From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Rebar Market Remains Stable Despite Energy Cost Pressures: Monitor Northern Italy & Celsa Poland

Europe’s rebar market is exhibiting stability amidst fluctuating prices and rising production costs, requiring careful monitoring, particularly in Northern Italy and Poland. This report analyzes market dynamics based on recent news and satellite-observed steel plant activity.

The European rebar market showed regional divergence, influencing price stability across the continent. The article “European rebar prices split amid rising energy, raw materials costs” highlights the cost pressures felt by Northern mills. While prices in Northern Europe held steady, as reported in “Steel rebar prices in Europe stable, seeking direction,” regional discrepancies continue to impact overall market sentiment.

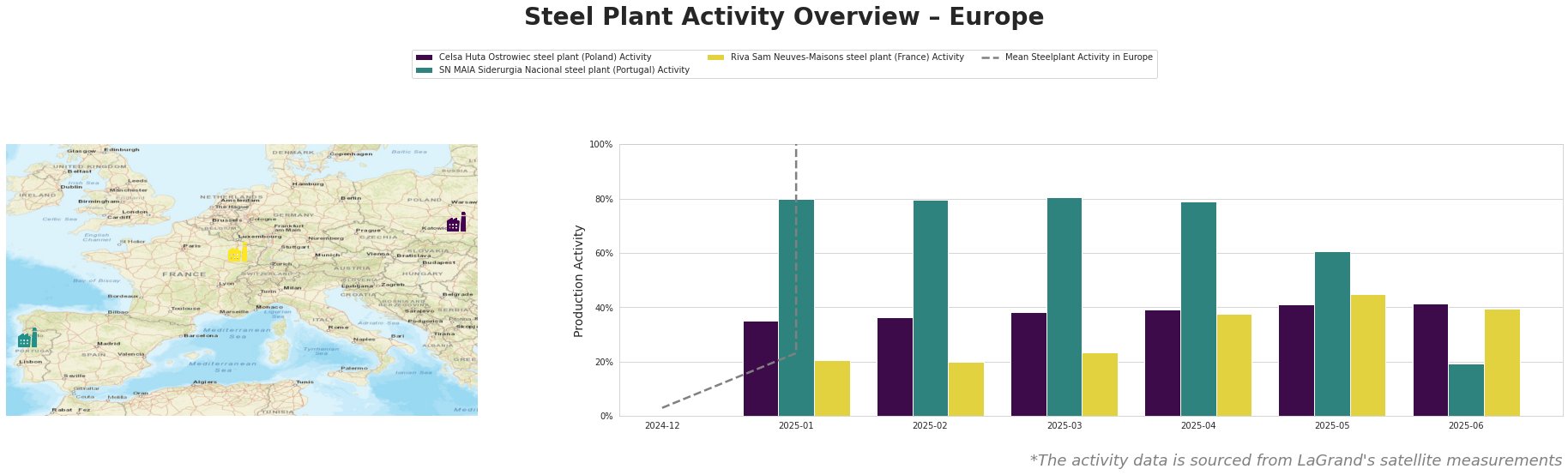

Measured Activity Overview

The mean steel plant activity in Europe shows high fluctuation during the period, starting at low levels in January 2025 and peaking in May, but this number is heavily skewed by implausible values in February, March, April, May and June.

Celsa Huta Ostrowiec in Poland shows a steady increase in activity, rising from 35% in January to 42% in June. SN MAIA Siderurgia Nacional in Portugal started with high activity at 80% but experienced a significant drop to 19% in June. Riva Sam Neuves-Maisons in France has increased its activity from 21% in January to 40% in June.

Celsa Huta Ostrowiec steel plant

Celsa Huta Ostrowiec, a Polish steel plant with an EAF-based production capacity of 900,000 tonnes of crude steel per year, primarily produces finished rolled products like rebar for the building and infrastructure sectors. The plant’s observed activity has steadily increased from 35% in January 2025 to 42% in June 2025. This increase in activity does not have an explicit, direct connection to any of the provided news articles, though it may indirectly align with the general stability in Northern European prices reported in “Steel rebar prices in Europe stable, seeking direction“.

SN MAIA Siderurgia Nacional steel plant

SN MAIA Siderurgia Nacional, a Portuguese steel plant utilizing EAF technology, has a crude steel capacity of 600,000 tonnes annually, focusing on rebar production. Its activity level experienced a sharp decline from 80% in January 2025 to 19% in June 2025. This decrease, potentially indicating a supply reduction, has no direct connection to the provided news articles, requiring further investigation.

Riva Sam Neuves-Maisons steel plant

Riva Sam Neuves-Maisons, a French steel plant operating with EAF technology, has a crude steel production capacity of 850,000 tonnes per year. Its product range includes semi-finished and finished rolled products such as billets, coils, wire, and rebar. The plant demonstrated a consistent increase in activity from 21% in January 2025 to 40% in June 2025. No direct correlation could be established between this rise in activity and the provided news articles.

Evaluated Market Implications

The news articles report general price stability in rebar despite fluctuating costs and regional divergence.

* Potential Supply Disruption: The significant activity drop at SN MAIA Siderurgia Nacional (Portugal) from 80% to 19% could indicate a potential supply disruption, primarily impacting rebar availability in the Iberian Peninsula. This drop occurs while Spanish prices increase as described in “Steel rebar prices in Europe stable, seeking direction“.

* Procurement Actions:

* Steel Buyers: Given the fluctuating rebar prices and rising production costs across Europe, buyers should closely monitor the availability of rebar from SN MAIA Siderurgia Nacional (Portugal), and consider diversifying supply sources to mitigate risk.

* Market Analysts: Focus on analyzing the causes behind the activity decrease in SN MAIA Siderurgia Nacional (Portugal), and its impact on regional price dynamics and trade flows. Track whether this decrease influences any further changes in Spanish prices and potential impacts on Northern Europe.