From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Optimism: Ukraine Boosts Output, Italian Stability Amidst Regional Shifts

Europe’s steel market shows a positive sentiment, influenced by increased Ukrainian output. “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025“ directly correlates with increased production at Zaporizhstal. Similarly, “Zaporizhcoke increased production to 513,000 tons in January-July“ signals rising coke output, a crucial element for steel production, which is also supported by the article “Ukraine’s Zaporizhkoks posts higher coke output for July 2025“. Direct links between these news items and observable plant activity data are further detailed below.

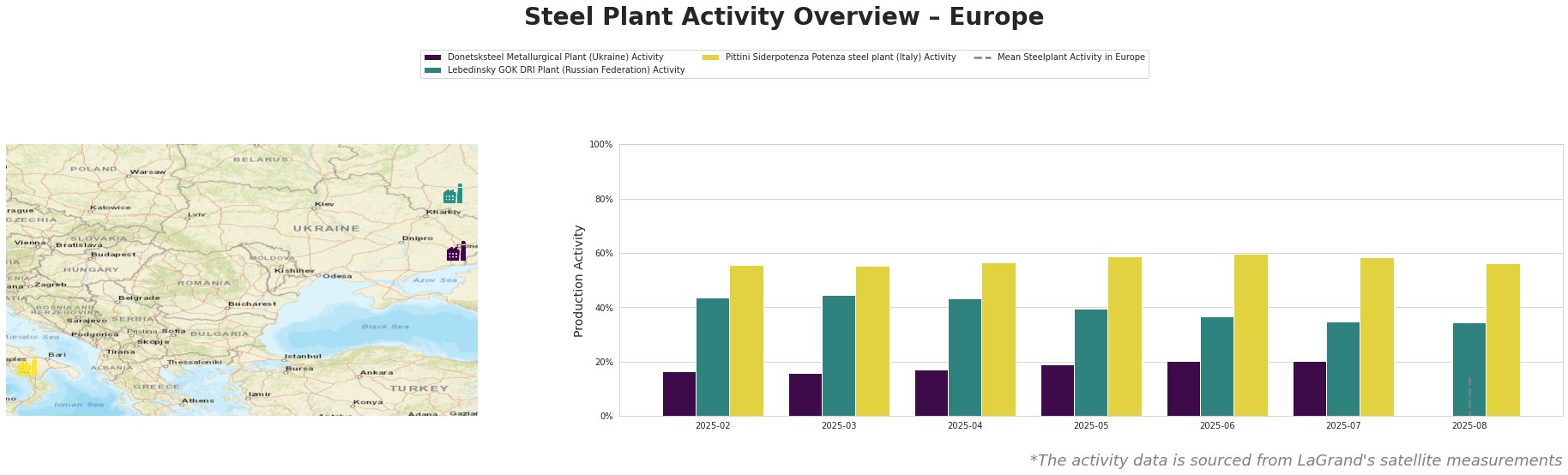

Observed activity at Donetsksteel Metallurgical Plant shows a consistent, gradual increase from February to June 2025, reaching 20% in June and July, before data becomes unavailable. Lebedinsky GOK DRI Plant demonstrates a declining activity trend, decreasing from 44% in February to 34% in August. Pittini Siderpotenza in Italy exhibits relative stability with fluctuations, ranging from 55% to 60%. The mean steel plant activity in Europe is highly unstable and has no clear trend, so it is not relevant.

Donetsksteel Metallurgical Plant, an integrated steel producer in the Donetsk region of Ukraine, relies on blast furnace technology to produce pig iron. Activity levels increased from 16% in February 2025 to 20% by June and July. The reported increase in activity at Donetsksteel does not have a clear correlation with the increased production at Zaporizhstal and Zaporizhkoks based on the provided news articles. No clear connection can be established.

Lebedinsky GOK DRI Plant in Russia, is focused on ironmaking via DRI, with a capacity of 4.5 million tons of DRI per year. The observed activity shows a decline from 44% in February 2025 to 34% in August 2025. No direct link can be established between this decline and any of the provided news articles.

Pittini Siderpotenza, an Italian steel plant, utilizes EAF technology to produce 700,000 tons of crude steel annually, mainly rebar for the construction sector. Activity at Pittini Siderpotenza has been relatively stable, fluctuating between 55% and 60% during the observed period. No direct link can be established between this stability and any of the provided news articles.

Based on “Ukraine’s Zaporizhstal posts 5.2% rise in crude steel output for Jan-July 2025” and “Zaporizhcoke increased production to 513,000 tons in January-July”, Ukrainian steel production is increasing. This could mitigate potential supply disruptions caused by geopolitical instability in the region. Steel buyers should consider diversifying their sources to include Ukrainian steel, capitalizing on the increased output at Zaporizhstal, especially if focused on flat products, long product. The observed decline in activity at Lebedinsky GOK DRI plant warrants monitoring for potential impacts on DRI availability. No immediate action is recommended, but staying informed about production trends in Russia remains crucial.