From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Plunges: Weak Demand & Production Cuts Signal Further Price Declines

Europe’s steel market faces significant headwinds as weak demand and sluggish trade are impacting production. Recent reports, including “European heavy steel plate prices pulled down by sluggish trade, weak demand” and “European coil market to remain subdued over summer,” highlight the ongoing challenges. While a direct relationship between these articles and specific activity level changes is not always demonstrable, the overall negative sentiment aligns with observed reductions in activity across several plants.

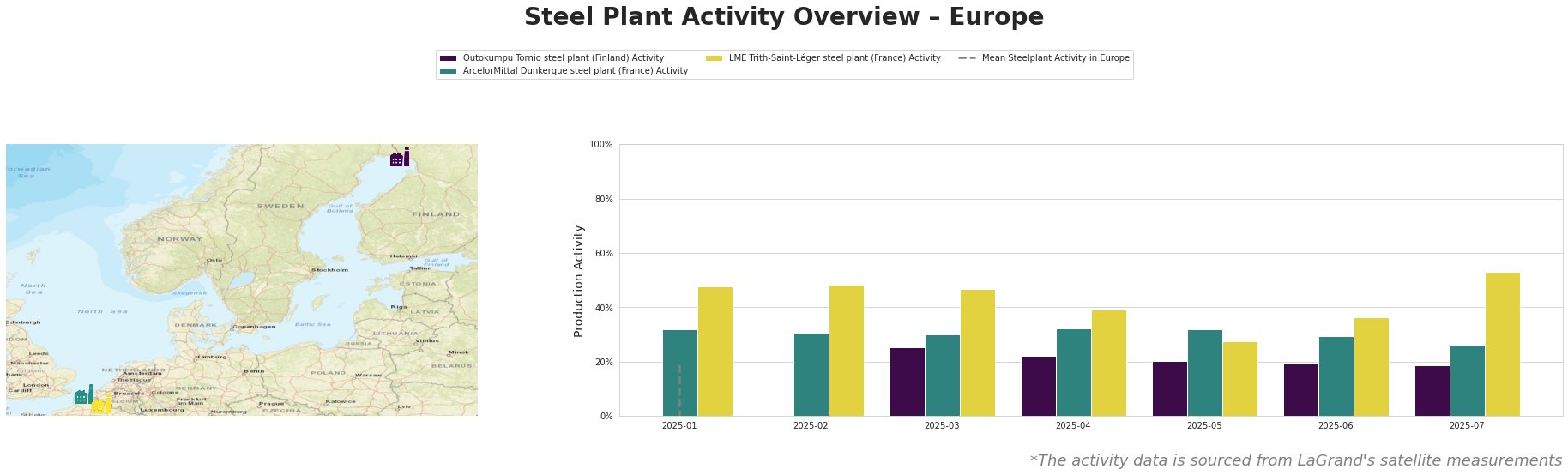

Across Europe, the mean steel plant activity level, as reported, is highly volatile and significantly negative, exhibiting major fluctuations each month. This makes comparison to individual plants difficult; this indicator should therefore be treated as providing indicative overall market conditions only and disregarded for plant level comparison. The activity level at Outokumpu Tornio steel plant, a major producer of stainless steel flat products with an EAF-based production route, has shown a consistent decline from 25% in March to 19% in June and July. This reduction may be connected to the general downturn reported in “European coil market to remain subdued over summer,” though no explicit link is evident from the available data. ArcelorMittal Dunkerque, an integrated BF-BOF plant producing slabs and hot-rolled coil, saw its activity decrease from 32% in April to 26% in July. This decline may reflect the overall weak demand described in “European heavy steel plate prices pulled down by sluggish trade, weak demand“, specifically impacting hot-rolled coil demand, although this connection is not definitively confirmed by available information. LME Trith-Saint-Léger, a smaller EAF-based plant focused on hot-rolled products, showed a significant drop from 48% in February to 27% in May, before climbing to 53% in July; no explicit connections could be found to current market commentary, suggesting a plant specific factor.

Evaluated Market Implications:

The observed activity reductions at ArcelorMittal Dunkerque, coupled with reports of weak demand in “European heavy steel plate prices pulled down by sluggish trade, weak demand,” suggest a potential supply constraint in the hot-rolled coil market.

- Procurement Action: Steel buyers should prioritize securing supply contracts for hot-rolled coil, particularly from alternative sources, to mitigate risks associated with potential production cuts at integrated mills. Closely monitor LME Trith-Saint-Léger’s production and factor its volatility into supply considerations, factoring in possible disruption.

The consistent decline in activity at Outokumpu Tornio, in conjunction with overall market weakness outlined in “European coil market to remain subdued over summer,” raises concerns about pricing pressure on stainless steel flat products.

- Procurement Action: Steel buyers should negotiate aggressively on price for stainless steel flat products, leveraging the current market conditions and potential for further price declines as described in the article. Explore opportunities to diversify supply to avoid reliance on a single producer facing operational constraints or reduced output.