From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Downturn: HRC Prices Plunge Amid Weak Demand and Import Pressure

Europe’s steel market faces persistent negative sentiment driven by weak demand and import competition, impacting prices and potentially leading to supply chain adjustments. As reported in “Negative sentiment persists in the European HRC steel market,” European HRC prices continue to decline. This price decline is further confirmed by “European HRC prices keep falling“, as the Northern European HRC index dropped to €575.71 per tonne. “Sale of thick-rolled products in Europe: prices decrease due to weak demand” also confirms weak demand leading to price decreases of thick-rolled products. Satellite data partially reflect this, with plant activity data showing mixed signals; however, it’s difficult to directly correlate the activity data with the named news articles due to the aggregated nature of the data, and potential time lags between production and price impacts.

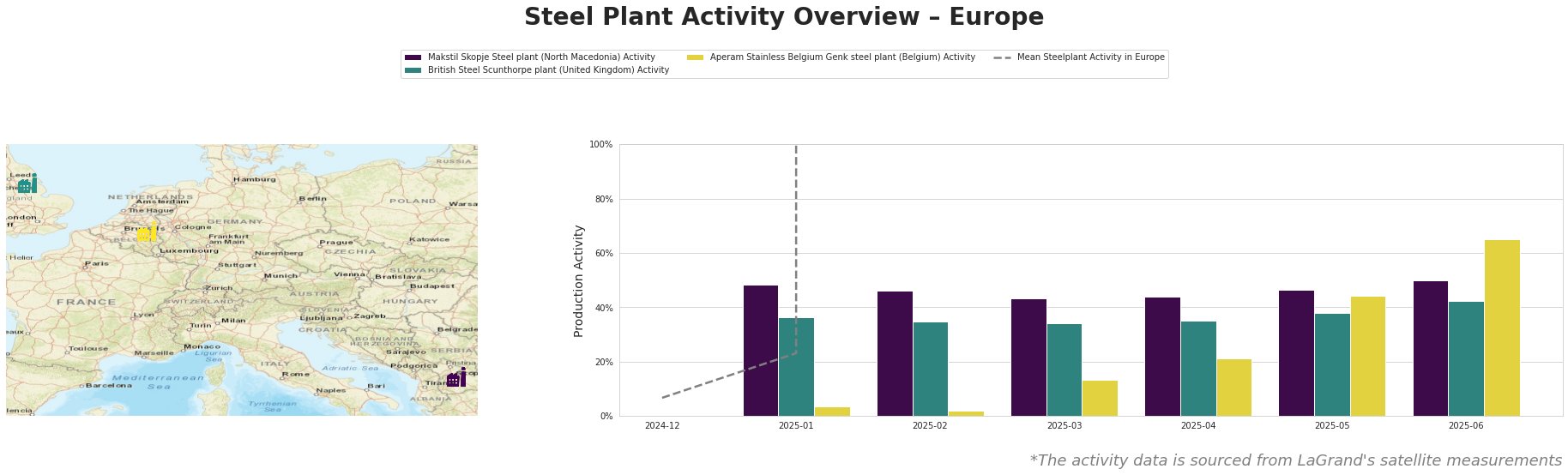

From January to June 2025, the mean steel plant activity in Europe has fluctuated significantly, starting at 23.0 and peaking in May before decreasing in June. Makstil Skopje’s activity remained relatively stable, consistently above the European mean, increasing from 48.0 in January to 50.0 in June. British Steel Scunthorpe showed a gradual increase in activity from 36.0 in January to 42.0 in June, also consistently above the European average. Aperam Genk’s activity increased dramatically from 4.0 in January to 65.0 in June, indicating a substantial production ramp-up, especially relative to the European mean. Due to the high degree of aggregation, these satellite data can not be directly linked to the content of the named new articles.

Makstil Skopje, an EAF-based plant with a 550ktpa crude steel capacity focusing on semi-finished slab products, has maintained a consistently high activity level throughout the observed period, peaking at 50.0 in June. This suggests stable production despite broader market pressures, but no direct connection to the named news articles can be established.

British Steel Scunthorpe, an integrated BF-BOF plant with a 3200ktpa crude steel capacity producing both semi-finished and finished rolled products, exhibited a steady increase in activity, reaching 42.0 in June. This increase does not immediately reflect the price declines mentioned in “Negative sentiment persists in the European HRC steel market,” and “Sale of thick-rolled products in Europe: prices decrease due to weak demand,” indicating a potential lag between production and market impact or a focus on fulfilling existing orders.

Aperam Stainless Belgium Genk, an EAF-based stainless steel producer with a 1200ktpa crude steel capacity, showed a substantial increase in activity, reaching 65.0 in June. This could signify increased demand for stainless steel or a strategic production shift, but no direct linkage to the named news articles discussing HRC and thick-rolled product prices can be established.

Given the continued decline in HRC prices and the pressure from cheaper imports highlighted in “Negative sentiment persists in the European HRC steel market,” and “European HRC prices keep falling,” steel buyers should consider the following:

- Negotiate aggressively with domestic suppliers: Leverage the downward price trend and import competition to secure better deals. Focus on short-term contracts to capitalize on further price drops.

- Evaluate import options carefully: While Indonesian, Algerian, Turkish and Vietnamese HRC offer cost advantages, buyers must rigorously assess quality, delivery times, and potential duties before committing, based on the import price levels cited in the news articles.

- Monitor British Steel Scunthorpe closely: The plant’s increased activity, while not immediately impacting prices, could lead to increased supply in the near term. Track their output and adjust procurement strategies accordingly.