From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Report: Neutral Sentiment Amid Fluctuating Activity Levels

Recent activity levels in Europe’s steel plants have demonstrated considerable fluctuations, influenced by global coal market pressures. The developments are aligned with insights from “Australia’s QCoal to keep producing after mine closure“, which foreshadows coal supply stability amid operational closures. This is crucial as the ongoing stability in coking coal supply can impact steel production costs across Europe, although direct correlations with plant activity were not established.

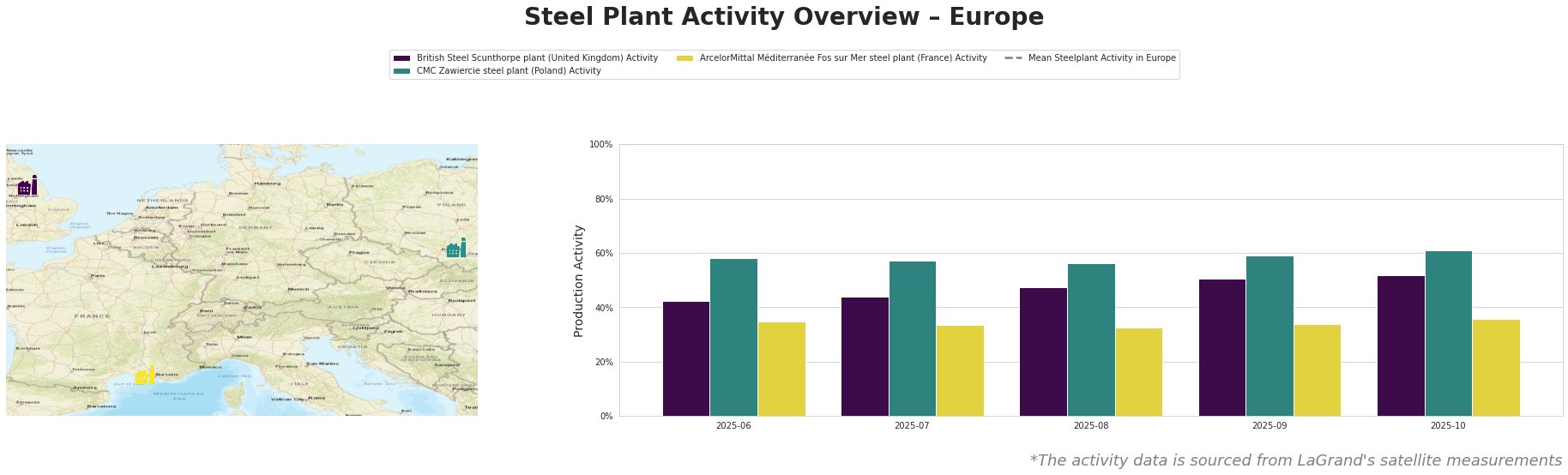

Measured Activity Overview

Activity levels varied, with a noticeable decline from 407,779,666 in July-August to 271,853,108 in October, indicating potential capacity constraints or demand shifts. The British Steel Scunthorpe plant has shown slight increases, rising from 42.0% in June to 52.0% by October, attributed to stable operations. In contrast, CMC Zawiercie’s activity peaked at 61.0% in October, showcasing robust demand for its electric arc furnace (EAF) production, though no direct link to recent news was determined. Meanwhile, ArcelorMittal Méditerranée faced modest fluctuations, hovering between 33.0% to 36.0%, reflecting its integrated steelmaking challenges.

Evaluated Market Implications

Current trends indicate potential supply disruptions, particularly for ArcelorMittal, as ongoing operational pressures and the global coal market dynamics are affecting production costs and plant outputs. Procurement actions for buyers should consider the consistent performance of CMC Zawiercie, which may be leveraged for electric steel products, while British Steel offers stable output for construction-grade materials. It is advisable for buyers to secure contracts with CMC Zawiercie for timely deliveries amid rising activity levels, while monitoring ArcelorMittal for potential disruptions in semi-finished and finished product supplies. The impacts of Australian coal production trends signal a broader market reactivity, particularly if production costs escalate.