From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukrainian Export Decline Offset by Stable EU Production, Positive Outlook

Europe’s steel market faces mixed signals as Ukrainian iron ore and pig iron exports decline, while EU steel plant activity remains stable. The situation in Ukraine, as detailed in “Ukraine reduced iron ore exports by 10% y/y in January-April” and “Ukraine reduced pig iron exports by 60% m/m in April,” highlights potential raw material supply chain vulnerabilities. These declines do not appear to be directly impacting steel plant activity levels in Germany or Russia.

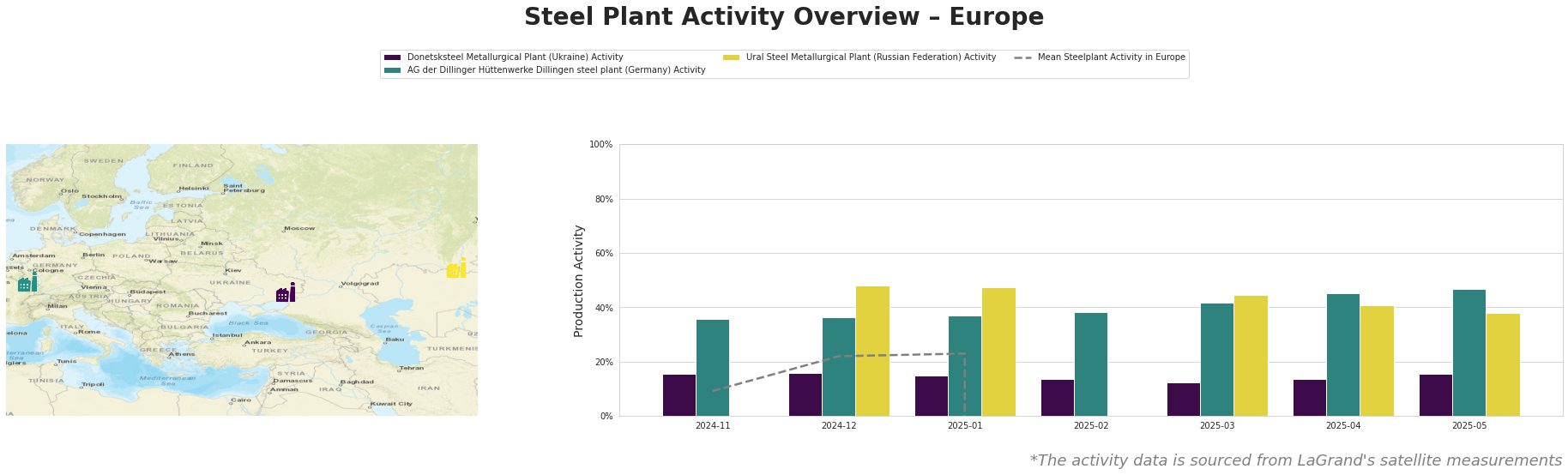

Observed monthly steel plant activity data shows that the mean steel plant activity in Europe fluctuates wildly due to data errors and is not a reliable measurement in this data set. Donetsksteel Metallurgical Plant activity remained relatively stable at around 14%, however, its overall activity level is low. AG der Dillinger Hüttenwerke Dillingen steel plant shows increasing activity, from 36% in November 2024 to 47% in May 2025. Ural Steel Metallurgical Plant activity, only intermittently reported, shows a decrease from 48% in January 2025 to 38% in May 2025.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated BF-based production. Its activity has been relatively stable, fluctuating between 12% and 16% utilization since November 2024. However, no direct connection can be established between its operational levels and the export declines highlighted in “Ukraine reduced iron ore exports by 10% y/y in January-April” or “Ukraine reduced pig iron exports by 60% m/m in April,” although it is plausible these factors contribute to the low activity level.

AG der Dillinger Hüttenwerke Dillingen steel plant, situated in Saarland, Germany, focuses on heavy-plate products for various sectors, including automotive and energy, utilizing integrated BF-BOF production. Its activity has consistently risen, increasing from 36% in November 2024 to 47% in May 2025. The rise in activity is not directly linked to the news articles but suggests stable or growing demand for its products, offsetting any negative impact from the Ukrainian export situation.

Ural Steel Metallurgical Plant, based in the Orenburg region of Russia, produces a range of products from pig iron to flat products, using both BF and EAF technologies. Its activity decreased from 48% in January to 38% in May 2025. No direct link to the Ukrainian export news can be established, since Ural Steel would only indirectly be affected.

The decline in Ukrainian iron ore and pig iron exports, coupled with stable, yet low activity at Donetsksteel Metallurgical Plant, could lead to localized supply tightness in pig iron, particularly for consumers previously reliant on Ukrainian sources. Considering the information provided in “Ukraine reduced pig iron exports by 60% m/m in April,” steel buyers should assess their pig iron supply chains and explore alternative sourcing options outside of Ukraine to mitigate potential disruptions. Additionally, ferroalloy purchasers should monitor the situation, considering the increase in ferroalloy exports as reported in “Ukraine’s ferroalloy industry exported 39 thousand tons of products in January-April.” The increasing activity observed at AG der Dillinger Hüttenwerke suggests a healthy demand within the EU market, indicating that any procurement adjustments are unlikely to impact steel prices in general.