From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Shows Rebar Price Increases Amid Stable HRC and Rising Plant Activity

Europe’s steel market presents a mixed picture, with rising rebar prices contrasted by stable HRC costs amid summer slowdown. Recent activity at European steel plants shows an upward trend, coinciding with rebar price adjustments as described in “In some European plants, fittings will become more expensive after additional adjustment.” and “Coiled rebar prices climb in Austria“. However, no direct connection could be established between changes in plant activity and prices for HRC.

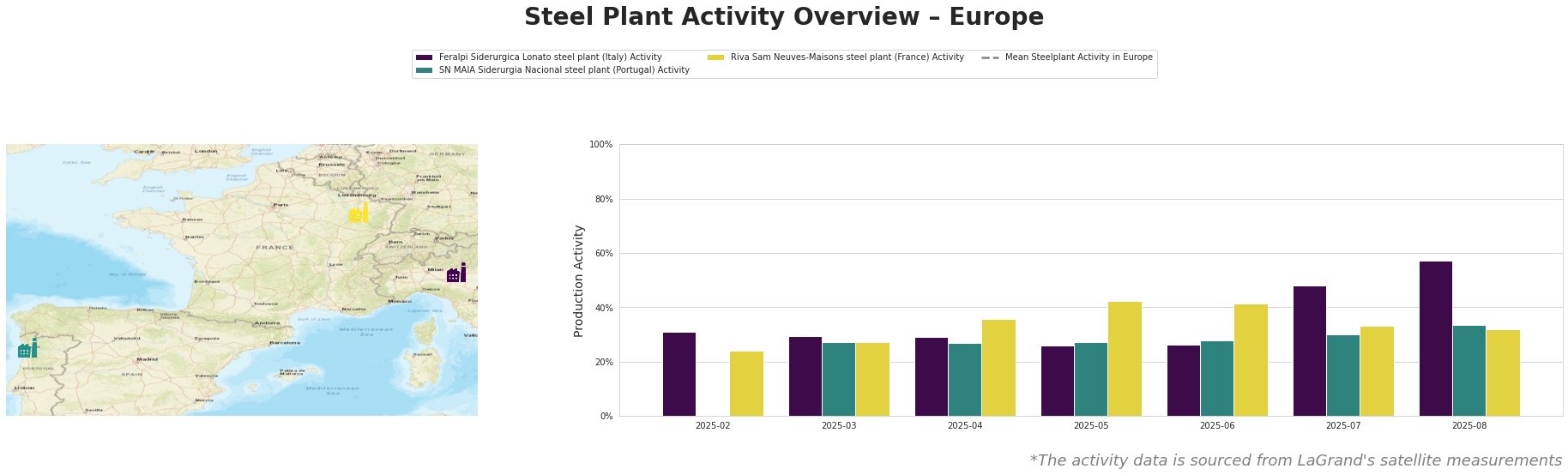

Measured activity across observed steel plants in Europe, expressed as a percentage of all-time highs:

Activity levels are fluctuating, with no clear trend for the “Mean Steelplant Activity in Europe” due to the data irregularities. Feralpi Siderurgica Lonato steel plant in Italy showed a significant increase, rising from 26% in June to 57% in August. The SN MAIA Siderurgia Nacional steel plant in Portugal saw a gradual increase, and the Riva Sam Neuves-Maisons steel plant in France showed a peak in May, then decreased.

Plant Information:

Feralpi Siderurgica Lonato steel plant, located in the Province of Brescia, Italy, operates with an EAF-based production process, boasting a crude steel capacity of 1.1 million tonnes per annum and holds ResponsibleSteel Certification. Satellite data indicates a substantial surge in activity, increasing from 26% in June to 57% by August. This observed activity rise correlates with reported rebar price increases. As “In some European plants, fittings will become more expensive after additional adjustment.” reports, base prices have increased, with offers about 30 euros per ton higher than July.

SN MAIA Siderurgia Nacional steel plant in Porto, Portugal, also utilizes EAF technology and has a capacity of 600,000 tonnes per annum with ResponsibleSteel Certification, primarily producing rebar. The satellite data shows a steady increase in activity, from 27% in March to 34% in August. Considering the report “European longs market stable amid seasonal and international uncertainty” indicates stable rebar prices, this increasing plant activity level may anticipate a change in production volume.

Riva Sam Neuves-Maisons steel plant, situated in Grand Est, France, also uses EAF and has a capacity of 850,000 tonnes per year. This plant is ResponsibleSteel certified and produces a range of long products. While it initially showed a rise in activity peaking in May, the plant experienced a drop to 32% in August. There is no explicit news article that explains this current activity levels.

Evaluated Market Implications:

Observed activity at Feralpi Siderurgica Lonato coupled with reports of rising rebar prices in “In some European plants, fittings will become more expensive after additional adjustment.” and “Coiled rebar prices climb in Austria“, indicates potential supply-side pressure in the rebar market.

Recommended Procurement Actions:

- For steel buyers focused on rebar: Given the upward price trend and increased activity at Feralpi Siderurgica Lonato, consider securing rebar contracts promptly to mitigate potential price increases. Compare offers and negotiate volumes now, particularly in light of the impending safeguard measure revisions and CBAM implementation mentioned in “European longs market stable amid seasonal and international uncertainty“. Actively monitor the spot market for opportunistic purchases if production at Riva Sam Neuves-Maisons recovers and influences prices.