From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Headwinds: Weak Demand and Production Adjustments Impact Rebar and Wire Rod Prices

Europe’s steel market is experiencing headwinds, primarily driven by weak demand and fluctuating prices, as reflected in “The global rebar market remains under pressure from weak demand in the fall,” “Italian longs flatten amid weak demand, quiet exports,” and “European long steel market struggles to gain traction amid limited demand.” While some price stabilization efforts are underway, the market remains fragile. No direct relationship between these articles and activity level changes can be established based on available data.

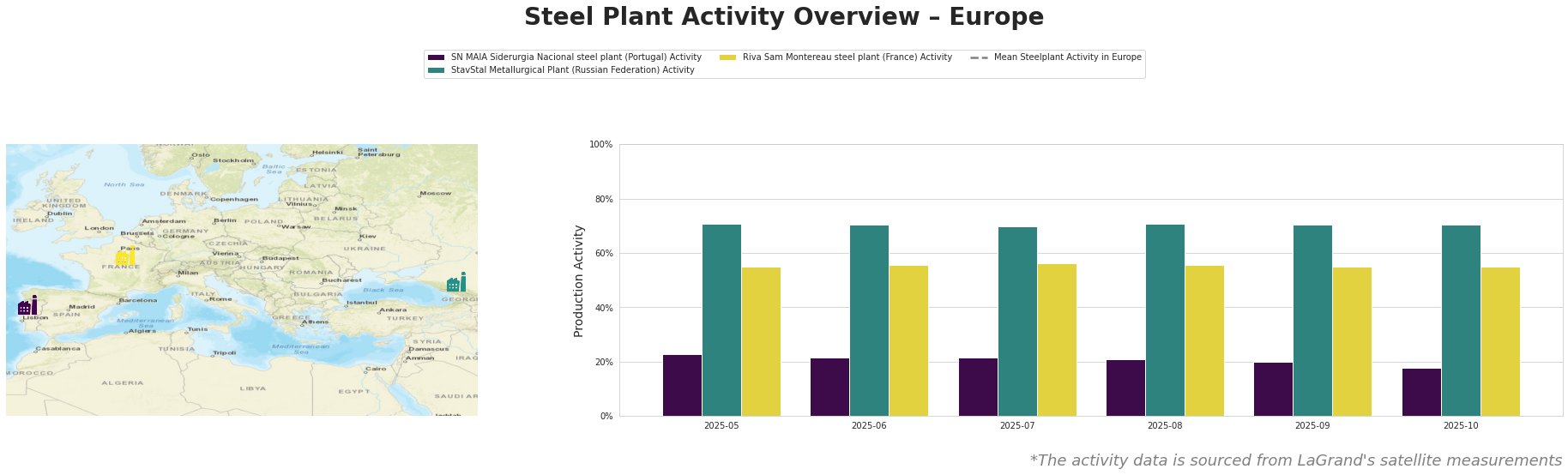

The mean steel plant activity in Europe has fluctuated, generally trending downwards, reaching its lowest point in October 2025.

SN MAIA Siderurgia Nacional, a Portuguese steel plant with a 600ktpa EAF-based capacity focused on rebar production, has seen a continuous decline in activity from May (23%) to October (18%). This decrease might be correlated with the described weak demand outlined in the articles “The global rebar market remains under pressure from weak demand in the fall” and “European long steel market struggles to gain traction amid limited demand”, however, a direct causal relationship cannot be explicitly established.

StavStal Metallurgical Plant, a Russian facility producing rebar and wire rod via EAF technology with a capacity of 500ktpa, has maintained a relatively stable activity level around 71% throughout the observed period, slightly decreasing to 70% in October. While “European longs prices continue to follow different trends” highlights varied market conditions, no explicit link to StavStal’s stable activity can be directly established from the provided news.

Riva Sam Montereau, a French steel plant producing rebar and wire rod with a 720ktpa EAF capacity, shows stable activity at around 55-56% throughout the period. While “European longs prices continue to follow different trends” highlights varied market conditions, no explicit link to Riva Sam Montereau’s activity can be directly established from the provided news.

The industrial accident at Pittini Group’s Italian plant, as mentioned in “European longs prices continue to follow different trends” and “Prices for European long positions continue to follow various trends,” has the potential to disrupt supply and support price increases in the Italian rebar market. Italian rebar prices have already shown stabilization.

Given the potential for supply disruptions in the Italian rebar market due to the Pittini Group incident and the general downward pressure on wire rod prices as per “European longs prices continue to follow different trends” and “Prices for European long positions continue to follow various trends,” steel buyers should:

- Monitor Italian Rebar Prices: Closely track rebar price fluctuations in Italy and consider securing supply from alternative sources outside Italy if prices increase significantly due to the Pittini Group disruption.

- Negotiate Wire Rod Contracts: Leverage the anticipated decrease in wire rod prices, particularly in Italy and Central/Eastern Europe, to negotiate more favorable contract terms with suppliers in November.

- Evaluate Turkish Imports Carefully: While Turkish rebar prices have seen a slight decrease, monitor the Euro-Dollar exchange rate and import conditions closely before committing to large volumes.