From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Activity Dips Amidst Energy Cost Concerns and Automotive Policy Uncertainty

Europe’s steel market faces a complex landscape as energy cost anxieties and automotive policy debates impact production. The steel market implications of the growing opposition to the EU’s combustion engine ban, as highlighted in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert,” may be reflected in production adjustments at plants supplying the automotive sector. The article “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten” suggests potential cost pressures, potentially impacting energy-intensive steel production. While this article highlights the need for a rapid energy transition, no explicit link to observed plant activity trends can be established directly from the provided data.

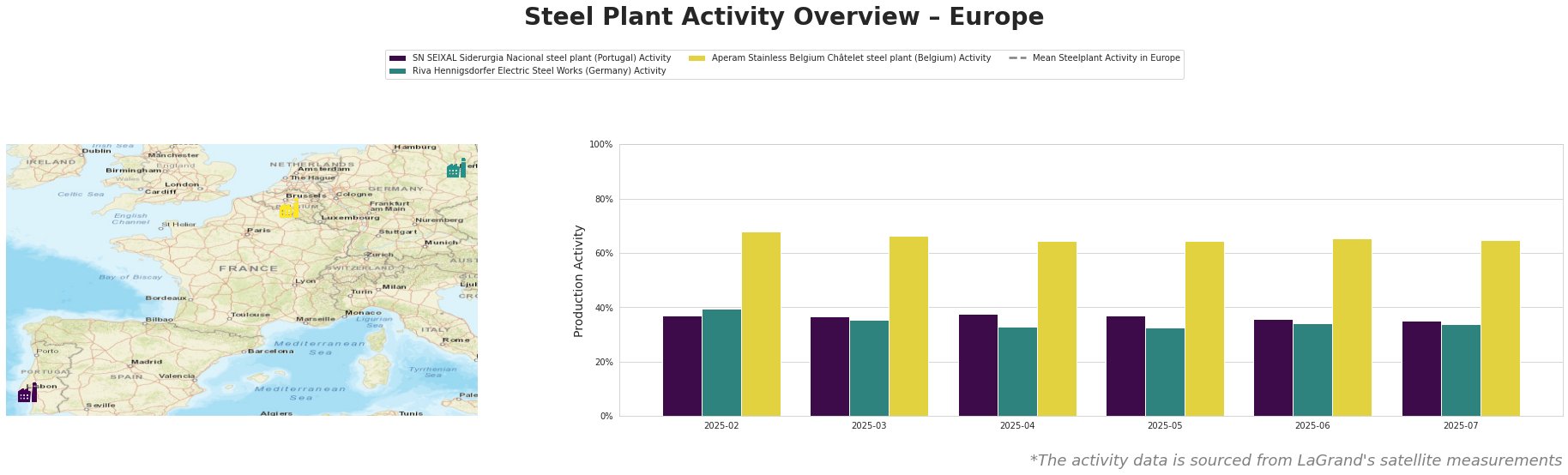

Activity levels across the observed plants show a slight downward trend in the most recent months. The SN SEIXAL plant in Portugal experienced a decrease from 37% in May 2025 to 35% in July 2025. Riva Hennigsdorfer in Germany also saw a decrease, from 39% in February 2025 to 34% in July 2025. Aperam Stainless Belgium shows a decrease from 68% in February 2025 to 65% in July 2025.

SN SEIXAL Siderurgia Nacional steel plant is an EAF-based steel plant in Setúbal, Portugal, with a crude steel capacity of 1.1 million tonnes per annum (ttpa). It focuses on semi-finished and finished rolled products, including mesh, wire, hot-rolled coils, and bars. The plant’s activity level saw a slight decrease, dropping from 37% in May to 35% in July. No direct link to the provided news articles could be established.

Riva Hennigsdorfer Electric Steel Works in Brandenburg, Germany, operates two EAFs with a total melting capacity of 140 t/h, producing 1 million ttpa of crude steel. Its product range includes steel billets, rebar, bright steel, and round steel, with a focus on the automotive end-user sector. The plant’s activity decreased from 39% in February 2025 to 34% in July 2025. Given the plant’s automotive sector focus, the production adjustment may be related to uncertainty surrounding the transition to electric vehicles, as reported in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert“.

Aperam Stainless Belgium Châtelet steel plant, located in Wallonie, Belgium, has a crude steel capacity of 1 million ttpa, utilizing an EAF and an AOD converter to produce stainless steel slabs and cold-rolled products. The plant’s activity decreased from 68% in February 2025 to 65% in July 2025. No direct link to the provided news articles could be established.

Given the potential impact of energy costs discussed in “Umweltbundesamt: Präsident warnt vor steigenden Energiekosten durch zu viele Gas-Kapazitäten” and the automotive policy uncertainties highlighted in “Nur noch E-Autos ab 2035?: Wie sich in der Union offener Widerstand gegen das Verbrenner-Aus formiert,” procurement professionals should:

- Closely monitor Riva Hennigsdorfer’s output: As a key supplier to the automotive sector, any further decline in activity could signal potential supply constraints, especially for rebar and steel billets. Consider diversifying suppliers or negotiating longer-term contracts to mitigate risk.

- Factor in potential energy cost fluctuations: The UBA’s warning about rising energy costs suggests potential price volatility. Steel buyers should incorporate this uncertainty into their budgeting and procurement strategies, exploring options such as hedging or indexing contract prices to energy costs.