From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Demand Uncertainty Amid CBAM Concerns, Rebar Price Drops, and Fluctuating Plant Activity

The European steel market is facing headwinds due to weak demand and regulatory uncertainty, particularly surrounding the Carbon Border Adjustment Mechanism (CBAM). The “European HRC market quiets as buyers await clarity on CBAM, safeguards“ article highlights the postponement of restocking by many buyers, correlating with the overall negative sentiment. The “Rebar prices continue to fall in Italy amid lack of support“ article indicates further price pressure, adding to the market’s instability. While import prices for heavy plate are including potential CBAM costs as stated in the article “Italy steel heavy plate prices narrow upward ibn new deals; CBAM costs built into import offers“, demand remains low, with market participants preferring to await further guidance from the European Commission on the topic. Direct links between these broad market sentiments and individual plant activity levels are difficult to explicitly establish solely based on this information.

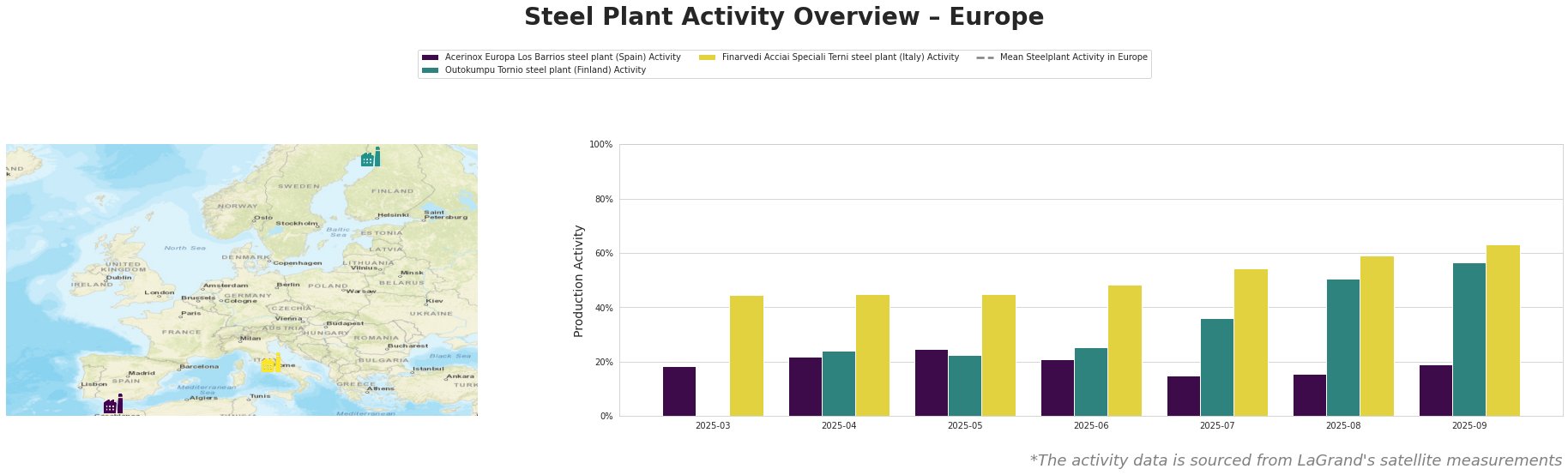

The mean steel plant activity in Europe shows fluctuations throughout the observed period, dropping significantly in April and again in September. Acerinox Europa Los Barrios in Spain, a 1.2 million tonne EAF stainless steel producer, experienced a decrease in activity from May (25%) to July (15%) before a slight rise to 19% in September. This activity drop does not have a directly evident relationship with the provided news articles. Outokumpu Tornio, a 1.2 million tonne EAF stainless steel producer in Finland focusing on cold and hot rolled coil, showed a strong increase in activity from April (24%) to September (56%). This upward trend contrasts with the general market negativity reported. The Finarvedi Acciai Speciali Terni plant in Italy, also a 1.45 million tonne EAF stainless steel producer, exhibits a consistent upward trend in activity, rising steadily from March (45%) to September (63%), showing similar results as Outokumpu Tornio. The increase at the Finarvedi plant in Italy coincides with reported drops in rebar prices in Italy, however no direct link can be explicitly established.

Given the overall negative market sentiment and the uncertainty highlighted in the “European HRC market quiets as buyers await clarity on CBAM, safeguards” article, steel buyers should prioritize short-term contracts with suppliers who can offer flexibility and potentially absorb some CBAM-related costs in the near term. Monitor import offers closely, but factor in potential delivery risks from Southeast Asia, as the news suggests. For rebar procurement, leverage the downward price trend in Italy, as indicated by the “Rebar prices continue to fall in Italy amid lack of support” article, but be mindful of potential supply disruptions if Italian mills reduce production in response to falling prices. Given the increasing activity at the Finarvedi Acciai Speciali Terni steel plant, investigate whether they are offering competitive pricing to capitalize on their increased production.