligns primarily with internal capacities rather than the external events highlighted in recent news articles.

Evaluated Market Implications

The investments highlighted, particularly in the Triple-S Steel Holdings initiative, could lead to increased liquidity and expansion of product offerings at Zimmer Staal, anticipating raised activity levels in European steel distribution. Steel buyers should closely monitor this trend, particularly at the Makstil and SSAB plants, as fluctuations could affect pricing and availability.

Given current activity levels, potential supply disruptions may arise from the Makstil Skopje plant, suggesting buyers prioritize strategic procurement, especially for semi-finished products where fluctuations may occur. Engaging with suppliers from regions of stability, such as the Marcegaglia and SSAB plants, is advisable to mitigate risks associated with demand spikes following recent strategic expansions in network and product capabilities.