From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Price Hikes & CBAM Uncertainty Amidst Stable Plant Activity

Europe’s steel market faces rising prices for long and heavy plate products amidst Carbon Border Adjustment Mechanism (CBAM) uncertainty, while HRC trading remains stagnant due to ample stocks. This is reflected in news titles such as “ArcelorMittal raises prices for long products in Europe by €30/t,” “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs,” and “European HRC trading at near standstill amid ample stocks, CBAM uncertainty.” However, no direct relationship between these pricing and market dynamics and the observed plant activity levels can be explicitly established based on the provided data.

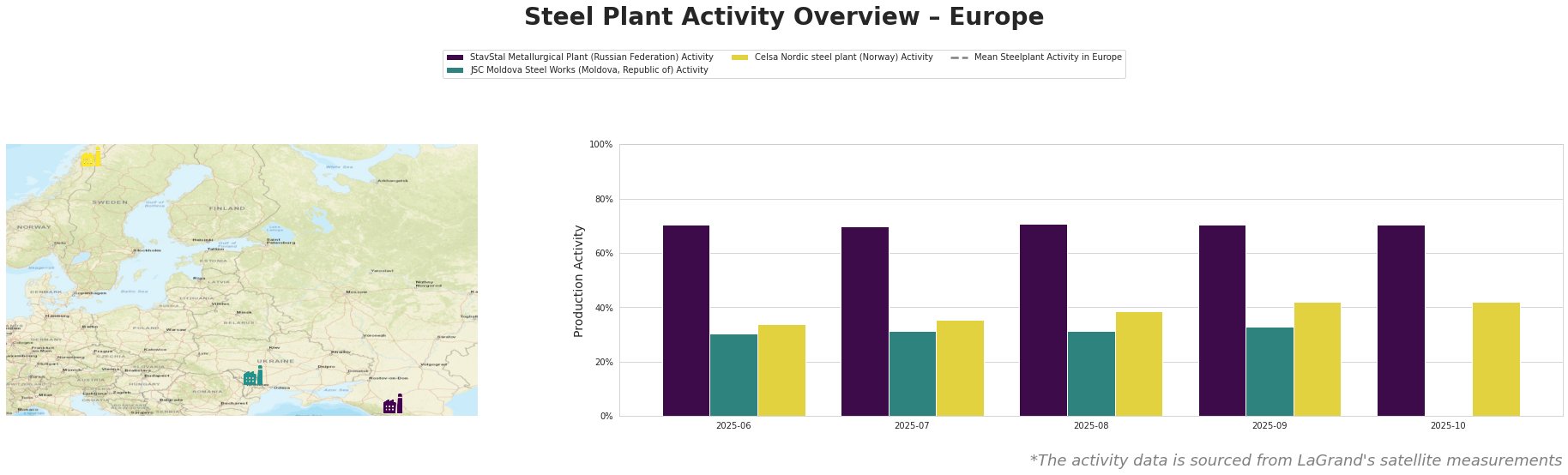

The mean steel plant activity in Europe shows some fluctuation, with a peak in July/August.

StavStal Metallurgical Plant (EAF-based, 500kt crude steel capacity, located in Stavropol Krai, Russia, focusing on semi-finished and finished rolled products like rebar and wire rod) activity remained relatively stable at around 70-71% between June and October 2025. This stability occurs despite news of European price increases (“ArcelorMittal raises prices for long products in Europe by €30/t“) and CBAM-related uncertainty, but no direct link can be established as this is a Russian plant.

JSC Moldova Steel Works (EAF-based, 1000kt crude steel capacity, located in Transnistria, producing wire rod, rebar, and billet) showed a slight increase in activity from 30% in June 2025 to 33% in September 2025. Data is missing for October. The news items describe prices and uncertainty in the EU, but there is no explicit connection to the Republic of Moldova.

Celsa Nordic steel plant (EAF-based, 700kt crude steel capacity, located in Mo i Rana, Norway, focused on billet, rebar, and wire rod for building and infrastructure) exhibited a steady increase in activity, rising from 34% in June 2025 to 42% in September/October 2025. It is unclear if this increasing activity is related to “ArcelorMittal raises prices for long products in Europe by €30/t” or driven by other factors not mentioned in the news.

Considering the increasing prices of long and heavy plate products in Europe, driven by expectations of CBAM costs (“ArcelorMittal raises prices for long products in Europe by €30/t” and “Steel heavy plate prices edge higher supported by persistent expectations of CBAM costs“), and the stable activity levels at StavStal and increasing activity at Celsa Nordic, steel buyers should:

- Prioritize securing long-term contracts with domestic (EU/EEA) suppliers, specifically for rebar and wire rod. This mitigates CBAM-related price volatility on imports, as highlighted in the news “European HRC trading at near standstill amid ample stocks, CBAM uncertainty.” The increase in activity at Celsa Nordic could indicate increased domestic supply capacity, making them a potential key partner.

- Carefully evaluate offers from Turkish suppliers. According to the news “Europe steel market in the final week of november: Weak demand, tighter quotas and stabilizing prices“, “Turkish-European steel ties strengthen, with Turkish companies securing significant EU project contracts.”