From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Taranto Transition, Danieli Expansion Signal Optimism

In Europe, the steel market shows a very positive outlook with signs of strategic shifts and investments. Recent news, such as “End of steel monoculture proposed for Taranto mill” and “Danieli takes stake in Novastilmec,” point towards significant restructuring and technological advancements. While a direct causal relationship between these articles and observed plant activity levels cannot be explicitly established from provided satellite data, the news provides crucial context for interpreting the trends.

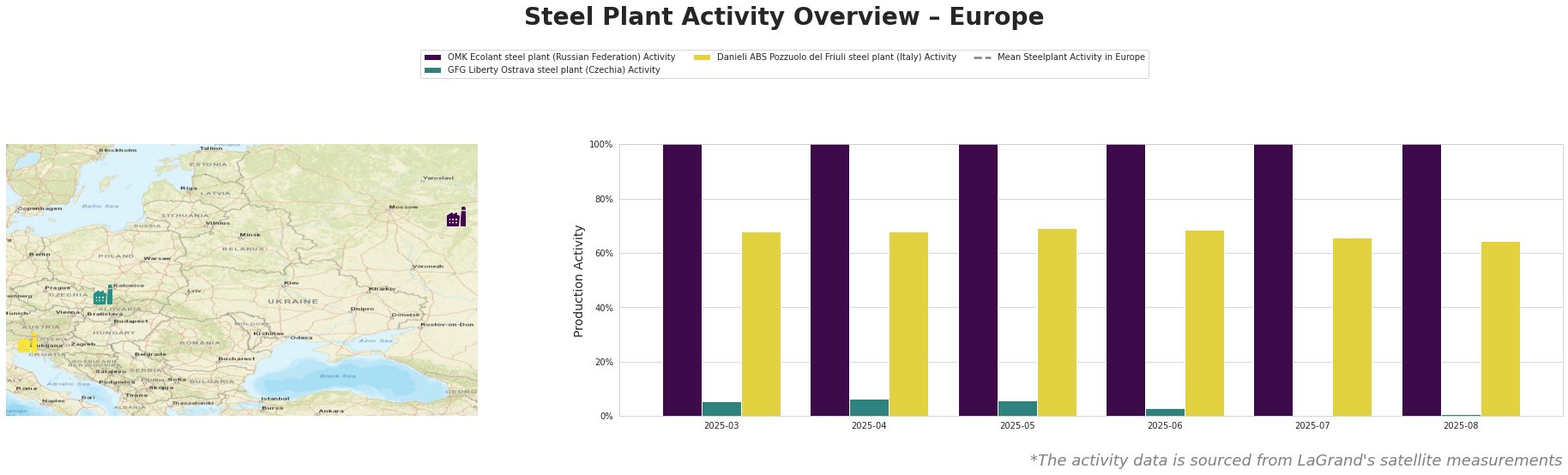

Measured Activity Overview

The mean steel plant activity in Europe has fluctuated between approximately 15.2T and 20.3T units over the last six months. The OMK Ecolant steel plant in Russia shows consistently high activity levels, far exceeding the European mean, but remains constant throughout the observed period. GFG Liberty Ostrava in Czechia experienced a significant decrease in activity, dropping from 6% in May to 1% in August. Danieli ABS Pozzuolo del Friuli in Italy shows a gradual decrease from 68% in March to 64% in August.

Plant Information

OMK Ecolant steel plant: Located in Nizhny Novgorod, Russia, this plant boasts a capacity of 1.8 million tonnes of crude steel produced via EAF and 2.5 million tonnes of DRI. Satellite data indicates consistent activity levels throughout the period. No direct link to the provided news articles can be established.

GFG Liberty Ostrava steel plant: Situated in Moravia-Silesia, Czechia, this integrated BF-BOF plant has a crude steel capacity of 3.6 million tonnes. Activity levels have significantly decreased from 6% in May 2025 to 1% in August 2025. While no specific news directly addresses this plant, the overall market trends towards decarbonization might be indirectly influencing operational adjustments.

Danieli ABS Pozzuolo del Friuli steel plant: This Italian EAF-based plant, located in the Province of Udine, has a crude steel capacity of 1.1 million tonnes. There has been a gradual decrease in activity levels from 68% in March 2025 to 64% in August 2025. News such as “Danieli takes stake in Novastilmec,” demonstrating Danieli’s strategic investments and strong financial performance, may indirectly relate to this plant’s activity, suggesting possible future upgrades or expansions that could temporarily affect production.

Evaluated Market Implications

The “End of steel monoculture proposed for Taranto mill” suggests a potential restructuring of the Taranto steel mill, which may lead to short-term supply disruptions, especially for flat steel products.

Recommended Procurement Actions:

- Steel Buyers focused on flat steel: Closely monitor developments in Taranto. Diversify suppliers, especially those providing flat steel, to mitigate potential supply chain disruptions caused by the restructuring at Acciaierie d’Italia.

- Market Analysts: Track the progress of the “Letter of Procedure II” tender for the Taranto site, paying close attention to the decarbonization requirements and binding offer deadlines. These factors will significantly influence the future supply dynamics of the European steel market.

- Steel Buyers seeking decarbonized Steel: Engage with Danieli and Novastilmec to understand how their combined technologies can support the transition to greener steel production. Inquire about their offerings for DRI-EAF based production, which is a key focus for decarbonizing integrated steel plants.

- Procurement Professionals in Czechia: Monitor the GFG Liberty Ostrava steel plant for potential longer-term production impacts if the observed activity drop continues. Evaluate and secure alternate suppliers for wire rod, billets, hot strip, sections, tubes, and slabs.