From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukrainian Export Shifts Amidst Stable Plant Activity Signal Continued Strength

Europe’s steel market shows resilience despite shifts in Ukrainian export patterns. The Ukrainian steel industry is experiencing notable changes in its export mix, as highlighted in the news articles “Ukrainian steelmakers cut exports of semi-finished products by 38% y/y in January-September,” “Scrap exports from Ukraine reached 311,000 tons in January-September,” “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025,” “Ukraine exported 1.29 million tons of flat products in January-September,” “Ukraine increased imports of flat products by 13.1% y/y in January-September,” and “Ukraine’s Imports of Flat Products Rise by 13.1% in January–September 2025“. While these articles detail fluctuations in Ukrainian steel trade, a direct relationship to significant changes in the satellite-observed activity levels of the selected European steel plants could not be established.

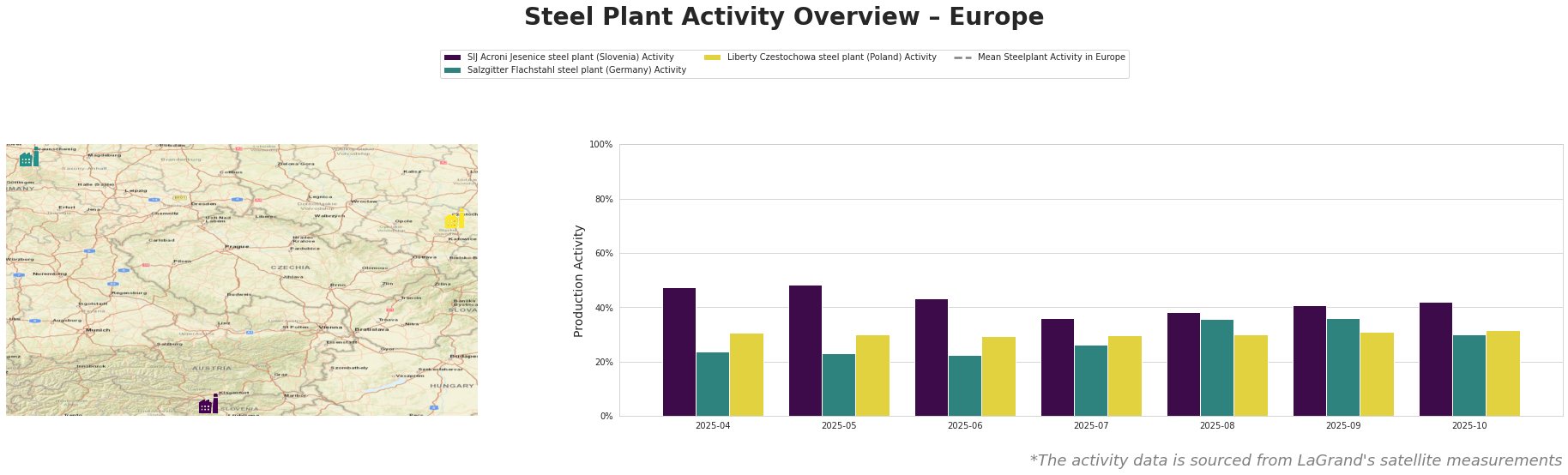

The mean steel plant activity in Europe shows fluctuations across the observed months. SIJ Acroni Jesenice steel plant in Slovenia, an EAF-based producer of 726,000 tonnes of crude steel capacity specializing in flat rolled products, experienced a decrease from 48% in May to 36% in July, followed by a slight recovery to 42% in October. Salzgitter Flachstahl in Germany, an integrated BF-BOF plant with a capacity of 5.2 million tonnes focusing on flat products for automotive and construction, demonstrated an increase from 22% activity in June to 36% in August and September before falling to 30% in October. Liberty Czestochowa steel plant in Poland, an EAF-based plate producer with a capacity of 840,000 tonnes, maintained a relatively stable activity level, fluctuating between 30% and 32% over the observed period. No direct connections between the observed plant activity and the news regarding Ukrainian exports could be explicitly established. The news article “Industrial production in Ukraine fell by 2.5% y/y in January-August” also states an increase in the Ukrainian steel industry and finished steel products of 7%, potentially indicating that the drop in exports is due to internal consumption.

Despite shifts in Ukrainian export markets and the stability observed in the monitored European plants, potential supply disruptions could arise due to increased domestic consumption in Ukraine as highlighted by “Ukraine’s total steel exports down 12.2 percent in Jan-Sept 2025“. Steel buyers are advised to carefully monitor supply chains and consider diversifying suppliers to mitigate potential risks associated with the shifts in the export market out of Ukraine. Given that “Ukraine increased imports of flat products by 13.1% y/y in January-September” and “Ukraine’s Imports of Flat Products Rise by 13.1% in January–September 2025“, it is recommended that steel buyers actively engage with suppliers and be prepared to secure supply from alternate sources.