From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Price Pressure Amidst Reduced Activity

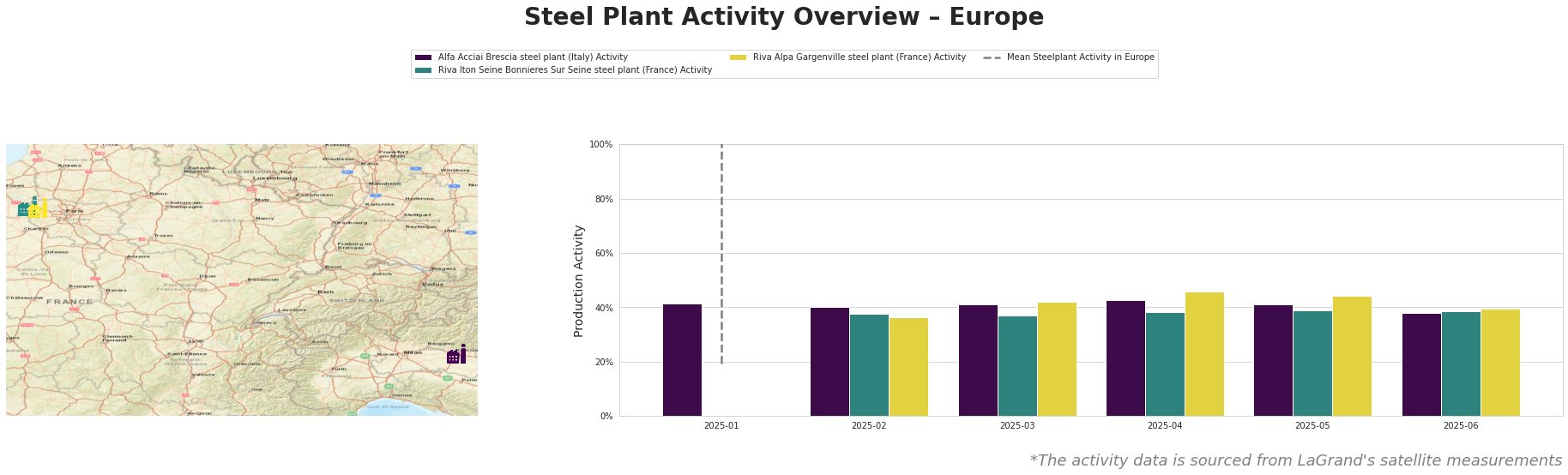

European steel prices are under pressure due to weak demand and import competition, as highlighted in “European HRC prices keep falling” and “Italian long steel market remains quiet amid price pressure“. While “Steel rebar prices in Europe stable, seeking direction” indicates some price stability in rebar, this appears to be an exception. Satellite data reveals fluctuating activity levels across European steel plants, though a direct correlation with the cited news articles cannot be definitively established at this time.

The mean steel plant activity in Europe fluctuates significantly. Alfa Acciai Brescia, a 1.7 million tonne per annum EAF-based rebar producer in Italy, saw activity decrease from 43% in April to 38% in June. While this decrease coincides with reported price pressure in the Italian long steel market as indicated in “Italian long steel market remains quiet amid price pressure,” a direct causal link cannot be definitively established.

Riva Iton Seine Bonnieres Sur Seine, a French EAF-based rebar producer with a 550,000 tonne capacity, shows a relatively stable activity level around 38-39% between February and June. Riva Alpa Gargenville, another French EAF-based rebar producer with a 700,000 tonne capacity, exhibited a decline in activity from 46% in April to 40% in June. No direct connections between activity and the named news articles could be established for the Riva plants.

The reported weak demand and import pressure in “European HRC prices keep falling” combined with potentially reduced activity at Alfa Acciai Brescia, could lead to localized supply constraints in rebar. Steel buyers should closely monitor inventory levels and consider diversifying suppliers, particularly given the availability of lower-priced imports from Turkey and Indonesia as highlighted in the “European HRC prices keep falling” article. A short-term procurement strategy focusing on securing supply from multiple sources is advised. Further analysis of import volumes and detailed production schedules is recommended for analysts to better anticipate and mitigate potential supply disruptions.