From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Price Declines Amid Weak Demand, Plant Activity Shifts

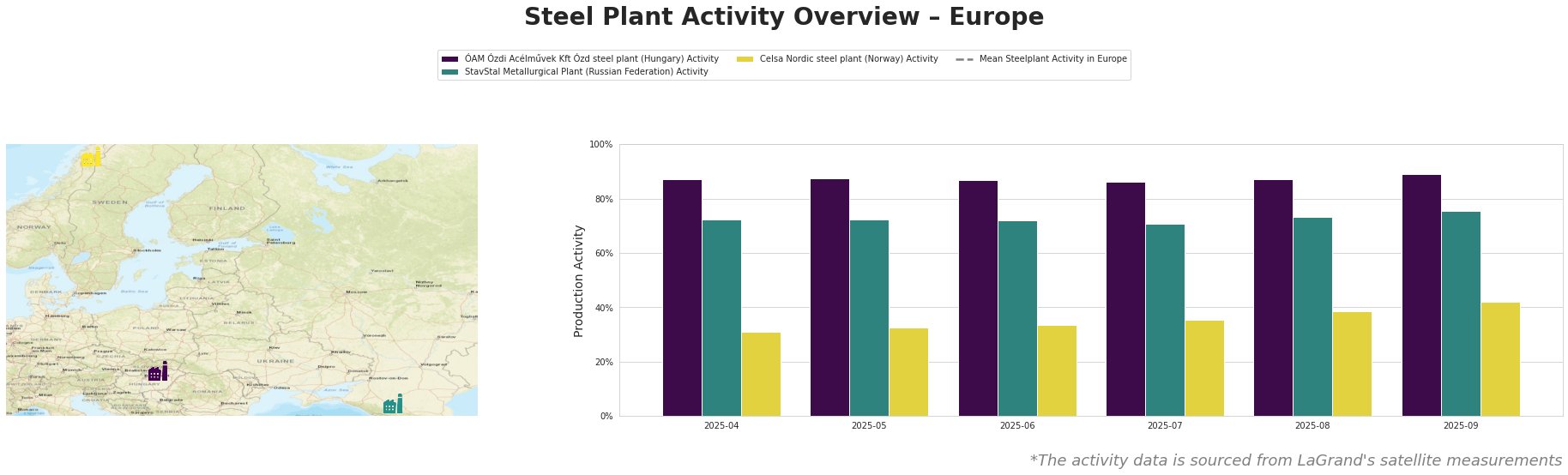

Europe’s steel market sentiment remains negative as rebar and wire rod prices continue their downward trend due to weak demand and import pressures. Activity levels at key steel plants show mixed trends. As reported in “European rebar, wire rod prices on downward track” and “Average European prices to decline in 2026: analyst“, downward pricing pressure from imports and lower scrap prices are contributing to the slump, particularly in Southern Europe. Satellite data of the plants’ activity partially reflect this pessimism.

The mean steel plant activity in Europe shows significant fluctuations throughout the observed period.

ÓAM Ózdi Acélművek Kft Ózd steel plant in Hungary, an EAF-based facility with a crude steel capacity of 690 ktpa producing rebar and wire coils, has maintained high activity levels throughout the period, fluctuating narrowly between 86% and 89%. This consistent activity, however, doesn’t directly correlate with the reported overall negative sentiment in the European longs market, as described in “European longs market mostly stable, Italian rebar prices decline,” and no immediate supply disruption is expected from this plant based on the activity data.

StavStal Metallurgical Plant in Russia, a 500 ktpa EAF-based producer of rebar and wire rod, shows a slight but consistent increase in activity from 72% in April to 75% in September. While this plant also shows increased production, its geographic location prevents direct connections to impacts on European markets mentioned in the news articles.

Celsa Nordic steel plant in Norway, an EAF-based facility with a 700 ktpa capacity focused on rebar and wire rod for building and infrastructure, shows a steady increase in activity from 31% in April to 42% in September. This gradual increase in activity doesn’t align with the overall market’s downward price trend described in “European rebar, wire rod prices on downward track,” and suggests that the plant might be benefiting from specific regional demand factors or supply contracts.

Given the projected price declines from “Average European prices to decline in 2026: analyst” and the observed downward pressure on rebar and wire rod prices, steel buyers should:

* Short-term focus: Leverage the current weakness in Italian rebar prices, as highlighted in “European longs market mostly stable, Italian rebar prices decline,” for immediate procurement needs, but be aware of potential for further price erosion.

* Careful Inventory Management: Avoid holding large inventories, particularly of rebar and wire rod, given the downward price pressure. Rely on short-term agreements and spot market purchases to better adapt to price fluctuations.

* Evaluate import options: Carefully evaluate import offers, especially from sources outside the EU, to potentially reduce costs, but consider potential trade barriers and quality concerns.