From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Rebar Market Diverges: Demand Weakness Offsets Rising Costs

Europe’s rebar market displays a mixed picture, with declining prices in many regions due to insufficient demand, despite rising energy and raw material costs. This is directly reflected in news such as “Rebar prices in most of Europe drop amid insufficient demand” and “Rebar prices are falling in most European countries due to insufficient demand.“. The article “European rebar prices split amid rising energy, raw materials costs” confirms this regional divergence, highlighting the impact of cost pressures. However, a direct link to satellite-observed plant activity levels cannot be conclusively established.

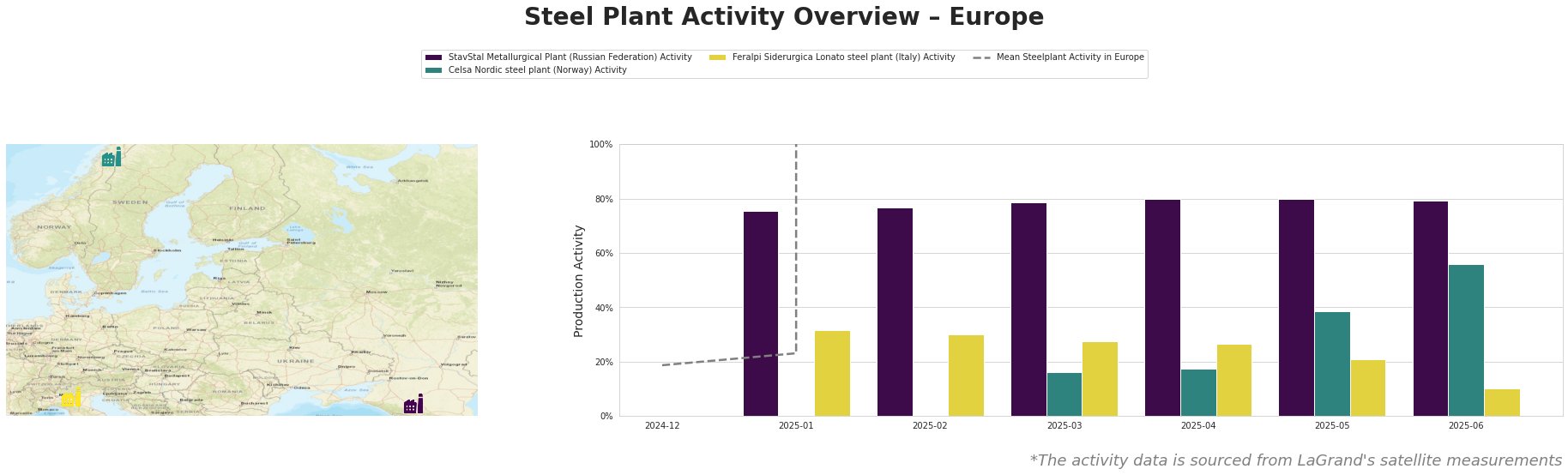

The mean steel plant activity level in Europe, derived from satellite observations, fluctuated significantly, with a rise from 19% at the end of 2024 to an apparent peak in May 2025. The StavStal Metallurgical Plant maintained relatively high activity, averaging around 78% – 80% throughout the observed period, consistently outperforming the European mean. Celsa Nordic showed a strong recovery in June, increasing to 56%, while Feralpi Siderurgica Lonato sharply decreased to only 10% in June. The activity levels seem to have decreased significantly in June, but this should be interpreted cautiously due to the large and potentially erroneous values for the mean in earlier months.

StavStal Metallurgical Plant, a Russian plant with 500ktpa EAF-based capacity producing rebar and wire rod, shows consistently high activity levels (around 80%) between January and June 2025. This high activity occurs despite the overall European trend of weakening demand as reported in “Rebar prices in most of Europe drop amid insufficient demand“. No direct correlation can be established between StavStal’s activity and the provided news articles regarding the European market.

Celsa Nordic, a Norwegian EAF steel plant producing 700ktpa of rebar and wire rod, exhibits fluctuating activity. Starting from a low base, activity gradually increased to 56% in June 2025. While there is an upward trend, a direct connection to the provided news articles on European rebar prices and demand cannot be explicitly established based on the provided information.

Feralpi Siderurgica Lonato, an Italian EAF-based plant with 1100ktpa capacity focusing on rebar and billets, saw a significant activity drop to 10% in June 2025 after remaining relatively stable in previous months. This aligns with the news in “Rebar prices in most of Europe drop amid insufficient demand” which mentions falling prices in Italy. The article “European rebar prices split amid rising energy, raw materials costs” indicates that northern Italian mills were lowering offers, potentially impacting Feralpi’s production in Lonato.

Based on the reported activity decrease at Feralpi Siderurgica Lonato in Italy and the news of falling rebar prices and weakening demand in Italy (“Rebar prices in most of Europe drop amid insufficient demand“), steel buyers should:

- Prioritize monitoring Italian rebar supply. The reduced activity at Feralpi suggests potential supply constraints from Italian mills.

- Consider diversifying suppliers. Given the uncertainty in the Italian market, buyers should explore alternative sources, particularly from Spain, where prices have remained relatively stable according to “European rebar prices split amid rising energy, raw materials costs“.

- Negotiate cautiously with Italian suppliers. The falling prices reported in “Rebar prices in most of Europe drop amid insufficient demand” suggest potential for favorable negotiation, but the rising energy costs mentioned in “European rebar prices split amid rising energy, raw materials costs” mean a short-term strategy only. Buyers should closely monitor supplier costs.