From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukraine Import Surge & SIJ Acroni Jesenice Steel Plant Activity Increase Signal Potential Shifts

Europe’s steel market faces increasing complexity as highlighted by “EUROFER: EU’s finished steel trade deficit increases in Q2 2025,” alongside significant shifts in Ukrainian steel trade detailed in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons.” While the EUROFER report points to a general trade deficit, the Ukrainian situation suggests specific regional realignments, particularly with increased imports of semi-finished products. A direct link between these broad trade trends and specific plant activity levels cannot be definitively established from the provided data.

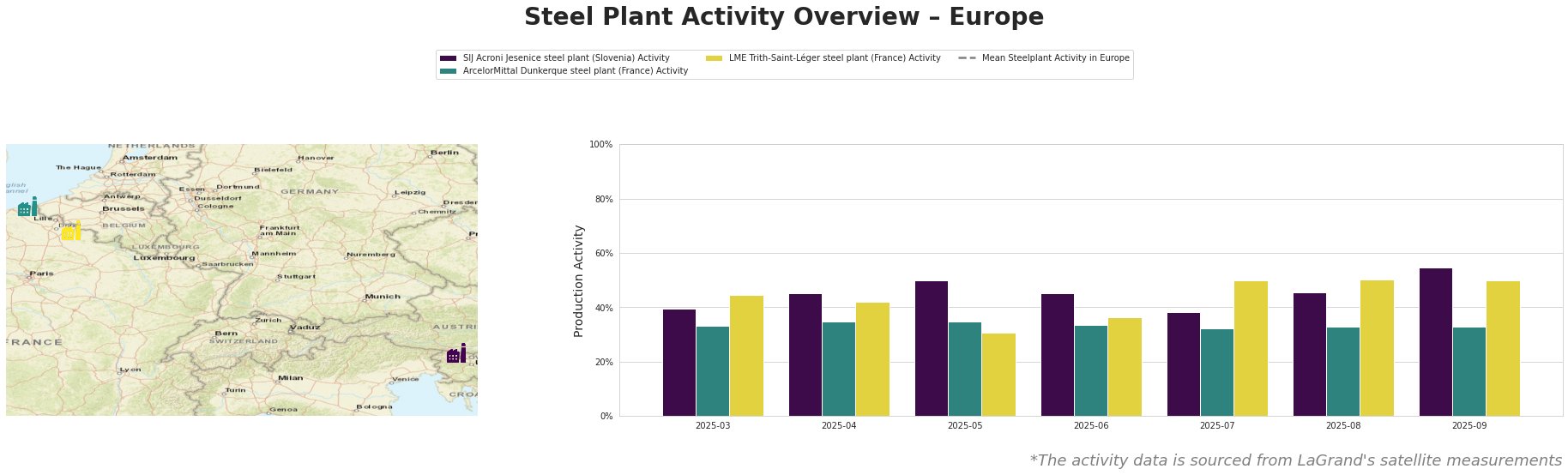

The mean steel plant activity in Europe shows volatility over the observed period, with peaks in May, July and August, and a notable drop in September. SIJ Acroni Jesenice steel plant shows a significant activity increase in September, reaching 55.0%, the highest level in the observed period. ArcelorMittal Dunkerque steel plant activity remains relatively stable at a low level. LME Trith-Saint-Léger steel plant activity is relatively stable with peaks in July, August and September.

SIJ Acroni Jesenice steel plant: This Slovenian plant, operating with EAF technology and a 726 thousand tonne crude steel capacity, produces semi-finished and finished rolled products, including flat rolled steel, plates, and hot/cold rolled products. Observed activity increased in September to 55.0%, after having decreased to 38.0% in July. No immediate link can be established between this increased activity and the provided news articles.

ArcelorMittal Dunkerque steel plant: This integrated BF-BOF plant in France, with a crude steel capacity of 6,750 thousand tonnes and a BF capacity of 6,900 thousand tonnes, produces slabs and hot-rolled coil. The plant’s activity remained consistently low throughout the observed period, fluctuating between 32.0% and 35.0%. The “EUROFER: EU’s finished steel trade deficit increases in Q2 2025” report highlights a decrease in EU steel exports, but no direct connection can be made to the specific activity level at this plant.

LME Trith-Saint-Léger steel plant: Operating an EAF with a capacity of 850 thousand tonnes, this French plant produces slabs and hot-rolled coil. The satellite data shows a stable activity with peaks in July, August and September (50%). There is no immediately obvious connection to the provided news articles.

Given the increase in Ukrainian imports of semi-finished products as highlighted in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons.” and the observed increase in activity at SIJ Acroni Jesenice steel plant, steel buyers should:

- Monitor semi-finished steel pricing trends closely. The surge in Ukrainian imports might create downward pressure on prices for semi-finished products, especially those sourced from Oman, Germany, and the Czech Republic.

- Assess the supply chain resilience of flat steel imports with focus on Turkey, as the news article “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August” indicates increase imports.