From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Overview: Activity Trends and Strategic Insights Amidst Ongoing Ukraine Challenges

Steel production in Europe has hit a stable yet cautious phase, notably influenced by recent developments in Ukraine’s steel sector and shifts observed in satellite data. As outlined in the articles “Ukraine’s 2026 steel output may match 2025: GMK” and “The volume of steel production in Ukraine in 2026 may correspond to the level of 2025: GMK”, Ukraine is forecasted to produce around 7.2 million tonnes of steel in 2026, facing critical risks from EU carbon management regulations (CBAM) and declining export capacity, which may directly impact the EU steel supply chain. Recent production drops in November and a shift in activities at various plants further reinforce the need for strategic procurement planning.

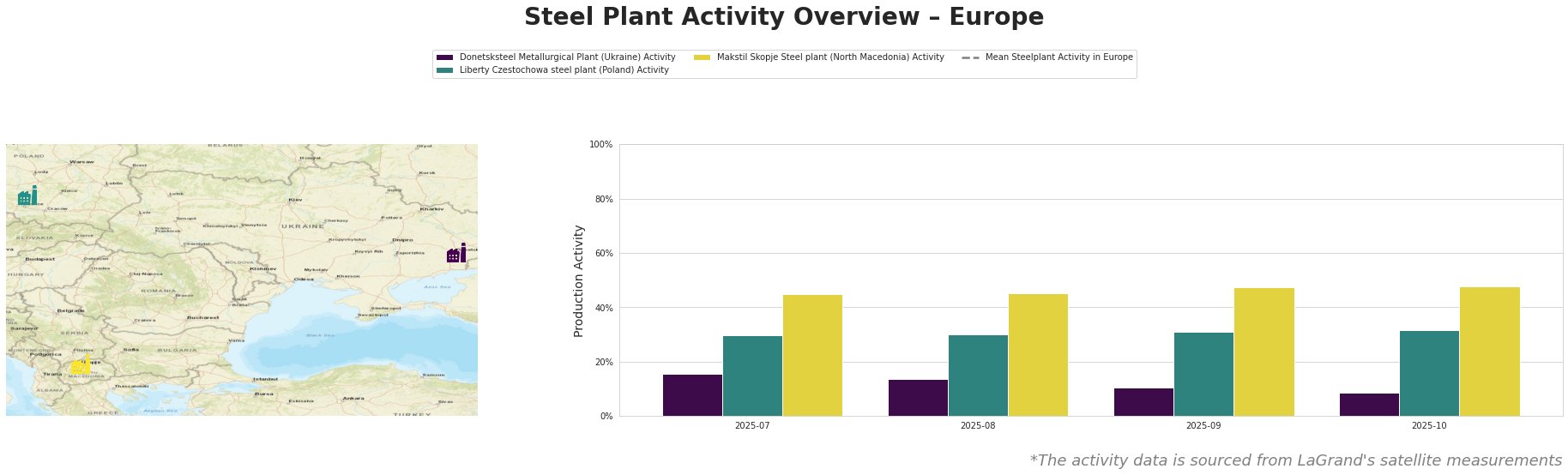

The mean activity across European steel plants shows a declining trend, dropping from a peak of 407.7 million in July to just 271.8 million by October. Notably, the Donetsksteel Metallurgical Plant in Ukraine logged a considerable decline in activity, falling from 15% in July to 9% in October. This decrease is evident amidst challenges highlighted in the news regarding plant operations and the potential shutdown of furnaces due to tight export regulations. Concurrently, the Liberty Czestochowa and Makstil Skopje plants maintained relatively consistent performances, though slight activity improvements were observed, with Makstil reaching 48% in October.

The Donetsk steel plant has faced notable operational challenges as production capacities have been severely hindered by the ongoing regional conflict and the resultant export restrictions. This aligns with the news from “The Cabinet of Ministers of Ukraine has extended the ban on the export of timber and scrap metal until the end of 2026,” which directly impacts resource availability and domestic processing capabilities. Similarly, Liberty Czestochowa, relying on electric arc furnace (EAF) technology, appears to sustain a stable outturn in light of regional instability but may still be susceptible to fluctuations in raw material supplies from Ukraine due to their reliance on neighboring markets.

Given the impending changes in export regulations and production forecasts, steel buyers should prepare for potential supply disruptions, particularly from Ukraine, where a total ban on the export of scrap metal will underscore domestic processing capabilities while affecting the wider European market supply dynamics. Steel procurement professionals should closely monitor activity levels at the Donetsksteel Metallurgical Plant, as its output uncertainty may necessitate shifts in sourcing strategies towards more stable providers such as Poland’s Liberty Czestochowa and North Macedonia’s Makstil Skopje plants.

In conclusion, the landscape suggests steady procurement practices focused on alternative markets for semi-finished steel while proactively planning for any tighter supply conditions stemming from Ukrainian regulations.