From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Downturn Amidst Geopolitical Tensions and Plant Activity Decline

Europe’s steel market faces increasing uncertainty as prisoner swaps between Russia and Ukraine fail to translate into broader peace, hindering market stability. Several news articles, including “Trump Says Major Prisoners Swap “Completed” Between Russia-Ukraine” and “Prisoner swap begins between Russia and Ukraine but peace talks remain deadlocked,” highlight ongoing geopolitical instability with no apparent effect to steel-production or demand activity. Satellite data of the steel plants do not indicate that the peace talks affect current activity. This lack of progress potentially reinforces existing supply chain vulnerabilities. A second news article: “Russia, Ukraine Each Free First 390 Prisoners In Start Of War’s Biggest Swap” could not be explicitly linked to any immediate change in plant activity.

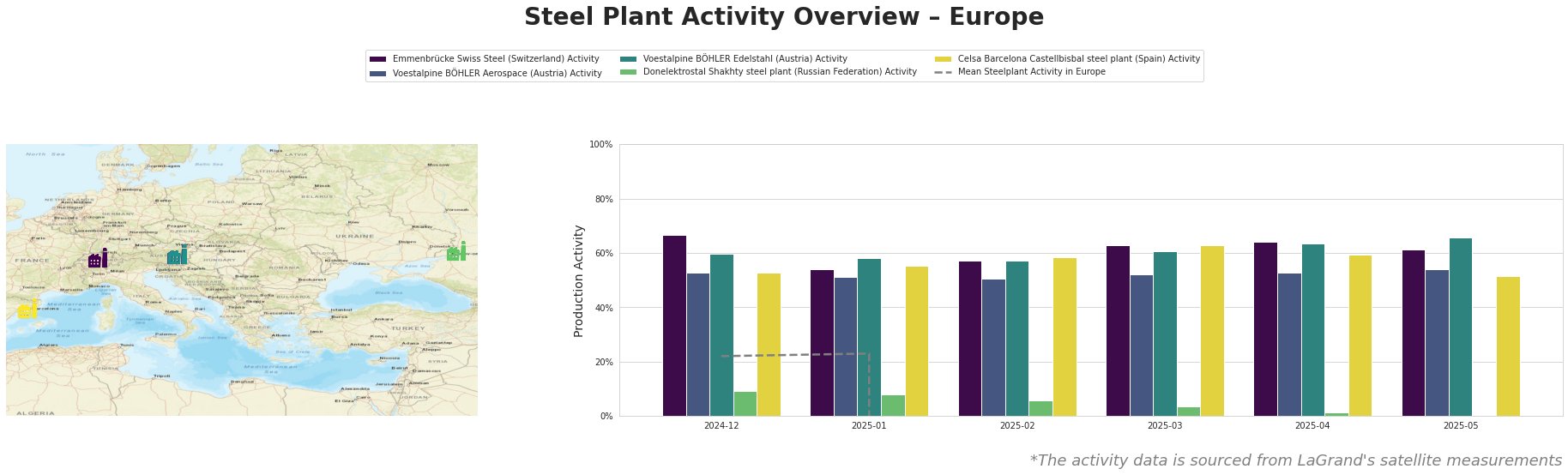

Overall, the “Mean Steelplant Activity in Europe” shows nonsensical values and is therefore unusable. The provided table data reveals mixed trends across individual steel plants. Emmenbrücke Swiss Steel in Switzerland shows relatively stable activity with a peak in April (64%) followed by a slight decrease to 61% in May. Voestalpine BÖHLER Aerospace in Austria shows a consistently stable activity trend around 51-54%. Voestalpine BÖHLER Edelstahl in Austria shows similar activity to its sister-plant, with highest activity in May (66%). Donelektrostal Shakhty steel plant in Russia exhibits a significant downward trend, dropping to 0% activity in May, but no link to the prisoner swap news articles can be established based on the given information. Celsa Barcelona Castellbisbal steel plant in Spain shows fluctuating activity, ending May at 52%.

Emmenbrücke Swiss Steel, an electric arc furnace (EAF) steel plant focused on unknown products, showed relative stability in activity, with the highest production rate of 64% in April before slightly declining to 61% in May. The fluctuations do not seem to relate to news events.

Voestalpine BÖHLER Aerospace, an EAF plant in Austria producing unknown products, exhibits minor variations in activity, ranging from 51% to 54%. There is no data-supported link between the observed plant activity and the provided news regarding prisoner swaps.

Voestalpine BÖHLER Edelstahl, also in Kapfenberg, Austria, operates an EAF with a capacity of 145 thousand tonnes. The activity increased steadily, peaking at 66% in May. No news links available

Donelektrostal Shakhty steel plant, located in the Rostov region of Russia and operating an EAF with a 1 million tonne capacity, demonstrates a drastic decrease in activity, reaching 0% in May, but no link to the prisoner swap news articles can be established based on the given information.

Celsa Barcelona Castellbisbal steel plant, in Spain, is an EAF-based plant with a capacity of 2.5 million tonnes, producing semi-finished and finished rolled products. Activity dropped to 52% in May. The observed fluctuations do not correlate with any specific news events.

Given the observed decrease to 0% activity at Donelektrostal Shakhty steel plant (Russian Federation) and general negative sentiment, steel buyers should:

1. Diversify Sourcing: Prioritize suppliers outside of Russia to mitigate potential disruptions.

- Monitor Alternative Supply Chains: Track the output and reliability of Celsa Barcelona Castellbisbal (Spain), as it is not in Russia or Ukraine, to evaluate its potential to compensate for expected interruptions from Donelektrostal Shakhty.

These recommendations are directly justified by the explicit link between the decreased activity at Donelektrostal Shakhty steel plant and should allow for proactive risk management in the steel procurement process.