From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: ArcelorMittal Bosnia Exit & Rising Russian Output Signal Market Shift

ArcelorMittal’s strategic realignment in Europe is underway, marked by the finalized sale of its Bosnian assets, as indicated in the news articles: “ArcelorMittal completes sale of assets in Bosnia and Herzegovina,” “ArcelorMittal completes sale of Bosnian steel mill,” “ArcelorMittal completes sale of Bosnian steel mill,” and “ArcelorMittal completes sale of Bosnia plant“. Satellite data shows no direct relationship between this sale and observed activity levels at the selected steel plants in Germany, Russia, and Ukraine.

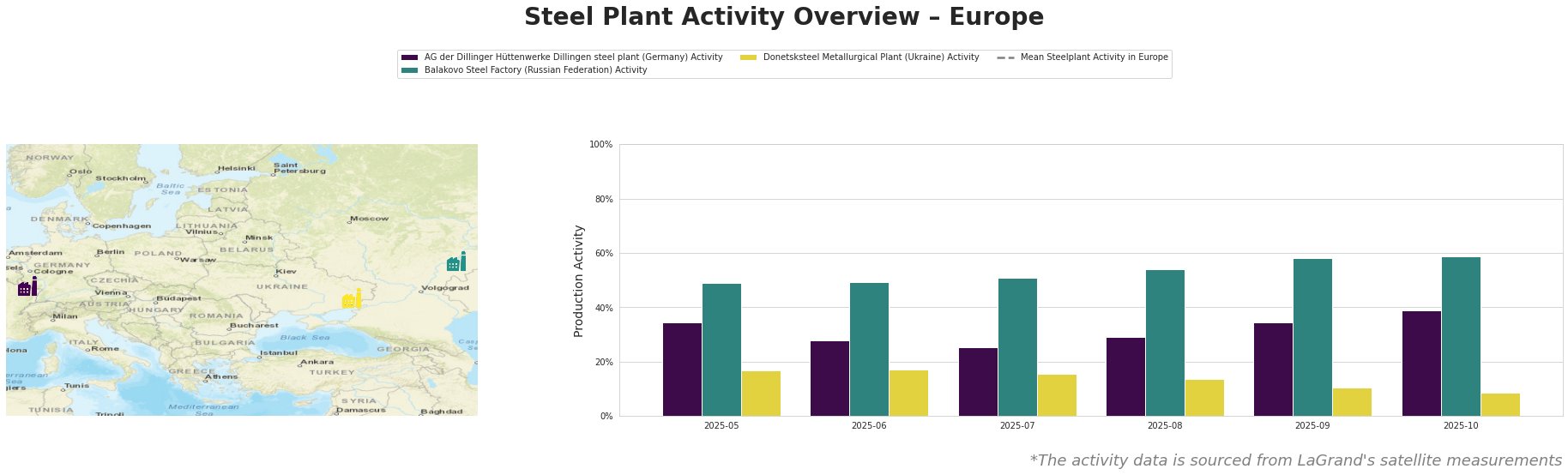

The mean steel plant activity in Europe fluctuated significantly over the observed period, reaching its highest level in July and August 2025, and declining notably in September and October. AG der Dillinger Hüttenwerke Dillingen steel plant in Germany, an integrated BF/BOF producer of heavy-plate products, saw a gradual increase in activity from 25% in July to 39% in October. This shows a stable trend, contrasting against the other plants and mean. The Balakovo Steel Factory, an EAF-based long product producer in Russia, demonstrated a consistent upward trend, increasing from 49% in May to 59% in October, significantly outperforming the European average. The Donetsksteel Metallurgical Plant in Ukraine, primarily a pig iron producer with BF technology and mothballed EAF facilities, experienced a consistent decline in activity, dropping from 17% in May to 9% in October.

AG der Dillinger Hüttenwerke Dillingen steel plant, a major integrated producer in Germany specializing in heavy plate with a capacity of 2.76 million tonnes of crude steel, showed a gradual activity increase over the period. Satellite data shows no direct correlation between activity changes in Dillingen and the ArcelorMittal news.

The Balakovo Steel Factory, a 1.2 million tonne EAF-based producer of long products in the Saratov region of Russia, exhibited a significant rise in activity from 49% in May to 59% in October. This plant does not appear to be directly impacted by the ArcelorMittal sale, as there is no established connection between the news articles and the increase in activity at this location.

The Donetsksteel Metallurgical Plant, located in Ukraine, primarily produces pig iron using BF technology. Its activity consistently decreased, reaching a low of 9% in October. No direct link can be established between the ArcelorMittal divestment in Bosnia and the activity decline in Donetsk.

The sale of ArcelorMittal’s Bosnian assets, specifically ArcelorMittal Zenica with a 700,000 tonne capacity in long products, could lead to a temporary supply disruption in the Balkan region for long steel products. Steel buyers in the Balkans should proactively engage with Pavgord Group to understand their production plans and potential changes in product offerings. Simultaneously, explore alternative suppliers for long products, considering the rising output at Balakovo Steel Factory in Russia as a potential, albeit potentially politically sensitive, source. Market analysts should closely monitor Pavgord Group’s investment and operational strategies at ArcelorMittal Zenica to assess its long-term impact on the Balkan steel market and potential shifts in trade flows.