From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Poised for Green Growth: ArcelorMittal’s EAF Investment Signals Positive Outlook

The European steel market is showing signs of renewed vigor driven by decarbonization efforts, with plant activity levels remaining high. ArcelorMittal’s commitment to building a €1.2 billion EAF in Dunkirk, as reported in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk,” “ArcelorMittal confirms its intention to invest in the decarbonization of its Dunkirk plant,” “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” “The European steel giant is preparing to restart green projects after the summer holidays,” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” signals a positive shift despite previous project delays. This investment is closely linked to the European Commission’s Steel and Metal Action Plan, which aims to bolster the internal market and enhance carbon border adjustments. While these news articles indicate investment and future capacity, they do not directly explain the current plant activity levels observed via satellite.

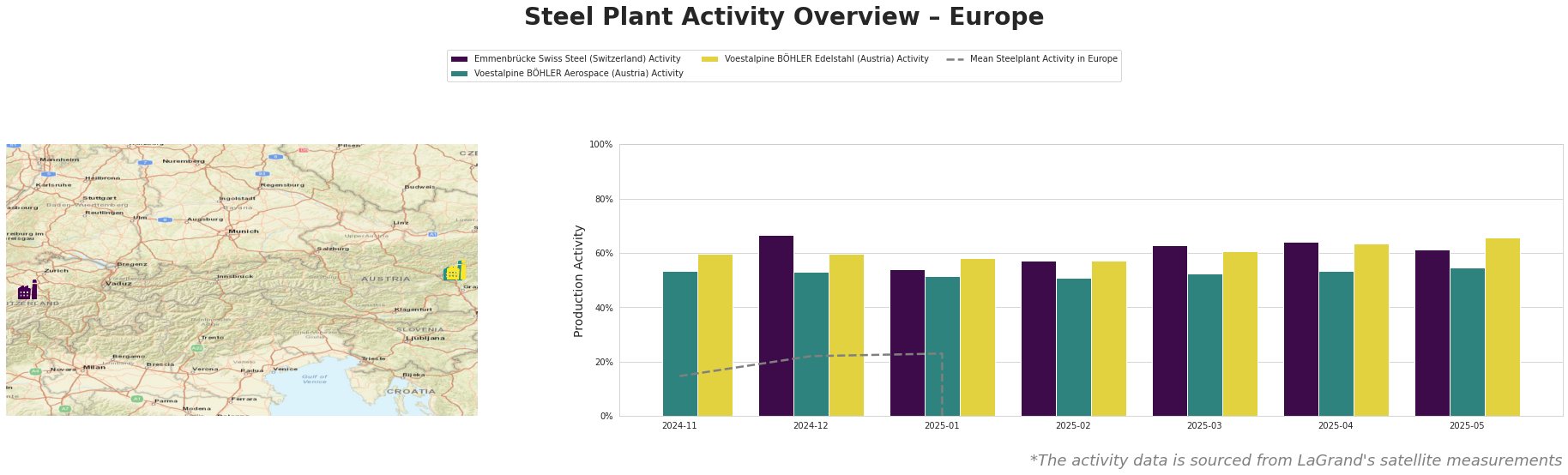

The mean steel plant activity levels in Europe, as observed from satellite data, show inconsistent values after 2025-01-31 due to potential measurement errors or data anomalies. The observed plants, however, show steady activity, indicating stable regional steel production despite broader market challenges. The Emmenbrücke Swiss Steel plant in Switzerland showed activity between 54.0% to 67.0%, indicating stable output. Voestalpine BÖHLER Aerospace in Austria has consistent activity between 51.0% and 55.0%. Voestalpine BÖHLER Edelstahl in Austria has shown slightly increasing activity from 57.0% to 66.0%. No direct connections between these plant-specific trends and the ArcelorMittal news articles can be established.

Emmenbrücke Swiss Steel, located in Luzern, Switzerland, primarily utilizes EAF technology and is certified by ResponsibleSteelCertification. Activity levels have remained relatively stable in recent months. Since it is not directly addressed in the provided news articles, no connection can be established between the ArcelorMittal developments and the plant’s operations.

Voestalpine BÖHLER Aerospace, located in Kapfenberg, Austria, also relies on EAF technology and holds ResponsibleSteelCertification. Its activity has remained consistent. As with Emmenbrücke Swiss Steel, no direct link can be made between Voestalpine BÖHLER Aerospace’s activity and the ArcelorMittal news.

Voestalpine BÖHLER Edelstahl, situated in Kapfenberg, Austria, operates an EAF with a capacity of 145 metric tons, employing 2500 workers. This plant has shown a small increase in activity recently. Similar to the other plants, there is no discernible link between the Voestalpine BÖHLER Edelstahl trends and the ArcelorMittal news releases.

The news regarding ArcelorMittal’s investment in Dunkirk signals a potential shift in the European steel supply landscape towards greener production methods. Despite current high activity at observed plants, the planned EAF in Dunkirk may influence the competitive environment and potentially affect long-term supply dynamics. Steel buyers should monitor the progress of the Dunkirk EAF project, as detailed in “ArcelorMittal Confirms Intention to Build €1.2 Billion EAF in Dunkirk,” “ArcelorMittal confirms its intention to invest in the decarbonization of its Dunkirk plant,” “ArcelorMittal has committed to resume the implementation of the French decarbonization plan in line with EU measures,” “The European steel giant is preparing to restart green projects after the summer holidays,” and “ArcelorMittal committed to restarting French decarbonization plan following EU measures,” to anticipate potential shifts in the availability of traditionally produced steel and the emergence of greener alternatives. Procurement strategies should be prepared to accommodate potential price premiums associated with sustainably produced steel. Given that ArcelorMittal abandoned relocation plans and is investing heavily in new EAF technology, procurement analysts should evaluate the impact of the new Dunkirk plant on the regional steel supply and adjust forecasts accordingly, considering a possible long-term decrease in traditional steel production capacity in the Dunkirk region.