From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Uncertainty Amid CBAM Changes and Production Declines

Europe’s steel market faces increased uncertainty driven by evolving CBAM regulations and declining production levels. The “European Parliament adopts carbon border changes“ and “CBAM should not finish off Ukrainian industry – ULIE“ articles highlight ongoing concerns about the impact of CBAM on competitiveness and trade. While no direct link can be made to the “EU refused to discuss carbon tax with Russia: what does Ukraine have to do with it“ article based on the satellite data, the general theme of CBAM and its impact is reinforced. The news articles cannot be directly linked to observed plant activity levels.

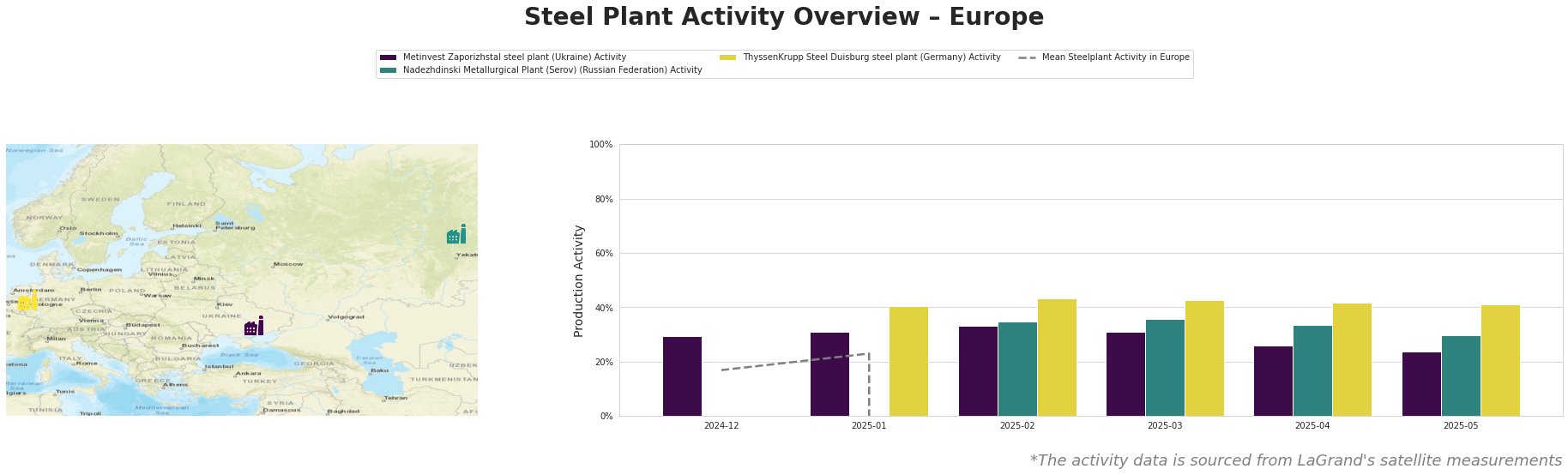

Observed activity levels across all plants show a downward trend over the reported period and impossible value ranges. There is no indication that the provided news articles relate to these.

Metinvest Zaporizhstal, a Ukrainian integrated steel plant with a crude steel capacity of 4.1 million tonnes per annum (TTPA), has seen its activity decline from 33% in February to 24% in May. Given the ULIE’s concerns highlighted in the article “CBAM should not finish off Ukrainian industry – ULIE”, the observed decline at Zaporizhstal could be related to CBAM uncertainty, although a direct causality cannot be established. Zaporizhstal primarily produces finished rolled products and sources from BF/OHF processes, making them vulnerable to carbon taxation.

Nadezhdinski Metallurgical Plant (Serov), a Russian electric arc furnace (EAF) based steel plant with a capacity of 756,000 TTPA, saw a decrease in activity from 36% in March to 30% in May. The “EU refused to discuss carbon tax with Russia: what does Ukraine have to do with it” article implies that Russian steelmakers could be impacted by CBAM, however there is no evidence that this is a factor in production levels.

ThyssenKrupp Steel Duisburg, an integrated German steel plant with a substantial 13 million TTPA capacity, experienced a slight activity decrease from 43% in February/March to 41% in May. The plant mainly sources from BF/BOF and produces hot strip, sheet, and heavy plate and given the “European Parliament adopts carbon border changes”, it could be impacted by imports/exports in the future due to the CBAM policy.

Given the declining activity at Zaporizhstal coupled with ULIE’s warnings regarding CBAM’s potential impact (“CBAM should not finish off Ukrainian industry – ULIE”), steel buyers should:

- Short-Term: Seek alternative supply sources for hot-rolled coil and sheet if reliant on Zaporizhstal.

- Mid-Term: Closely monitor CBAM implementation details and potential exemptions for Ukrainian producers. Diversify supply base to mitigate risks associated with geopolitical factors.

- Long-Term: Model cost implications of CBAM on steel imports from various regions to inform strategic sourcing decisions. Factor potential CBAM-related price increases into future budget projections.