From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Update: Activity Dips Amid Ongoing Crisis in Ukraine

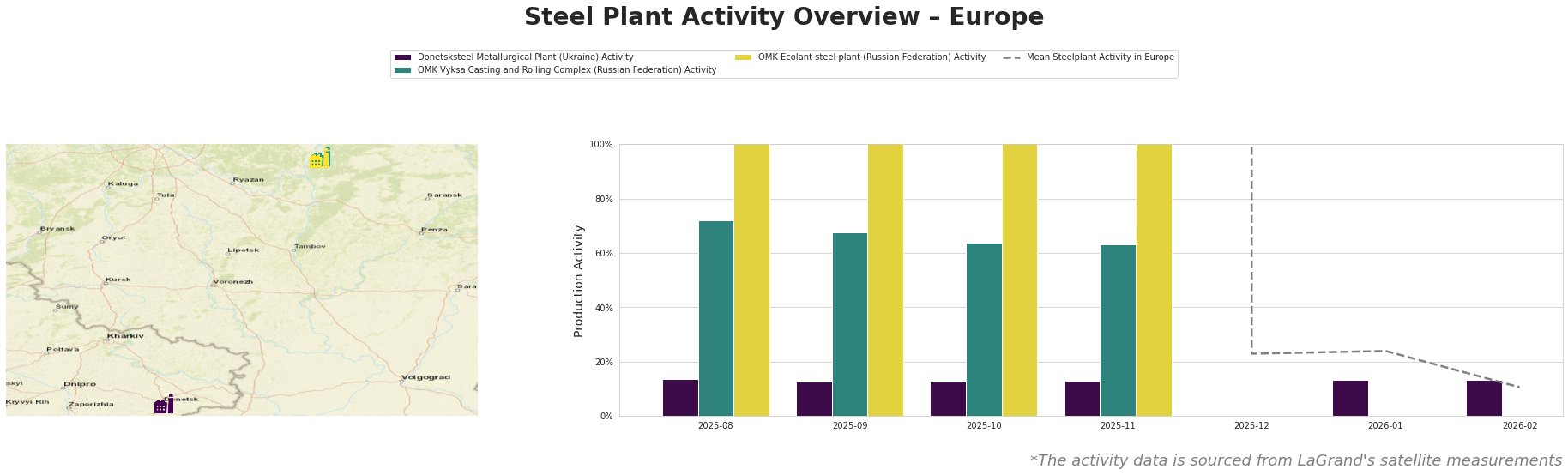

In Europe, particularly in Ukraine, the steel market is experiencing notable disruptions as evidenced by recent production reports, particularly “Zaporizhstal reduced steel production by 15.8% m/m in January” and “Industrial production in Ukraine fell by 2.4% y/y in 2025.” These developments correlate with reduced activity levels at key plants as assessed through satellite data, indicating broader implications for buyers and analysts.

The mean steel plant activity experienced a significant drop from 244,667,809.0 in November 2025 to just 11.0 in February 2026. This mirrors the challenges faced by Zaporizhstal, where production fell to its lowest levels since mid-2024 due to operational challenges linked to ongoing conflicts. Donetsksteel’s stable activity at 13.0 since October indicates limited operational fluctuations, but it reveals vulnerabilities amid broader regional disruptions that impact supply chains.

Donetsksteel’s operational activity remains minimal at about 13%, indicative of ongoing instability and challenges faced in the energy and transport sectors without direct news links to performance changes. In contrast, OMK facilities maintain existing activity levels, producing essential rolled and semi-finished steel products critical for infrastructure and energy sectors. However, production output from Zaporizhstal, which reported a 15.8% shortfall in January 2026, can potentially affect sourcing for downstream users reliant on Ukrainian steel.

Given this landscape, buyers should be aware of the following actionable insights:

1. Procurement Diversification: Consider diversifying sourcing options, particularly given the vulnerability of Ukraine’s steel production highlighted by “Zaporizhstal reduced steel production by 15.8% m/m in January.” Establishing relationships with suppliers in other regions may mitigate supply chain risks.

2. Monitoring Production Volatility: The trends outlined necessitate ongoing monitoring of steel activity levels, particularly at Zaporizhstal and Donetsksteel, as fluctuations could affect prices and availability.

3. Assessing Regional Transport Risks: As highlighted by “Zaporizhcoke reduced production by 19.7% y/y in January,” transportation disruptions may prove critical. It is essential to incorporate these risks into forward planning to avoid unforeseen shortages or delays.

4. Engagement with Local Suppliers: With reduced production from Ukrainian sources, engagement with suppliers from the OMK facilities could provide essential supplies while navigating potential import challenges from affected areas.

Overall, while the market sentiment remains neutral, buyers should leverage these immediate insights to adapt purchasing strategies and ensure stability amidst concerning production trends.