From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Soars on Green Initiatives, Italian Plant Revitalization Drives Optimism

Europe’s steel market shows a very positive sentiment driven by green steel initiatives and revitalization projects. The “Metinvest, Danieli complete €3bn flats mill JV closing” and “Metinvest and Danieli are completing the closure of a joint venture for the production of rolled products worth €3 billion” highlight significant investment in new capacity in Italy, aiming to revitalize the idled Piombino industrial site. These developments coincide with broader efforts to reduce emissions, as evidenced by “ArcelorMittal Sestao picks Danieli for new green steel upgrades in Spain” and “Voestalpine has begun construction on Austria’s largest climate project,” suggesting a shift towards sustainable steel production. No direct relationship between these news and satellite-observed changes in activity can be established, as the projects are either new constructions, technology upgrades, or do not have publicly available satellite data.

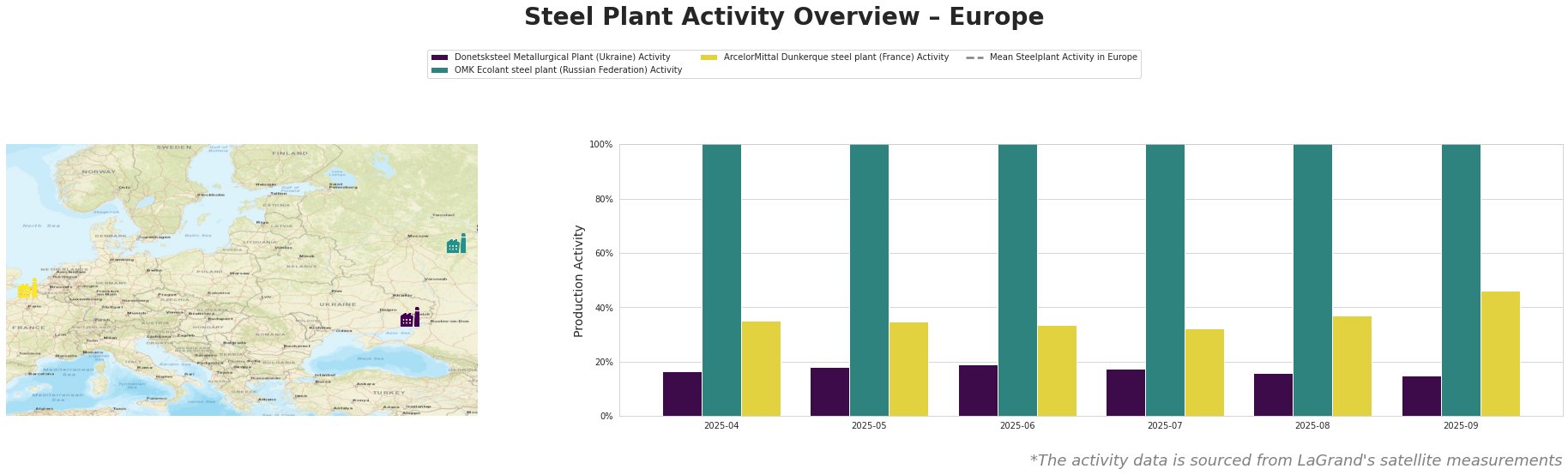

The mean steel plant activity in Europe fluctuated, peaking in May and August. Donetsksteel Metallurgical Plant shows a gradual decrease in activity, dropping from 19% in June to 15% by September. OMK Ecolant steel plant activity remains consistently high across the months. ArcelorMittal Dunkerque saw a rise to 46% in September, with a slight dip in July, and below the mean values across all months. No direct connection between these activity levels and the named news articles can be established.

Donetsksteel Metallurgical Plant in Donetsk, Ukraine, an integrated BF plant with a pig iron capacity of 1.5 million tonnes, saw its activity decline slightly over the observed period. This plant relies on BF and EAF technology, producing crude steel. The decline from 19% activity in June to 15% in September does not directly correlate with any of the provided news articles, suggesting potential regional factors or operational adjustments not captured in the news.

OMK Ecolant steel plant, located in Nizhny Novgorod, Russian Federation, operates as an integrated DRI plant with a crude steel capacity of 1.8 million tonnes and iron capacity of 2.5 million tonnes, utilizing DRI and EAF technologies to produce semi-finished products like slabs and round billets. Its activity remained consistently high. Given its location and product focus, there’s no direct impact readily apparent from the “Metinvest, Danieli complete €3bn flats mill JV closing” or the green steel initiatives detailed in other articles.

ArcelorMittal Dunkerque in France, a major integrated BF-BOF plant with a crude steel capacity of 6.75 million tonnes and iron capacity of 6.9 million tonnes, focuses on semi-finished and finished rolled products, including slabs and hot-rolled coil. The plant activity experienced a rise to 46% in September, although was below the mean steel plant activity across all observed months. While “ArcelorMittal Sestao picks Danieli for new green steel upgrades in Spain” highlights ArcelorMittal’s focus on green initiatives, it is not clear whether they affect this particular plant.

The slow progress of the “Only two investors are bidding for the full acquisition of Acciaierie d’Italia” emphasizes the complexity and potential risks associated with the Italian steel sector. This, combined with new capacity coming online (“Metinvest, Danieli complete €3bn flats mill JV closing”), could lead to price volatility in the flat steel market.

Evaluated Market Implications:

- Potential Supply Disruptions: The ongoing uncertainty surrounding Acciaierie d’Italia (ADI), as highlighted in “Only two investors are bidding for the full acquisition of Acciaierie d’Italia,” could lead to continued supply disruptions in the Italian market. This is compounded by the fact that only two bids were received for the entire company, indicating a lack of strong investor confidence in the short term.

- Procurement Actions: Steel buyers should closely monitor the ADI situation. Given the potential for supply chain instability, diversify sources for flat steel products to mitigate risk. While the new Metinvest Adria plant promises increased capacity, it will not be operational immediately, making alternative supply options crucial. Analysts should also incorporate the ADI uncertainty into their models, considering both best-case and worst-case scenarios for the company’s future. Prioritize suppliers committed to decarbonization, aligning with the broader European trend towards green steel production, as seen in the ArcelorMittal and Voestalpine initiatives.