From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel: Modernization Efforts and Stable Activity Amidst Decarbonization Trends

In Europe, steel modernization and decarbonization efforts are underway. This report examines steel plant activity in light of these initiatives, drawing upon observed satellite data and recent news, including “ArcelorMittal Poland in talks with government regarding state funding for modernization” and “ArcelorMittal enters into negotiations on state aid to Poland: reports,” and “Tata Steel seeks greener output with recycling push“. While ArcelorMittal’s potential modernization is significant, no direct impact on activity levels is immediately apparent. The “Tata Steel seeks greener output with recycling push,” illustrates a broader industry shift towards electric arc furnaces (EAFs).

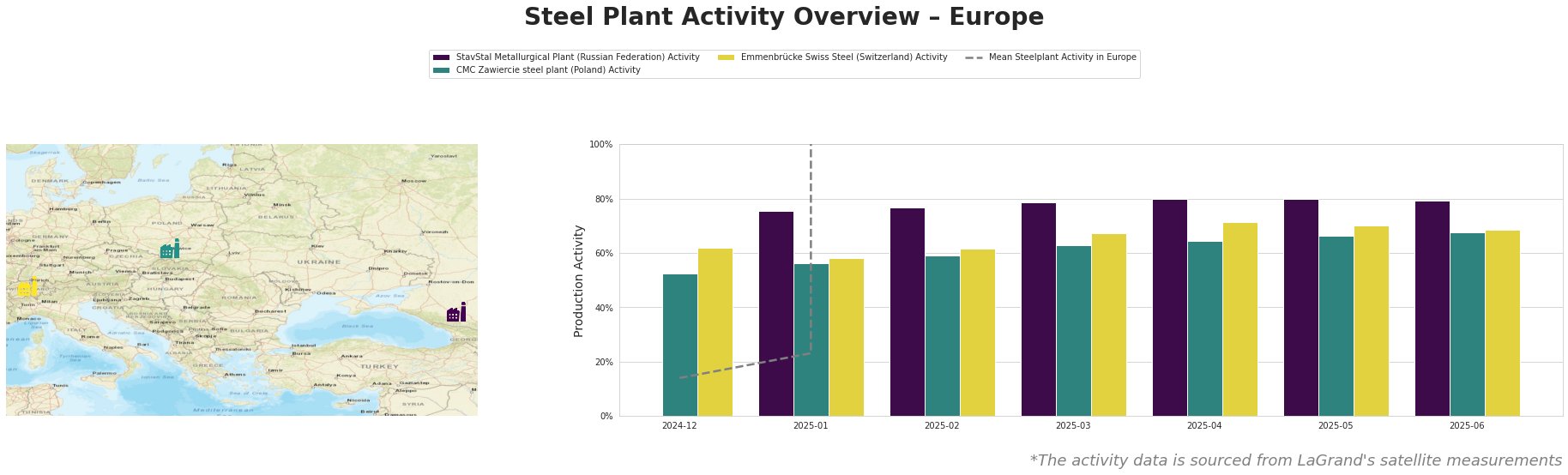

The mean steel plant activity in Europe exhibits significant volatility with large fluctuations, making trend analysis difficult.

StavStal Metallurgical Plant, located in Stavropol Krai, Russian Federation, is a 500ktpa capacity EAF-based steel plant producing semi-finished and finished rolled products such as square billet, rebar, and wire rod. Satellite data shows a consistently high activity level, fluctuating narrowly between 76% and 80% from January to May 2025, then slightly decreasing to 79% in June. There is no discernible connection between the high activity level at this plant and the news articles concerning European steel production.

CMC Zawiercie steel plant, situated in Silesia, Poland, has a 1700ktpa capacity based on two EAFs. Its activity level has steadily increased from 52% in December 2024 to 68% in June 2025. While “ArcelorMittal Poland in talks with government regarding state funding for modernization” discusses potential investment in Polish steel, no direct link can be established between this news and the observed increase in activity at CMC Zawiercie.

Emmenbrücke Swiss Steel, located in Luzern, Switzerland, uses EAF technology. The activity level has remained relatively stable, ranging from 58% in January 2025 to 70% in May 2025, before decreasing to 68% in June 2025. This Swiss plant’s activity shows no direct correlation with the news focused on ArcelorMittal in Poland or Tata Steel’s wider European decarbonization strategy.

Evaluated Market Implications

While “ArcelorMittal Poland in talks with government regarding state funding for modernization” and “ArcelorMittal enters into negotiations on state aid to Poland: reports” suggest potential future improvements in steel production efficiency in Poland, the immediate impact on supply is uncertain, since the state funding talks are still in a negotiation phase. Given the stable to slightly increasing activity at CMC Zawiercie and Emmenbrücke Swiss Steel, buyers should:

- Monitor Polish Government Announcements: Closely track the outcome of ArcelorMittal’s negotiations with the Polish government. If the modernization project proceeds as planned, steel buyers may anticipate increased domestic supply and potentially more competitive pricing for products like steel rails in the medium to long term.

- Factor in Potential EAF Capacity Shifts: The “Tata Steel seeks greener output with recycling push” underscores a broader trend of transitioning to EAFs. Procurement strategies should account for potential shifts in regional EAF capacity. Buyers who use to source steel from conventional blast furnaces should prepare for potential sourcing from electric arc furnaces that often have a different metallurgic properties.