From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Plunge: Longs Prices Tumble Amid Sluggish Demand, Italian and Spanish Mills Under Pressure

The European steel market faces significant challenges due to weak demand and declining prices, particularly in the long steel sector. This is reflected in recent news such as “European longs prices decline amid sluggish activity” and “Prices for European long positions are declining amid sluggish activity,” which highlight the ongoing downward pressure on rebar and wire rod prices across the continent. While a direct relationship between these news articles and specific satellite-observed plant activity is not explicitly established, the general market sentiment aligns with the observed stability or slight decreases in activity at certain plants.

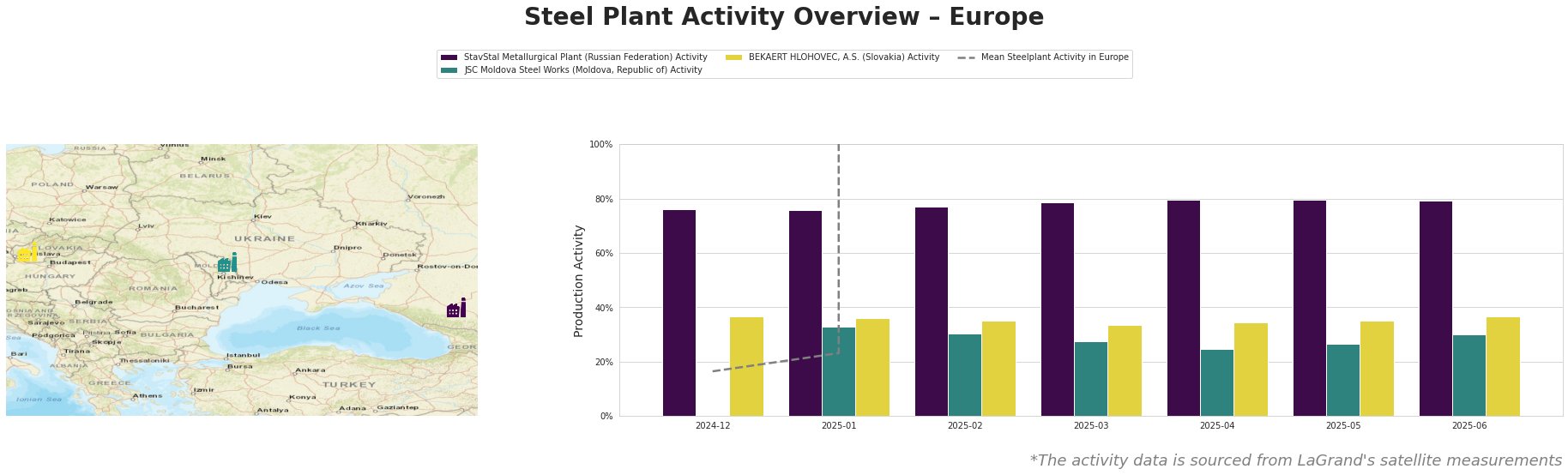

The data indicates highly fluctuating mean steel plant activity in Europe from February to June 2025.

StavStal Metallurgical Plant: This Russian plant, with an EAF-based capacity of 500 ttpa, primarily produces semi-finished and finished rolled products like rebar and wire rod. The plant has maintained consistently high activity levels between 76% and 80% from December 2024 through May 2025, dipping slightly to 79% in June 2025. This steady activity contrasts with the overall negative market sentiment in Europe, as described in “Low Italian, Spanish pricing concerns European longs mills,” however no explicit relationship between observed activity and named article exists.

JSC Moldova Steel Works: This Moldovan plant, featuring a 120-tonne EAF and a capacity of 1000 ttpa, produces wire rod, rebar, and billet. Its activity has fluctuated, starting at 33% in January 2025, dropping to 25% in April 2025, and recovering to 30% by June 2025. This volatility may reflect the “sluggish activity” mentioned in “European longs prices decline amid sluggish activity,” however, no direct link can be established.

BEKAERT HLOHOVEC, A.S.: Located in Slovakia, this plant focuses on wire rod for the automotive and construction sectors. Its activity remained relatively stable, fluctuating narrowly between 34% and 37% over the observed period. While not directly linked to any specific news article, this stability occurs within a broader context of declining European long steel prices, as highlighted in “Prices for European long positions are declining amid sluggish activity.”

Given the persistent weakness in demand and the downward pressure on prices as detailed in “Low Italian, Spanish pricing concerns European longs mills,” steel buyers should:

- Prioritize Short-Term Contracts: Given the declining price environment, buyers should avoid long-term commitments and focus on securing short-term contracts to capitalize on potential further price drops, particularly for rebar in Italy and Spain.

- Carefully Evaluate Import Offers: With import offers from Turkey and Spain providing lower prices, as noted in “Low Italian, Spanish pricing concerns European longs mills,” buyers should explore these options to leverage potential cost savings, while carefully considering logistical and quality implications.

- Monitor Scrap Prices: As “Prices for German fittings are decreasing” suggests, the decrease is linked to the drop in scrap prices. Therefore, monitoring scrap prices, especially in Rotterdam, is crucial for anticipating future price movements in rebar.