From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Optimism Fueled by Gas Price Drop Despite Low EU Storage

Europe’s steel market exhibits a cautiously positive sentiment as declining gas prices offer respite, though concerns remain regarding gas storage levels. According to “Gas prices in Europe fell below €30/MWh in November“, gas prices have fallen, potentially lowering energy costs for steel production. There is no direct link evident between this news and the satellite-observed plant activity data, but lower energy costs are generally positive for steel production margins. The article “EU gas stocks at four-year low on 1 December” highlights lower-than-average gas storage, indicating potential energy cost volatility if demand increases, but this doesn’t appear to have had a measurable impact on activity levels as of the observed period.

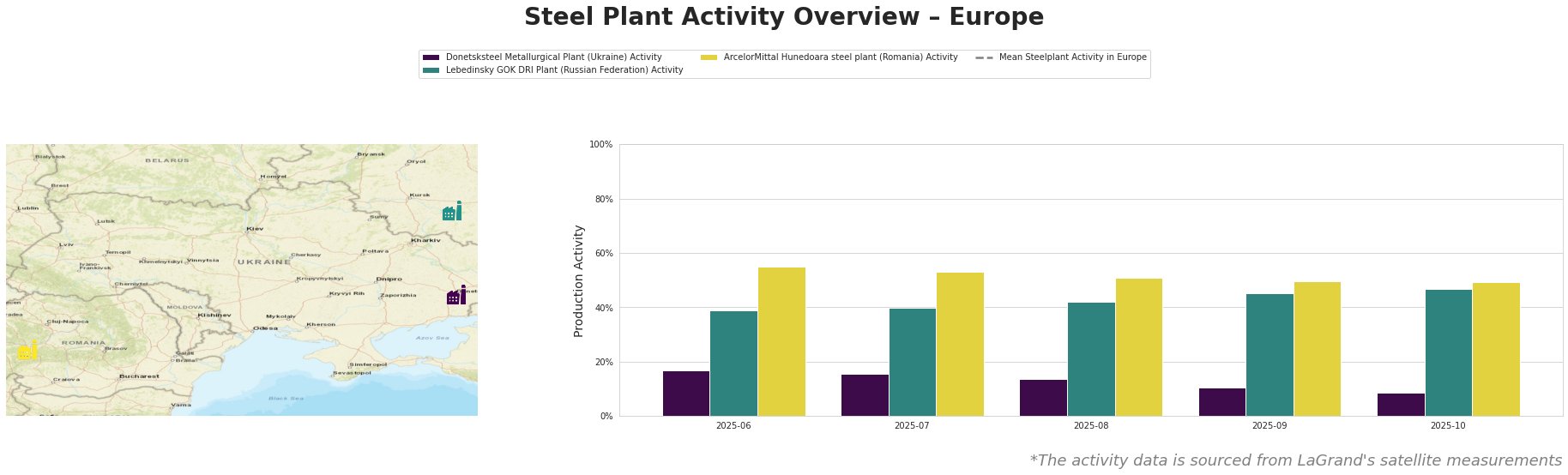

The mean steel plant activity in Europe fluctuated, peaking in July and August. Donetsksteel Metallurgical Plant shows a steady decline in activity, reaching its lowest observed level in October. Lebedinsky GOK DRI Plant exhibits a consistent increase in activity. ArcelorMittal Hunedoara shows a slight, consistent decrease in activity. No direct connection can be established between these plant-specific activity changes and the named news articles.

Donetsksteel Metallurgical Plant

Donetsksteel Metallurgical Plant, an integrated BF-based steel plant located in Donetsk, Ukraine, with a pig iron capacity of 1.5 million tons, has seen a continued decrease in activity from 17% in June to 9% in October. Given the ongoing conflict in the region, this decrease could be associated with supply chain disruptions or operational challenges, although no direct evidence is presented in the provided news articles.

Lebedinsky GOK DRI Plant

Lebedinsky GOK DRI Plant, a Russian DRI plant with a capacity of 4.5 million tons of HBI (DRI), shows a consistent rise in activity, increasing from 39% in June to 47% in October. Despite the EU’s intention to reduce reliance on Russian gas as described in “Wer noch russisches Gas bezieht,” this plant’s activity has increased, suggesting continued operation. No direct evidence in the news relates to the plant’s increasing activity.

ArcelorMittal Hunedoara steel plant

ArcelorMittal Hunedoara, an EAF-based steel plant in Romania producing long profiles, has shown a gradual decrease in activity from 55% in June to 49% in October. Despite its location within the EU and potential benefits from lower gas prices (according to “Gas prices in Europe fell below €30/MWh in November“), its activity has declined. There is no direct connection established between this decrease and the provided news articles.

Evaluated Market Implications

Given the conflicting trends of decreasing activity at Donetsksteel and ArcelorMittal Hunedoara alongside increasing activity at Lebedinsky GOK DRI Plant, combined with concerns surrounding EU gas storage levels from “EU gas stocks at four-year low on 1 December“, the following procurement actions are recommended:

- Diversify DRI suppliers: Due to increased activity at Lebedinsky GOK, buyers reliant on DRI should monitor the geopolitical situation and explore alternative supply sources to mitigate potential risks arising from dependence on a single supplier located in Russia.

- Carefully monitor regional disruptions: The continuing activity drop at Donetsksteel, situated in a conflict zone, should prompt buyers to assess their supply chain exposure and explore alternative sources for pig iron, anticipating possible further disruptions.

- Consider hedging energy costs: Given the volatility implied by low EU gas storage levels, explore hedging strategies to manage price risks, especially if reliant on EAF-based steel production within the EU, such as that from ArcelorMittal Hunedoara, to safeguard against potential energy cost spikes.

- Evaluate Impact of Gasoil Price Volatility: The article “Funds’ Ice gasoil long position down from 45-month high” indicates that increased volatility in gasoil may contribute to transport costs, so buyers should closely monitor gasoil price fluctuations and factor these into their procurement decisions.