From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Shows Mixed Signals: Ukraine Production Declines Offset by French Plant Stability

Europe’s steel market is experiencing mixed trends, primarily driven by Ukrainian production fluctuations. Recent data reveals decreased steel output in Ukraine, as indicated by the news articles “Ukraine produced 3.62 million tons of rolled steel in January-July“, “Metinvest” reduced steel output by 13%“, and “steel production in Ukraine dropped by 7 in 7 months%“. Satellite observations show fluctuating activity levels at the Donetsksteel Metallurgical Plant in Ukraine, while French plants display more stable operations; however, a direct relationship between French steel plant activity levels and Ukrainian steel production news cannot be established.

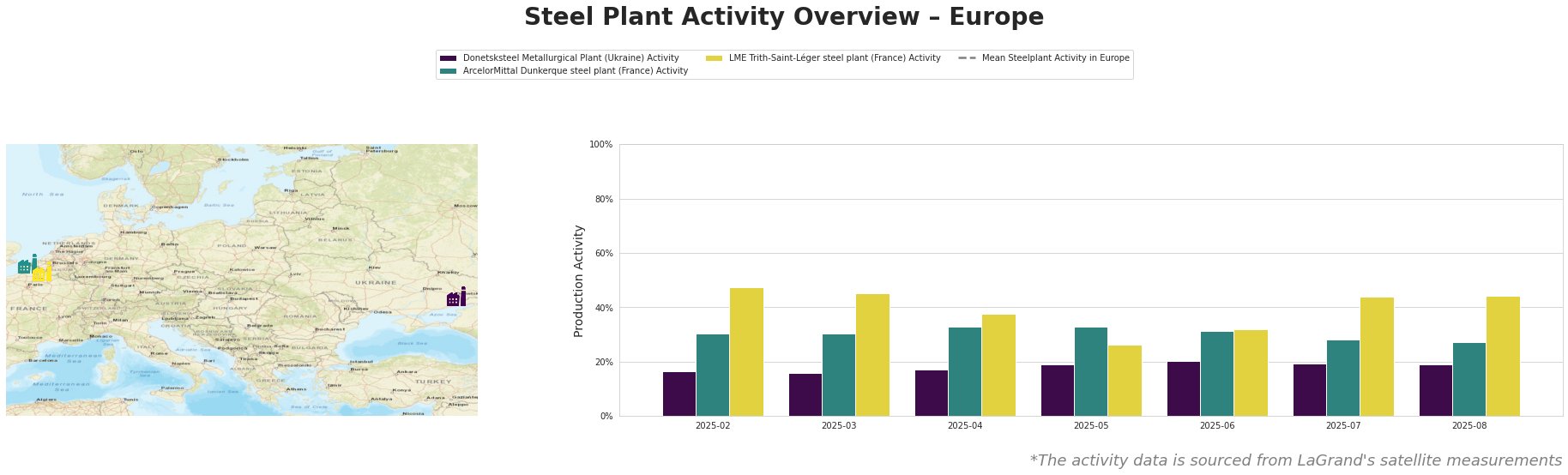

The mean steel plant activity in Europe remains inconsistent. The Donetsksteel Metallurgical Plant showed a slight upward trend from February to June, peaking at 20% activity, before slightly declining to 19% in July and August. ArcelorMittal Dunkerque steel plant showed relative stability, fluctuating between 27% and 33% activity. The LME Trith-Saint-Léger steel plant shows more volatility, dropping to 26% in May but recovering to 44% in July and August. Comparing individual plant activity to the mean European activity is difficult due to the non-sensical figures reported in the table for the average steel plant activity. The activity levels for the Donetsksteel Metallurgical Plant seem correlated with the trends described in “Ukraine produced 3.62 million tons of rolled steel in January-July“, “Metinvest” reduced steel output by 13%“, and “steel production in Ukraine dropped by 7 in 7 months%“, but a direct quantitative correlation cannot be definitively established from provided data.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, is an integrated steel plant using BF technology with a pig iron capacity of 1500 ttpa. The plant’s activity levels have fluctuated, showing a slight increase from 16% in February to 20% in June, before returning to 19% in July and August. This variability could be linked to the overall decline in Ukrainian steel production reported in “Ukraine produced 3.62 million tons of rolled steel in January-July“, “Metinvest” reduced steel output by 13%“, and “steel production in Ukraine dropped by 7 in 7 months%“, although further data is needed to confirm.

The ArcelorMittal Dunkerque steel plant in France, an integrated BF-BOF facility with a crude steel capacity of 6750 ttpa and a pig iron capacity of 6900 ttpa, produces semi-finished and finished rolled products like slabs and hot-rolled coils. The plant’s activity levels have remained relatively stable, fluctuating between 27% and 33% during the observed period. No direct connection between these stable activity levels and the Ukrainian production news could be established.

The LME Trith-Saint-Léger steel plant in France, an electric arc furnace (EAF) facility with a crude steel capacity of 850 ttpa, produces semi-finished and finished rolled products. Its activity fluctuated, decreasing to 26% in May before increasing to 44% in July and August. No direct link between these activity fluctuations and the Ukrainian production data could be established based on the provided information.

Based on the news of decreased Ukrainian steel production, coupled with the observed activity fluctuations at Donetsksteel Metallurgical Plant, potential supply disruptions, particularly in pig iron, are possible.

Recommended Procurement Actions:

- Steel Buyers focused on pig iron: Given the reduction in steel production as reported in “Ukraine produced 3.62 million tons of rolled steel in January-July“, “Metinvest” reduced steel output by 13%“, and “steel production in Ukraine dropped by 7 in 7 months%” and the observed fluctuations at the Donetsksteel Metallurgical Plant, buyers should proactively engage with their suppliers to assess potential impacts on pig iron availability, lead times, and pricing. Diversifying supply sources and closely monitoring inventory levels are recommended. Due to the lack of correlation to the French plants, no specific procurement actions are recommended at this time.