From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: US Tariffs Loom as Plant Activity Shows Mixed Signals

Europe’s steel market faces potential disruption as new US tariffs create uncertainty. Recent satellite data reveals varied activity levels across key European steel plants, with potential implications for steel supply chains. The “Trumps US-Zölle im Liveticker: Neue Zölle gelten wohl erst ab 7. August“ and “Trumps US-Zölle im Liveticker: Schweiz mit Zoll von 39 Prozent belegt“ articles highlight the imposition of new tariffs by the US, impacting several countries including Switzerland, Canada and Brazil. Although these new tariffs do not target the EU directly, uncertainty regarding trade flows, and steel prices have increased significantly across the continent. No direct relationship could be established between these news items and the observed plant activity in the provided data.

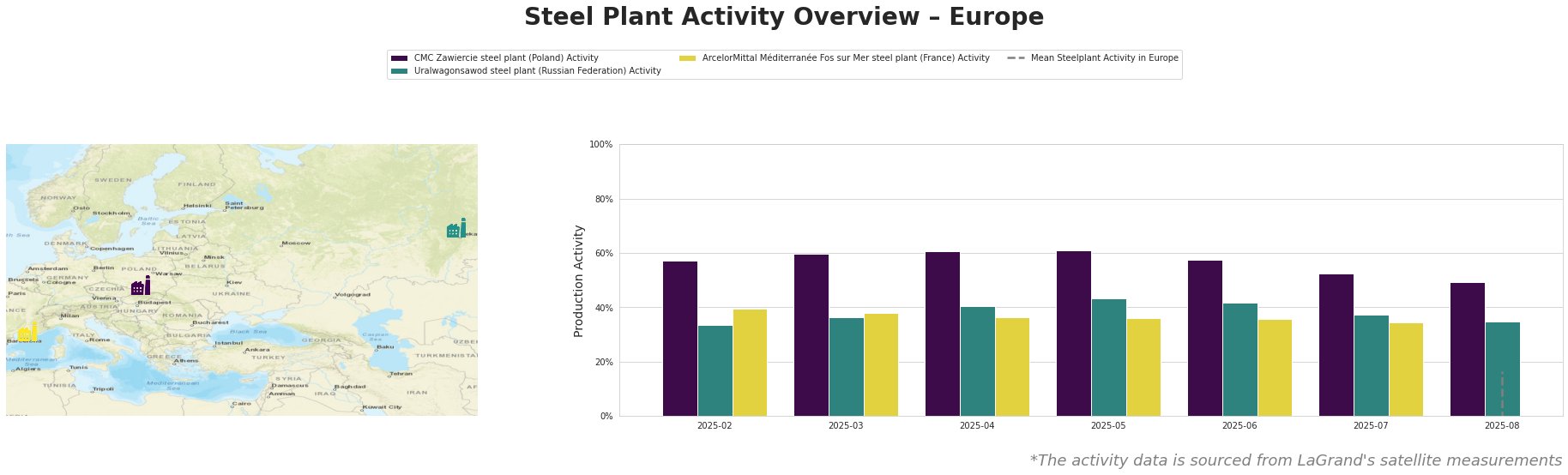

The mean steel plant activity in Europe has fluctuated significantly over the observed period, but due to the large negative values, it is hard to assess the changes in the mean. CMC Zawiercie steel plant in Poland exhibited relatively stable activity levels from February to May, peaking at 61%, before declining to 49% by August. Uralwagonsawod steel plant in Russia showed a gradual increase from February to May (34% to 43%) followed by a slight decline to 35% in August. ArcelorMittal Méditerranée Fos sur Mer in France remained relatively stable in activity between February and June. However activity decreased from 40% in February, to 34% in July.

CMC Zawiercie, located in Silesia, Poland, is a significant steel producer with an Electric Arc Furnace (EAF) capacity of 1.7 million tonnes per annum. The observed activity drop from 61% in May to 49% in August could not be directly linked to the provided news articles on US tariffs. However, the plant’s reliance on EAF technology might make it more susceptible to electricity price volatility.

Uralwagonsawod steel plant, located in Russia, focuses its production on the defense sector. The activity decline observed in July, after the peak in May, cannot be directly linked to the provided news on US tariffs. Its production capacity is unknown.

ArcelorMittal Méditerranée Fos sur Mer, located in France, is an integrated steel plant with a Basic Oxygen Furnace (BOF) capacity of 4 million tonnes per annum. The plant’s activity showed a continuous decline from 40% in February to 34% in July. Again, it is not possible to relate this production change directly to Trump’s tariffs. However, the article “Trumps Zollpolitik: Darf der US-Präsident Zölle verhängen?“ highlights the uncertainty surrounding the legality of these tariffs, which could influence production decisions.

Considering the potential for trade disruptions and the mixed activity signals, steel buyers should carefully monitor the legal challenges to the US tariffs as described in “Trumps Zollpolitik: Darf der US-Präsident Zölle verhängen?”. Given the decline in activity at the CMC Zawiercie plant in Poland, buyers dependent on this plant should evaluate alternative suppliers in the region to secure supply and mitigate possible bottlenecks.