From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Saarstahl Acquisition & Stable Plant Activity Signal Positive Outlook

European steel market dynamics are shifting amidst strategic acquisitions and steady production levels. The activity levels at key plants show overall stability, while corporate actions, as indicated by news headlines, signal potential market consolidation and a focus on specialized steel products. “Saarstahl acquires Dutch company FNSteel” points to consolidation in the cold heading steel sector. The impact of membership changes in EUROMETAL, covered by “European Staal becomes a member of EUROMETAL” and “The European company Staal becomes a member of EUROMETAL“, could not be directly linked to observed activity levels.

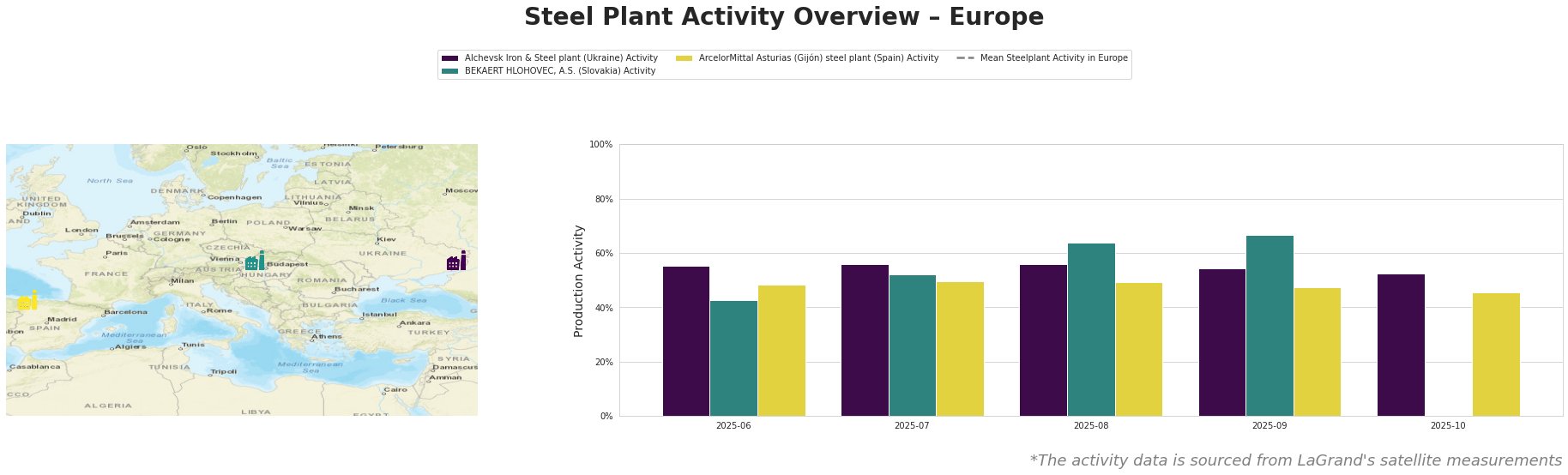

The average steel plant activity in Europe experienced fluctuations, peaking in July and August before decreasing in subsequent months. Alchevsk Iron & Steel plant, a BF/BOF-based integrated plant in Ukraine producing slabs, square billets, and structural shapes, showed a slight downward trend from 55% in June to 52% in October. BEKAERT HLOHOVEC, A.S., a wire rod producer utilizing EAF technology in Slovakia, demonstrated more significant fluctuation, rising from 43% in June to a peak of 67% in September. Activity data for October is unavailable. ArcelorMittal Asturias (Gijón) steel plant in Spain, an integrated BF/BOF producer of long plate, wire rod, and rail products, saw a similar slight decline from 48% in June to 45% in October. No direct connection can be established between these activity changes and the news articles.

Alchevsk Iron & Steel plant, located in the Luhansk region of Ukraine with a crude steel capacity of 5472 ttpa, has shown a moderate decrease in activity from 55% to 52% between June and October. Being an integrated plant reliant on BF/BOF technology and producing primarily semi-finished and finished rolled products, the facility’s output could be affected by regional instability. No direct relationship could be established between the observed activity levels and the provided news articles.

BEKAERT HLOHOVEC, A.S. in Slovakia, with a production focus on wire rod for the automotive and construction sectors, has experienced a more volatile activity pattern. Starting at 43% in June, it peaked at 67% in September before data became unavailable in October. As a dedicated wire rod producer, its activity levels may be closely tied to demand from the automotive and construction industries. No connection between the activity data and the provided news articles could be established.

ArcelorMittal Asturias (Gijón) steel plant, an integrated BF/BOF plant in Spain producing long plate, wire rod and rail products, has seen a gradual decrease in activity from 48% in June to 45% in October. With a crude steel capacity of 1200 ttpa, this plant’s performance may reflect broader trends in the European long steel market. No direct correlation with the provided news articles could be found.

Given the acquisition of FNSteel by Saarstahl as reported in “Saarstahl acquires Dutch company FNSteel”, steel buyers should anticipate potential shifts in the availability and pricing of cold heading steel. Procurement professionals relying on FNSteel for these specialized products should proactively engage with Saarstahl to understand future product roadmaps, pricing strategies, and supply chain integration plans. While plant activity levels show no immediate disruption, the acquisition warrants careful monitoring of the cold heading steel market to mitigate any potential supply chain risks. The EUROMETAL memberships (“European Staal becomes a member of EUROMETAL” and “The European company Staal becomes a member of EUROMETAL”) do not appear to have any immediate impacts based on the current data.