From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Plunges: German Production Cuts Deepen, Italy Falters

In Europe, the steel market faces increasing headwinds as evidenced by production cuts and weak demand. The decline in Germany, specifically detailed in “Germany reduced steel production by 15.4% y/y in June” and “German crude steel output down 11.6 percent in H1 2025,” highlights significant challenges for the region’s largest steel producer. While “Italy reduced steel production by 9% m/m in June” indicates a more mixed performance, the overall sentiment remains negative. There is currently no explicit connection between satellite observed plant activities and any news article, although the general European activity average is low.

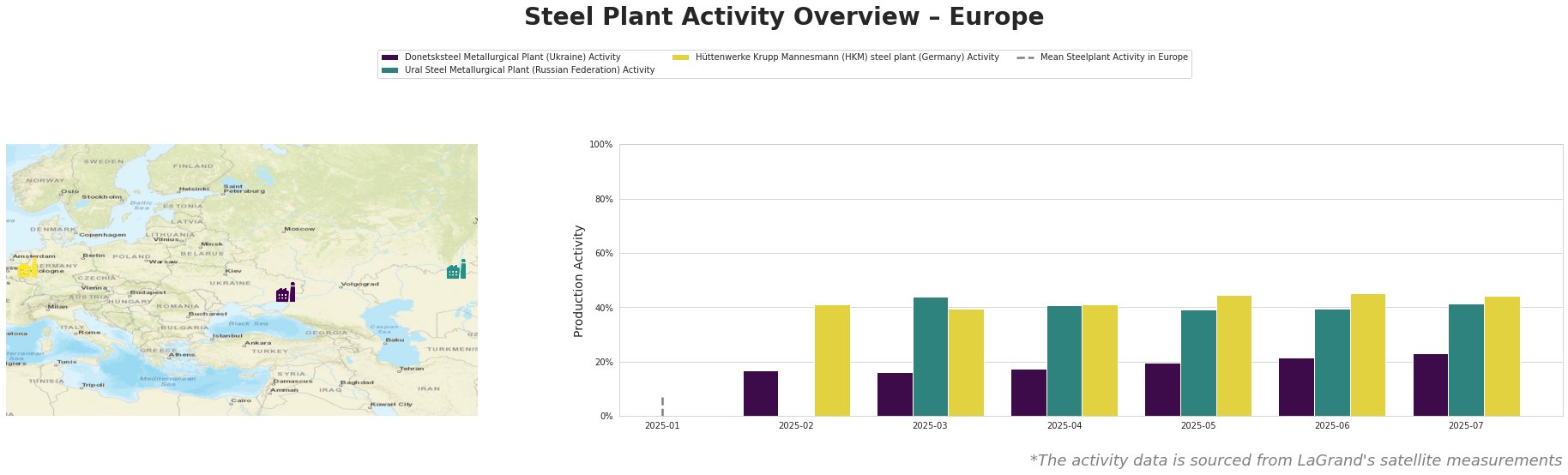

The mean steel plant activity level across observed European plants is showing a negative trend. Plant-specific activity shows a relatively stable trend from February to July. Donetsksteel Metallurgical Plant shows a rise from 17% in February to 23% in July. Ural Steel Metallurgical Plant shows a slight decline from 44% in March to 41% in July. Hüttenwerke Krupp Mannesmann (HKM) steel plant Activity shows a rise from 39% in March to 44% in July. It is important to note that the mean average is heavily impacted by a single outlier in the data.

Donetsksteel Metallurgical Plant, located in Donetsk, Ukraine, primarily produces pig iron using integrated (BF) processes and BF/EAF equipment. While satellite data shows a gradual increase in activity from 17% in February to 23% in July, no direct link to the provided news articles or explicit implications could be established, possibly due to the conflict in the region. The plant’s 1.5 million tonnes per annum (ttpa) iron production capacity could be crucial for specific regional buyers, but geopolitical instability adds significant risk.

Ural Steel Metallurgical Plant, situated in the Orenburg region of Russia, is an integrated steel plant with a crude steel capacity of 1.6 million ttpa. Its key products include pig iron, billets, and flat products. The plant’s activity has fluctuated slightly between February and July, with a notable peak in March at 44% and a drop to 39% in May and June, before a small recovery to 41% in July. This activity, however, cannot be directly linked to the European news articles concerning German and Italian production.

Hüttenwerke Krupp Mannesmann (HKM) steel plant in Germany, has a crude steel capacity of 6 million ttpa using integrated (BF) processes and BOF technology. The plant’s activity has shown a steady presence from February to July, with a peak activity level of 45% in May and June. However, this observed stability does not seem to reflect the sharp production declines reported in “Germany reduced steel production by 15.4% y/y in June” and “German crude steel output down 11.6 percent in H1 2025.”

Given the reported production declines in Germany and Italy, alongside the relative stability in activity at HKM, potential supply disruptions, particularly in flat steel products, are possible.

Recommended Procurement Actions:

– Steel Buyers Focused on the Automotive Sector: Given the weakness highlighted in the Italian automotive sector in “Italy reduced steel production by 9% m/m in June“, immediately diversify your flat steel supply base to mitigate potential shortages. Prioritize suppliers outside of Italy in the short term and closely monitor production data for Q3 2025.

– Buyers Dependent on German Steel: The significant production cuts in Germany, as reported in “Germany reduced steel production by 15.4% y/y in June” and “German crude steel output down 11.6 percent in H1 2025“, necessitate proactive measures. Secure alternative supply sources for H2 2025, and negotiate flexible delivery schedules to buffer against potential delays.