From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: Salzgitter’s Green Steel Delay Clouds Outlook; Stable Activity in Russia, Dillingen Shows Fluctuations

In Europe, the steel market faces uncertainty as decarbonization efforts encounter headwinds. The postponement of Salzgitter’s SALCOS project is highlighted in multiple reports, including “Salzgitter delays green steel plan amid economic, regulatory headwinds,” “Salzgitter postpones Green Steel plan amid economic and regulatory difficulties,” and “Salzgitter postpones Salcos Hydrogen Steel Project for three years.” While these delays are significant, no direct relationship can be established with the recent satellite-observed activity levels across selected plants, as the projects’ impact is primarily anticipated in future years.

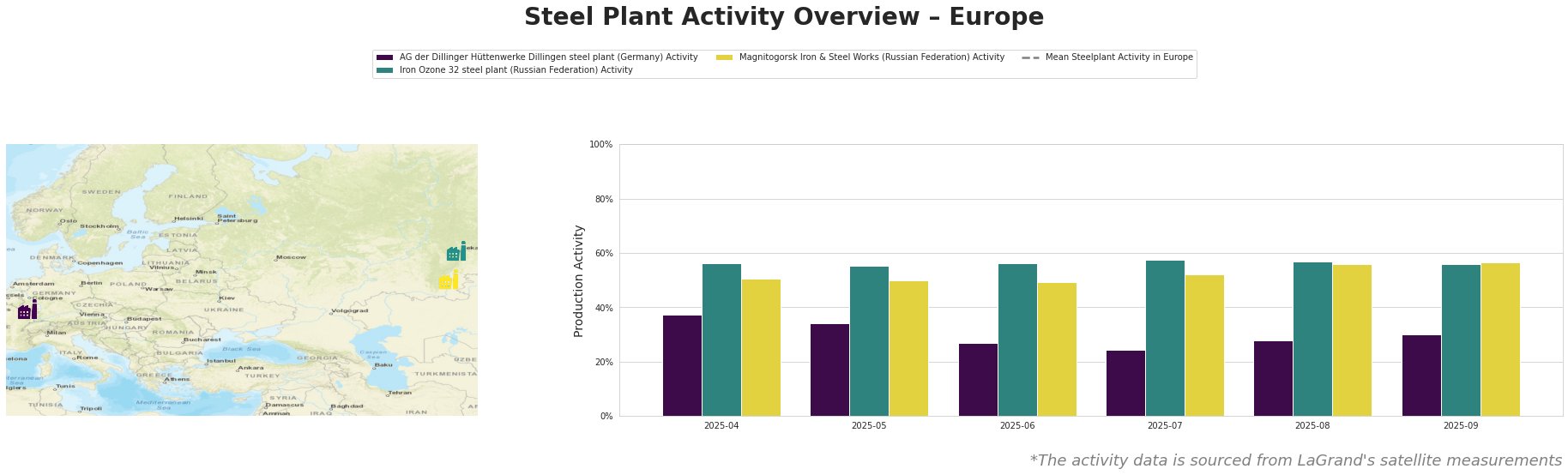

The Mean Steelplant Activity in Europe fluctuates between 52% and 70% over the observed period. Activity at AG der Dillinger Hüttenwerke Dillingen steel plant shows a declining trend from April to July (37% to 24%), followed by a slight increase in August and September (28% and 30% respectively). Iron Ozone 32 steel plant in Russia exhibits a relatively stable activity level, ranging between 55% and 58%. Magnitogorsk Iron & Steel Works in Russia shows a gradual increase in activity, from 50% in April and May to 57% in September.

AG der Dillinger Hüttenwerke, located in Saarland, Germany, is an integrated steel plant with a crude steel capacity of 2.76 million tonnes per year using BOF technology. It produces semi-finished and finished rolled products for various sectors, including automotive and energy. The observed decrease in activity from April to July, reaching a low of 24% followed by a slight recovery, cannot be directly linked to the Salzgitter SALCOS news, but it underscores the volatile conditions cited in those reports.

Iron Ozone 32 steel plant in Sverdlovsk, Russia, possesses an EAF-based production route with a capacity of 1.25 million tonnes of crude steel annually, specializing in billet production for the energy sector. The consistent activity levels observed via satellite do not directly correlate with the European news regarding Salzgitter’s project delays, indicating a relatively stable operational status within its regional context.

Magnitogorsk Iron & Steel Works, situated in Chelyabinsk, Russia, is a large integrated steel plant, boasting a crude steel capacity of 14.5 million tonnes per year via BOF and EAF routes. It produces a wide range of semi-finished and finished rolled products, catering to sectors like automotive and construction. The plant’s activity exhibited a gradual increasing trend during the period under review. No direct link between activity levels and the Salzgitter news can be established, suggesting operations remain insulated from the immediate challenges facing decarbonization projects in Western Europe.

Evaluated Market Implications:

The delay in Salzgitter’s SALCOS project, as reported in “Salzgitter delays green steel plan amid economic, regulatory headwinds,” “Salzgitter postpones Green Steel plan amid economic and regulatory difficulties,” and “Salzgitter postpones Salcos Hydrogen Steel Project for three years,” does not present immediate supply disruptions. However, it signals a potential longer-term constraint on the availability of green steel in Europe. Given that AG der Dillinger Hüttenwerke’s activity has seen a decline in recent months, despite not being explicitly tied to the Salzgitter situation, procurement professionals should:

- Diversify Sourcing: Actively explore alternative suppliers, particularly those with established green steel production capabilities outside of the immediate Salzgitter network, to mitigate risks associated with potential future green steel shortages.

- Monitor Russian Plant Activity: While currently stable, closely monitor the activity of Iron Ozone 32 and Magnitogorsk Iron & Steel Works for any unexpected shifts, as these could indicate broader supply chain adjustments or geopolitical impacts, given their apparent insulation from European economic headwinds.