From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Mixed Signals Amidst Fluctuating Raw Material Export Dynamics, Individual Plants Showing Stable Activity

Europe’s steel market faces a complex landscape influenced by global raw material trends and varying plant-level activities. The Australian export market for Iron Ore and Met Coal is critical for the European market. While “Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices“, this potentially positive sign for European steelmakers is tempered by the projected decline in iron ore revenues as highlighted in “Australia expects a $19 billion decline in iron ore export revenues by 2027“. It remains unclear whether these contradictory raw material export signals from Australia will directly affect the European steel industry at this time, but the observed activity trends at key European steel plants may offer some clues.

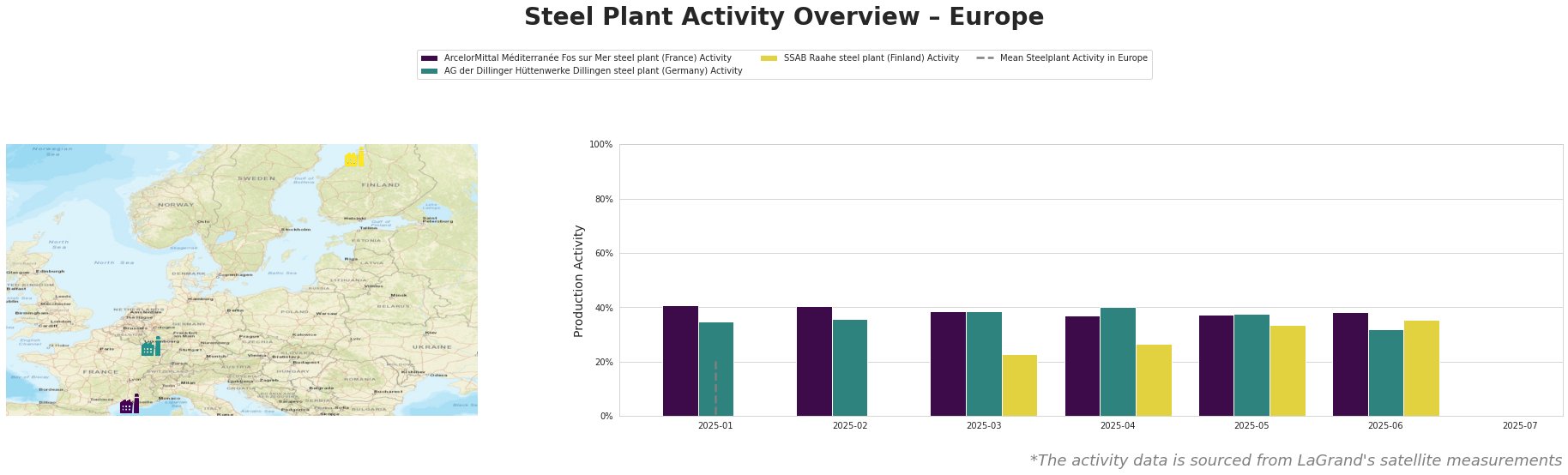

The following table shows the observed monthly activity for key steel plants in Europe:

The data contains erroneous negative numbers for Mean Steelplant Activity, which are not considered in the following analysis. From January to June 2025, ArcelorMittal Méditerranée Fos sur Mer maintained a relatively stable activity level, fluctuating between 37% and 41%. AG der Dillinger Hüttenwerke Dillingen similarly exhibited stable activity, ranging from 32% to 40%. SSAB Raahe shows an increasing trend from March (23%) to June (35%), although data is incomplete. Comparing individual plants to the flawed “Mean Steelplant Activity in Europe” provides no actionable insight. It’s crucial to note that “Australia’s Gladstone port coal exports drop in FY25“ due to various disruptions, including rail line closures. While this news may potentially impact coking coal supply to European steelmakers, no direct link can be established between this event and the stable activity levels observed in the provided steel plants.

ArcelorMittal Méditerranée Fos sur Mer, located in France, operates as an integrated BF-BOF plant with a crude steel capacity of 4000 ttpa. It produces semi-finished and finished rolled products like slabs and coils for various sectors, including automotive and infrastructure. The plant’s activity remained relatively stable between January and June 2025, fluctuating between 37% and 41%. No direct correlation can be established between the stable plant activity and the news regarding fluctuations in Australian coal and iron ore exports.

AG der Dillinger Hüttenwerke Dillingen in Germany, also an integrated BF-BOF plant, has a crude steel capacity of 2760 ttpa. It specializes in heavy-plate products for industries like energy and machinery. The plant demonstrated stable activity between January and June 2025, ranging from 32% to 40%. No direct relationship can be inferred between the stable activity and the Australian export market reports.

SSAB Raahe in Finland utilizes BF-BOF technology with a crude steel capacity of 2600 ttpa. This plant manufactures hot rolled and coiled products. Activity increased from 23% in March to 35% in June 2025. Again, no direct connection can be made between this observation and the provided Australian export news.

Given the stable activity levels at the observed European steel plants, despite the news of fluctuating raw material exports, steel buyers should avoid panic-driven procurement strategies. While Australia expects a decline in Iron Ore export revenues due to reduced demand and production in China as well as increased competition from Brazil and Africa per the article, “Australia expects a $19 billion decline in iron ore export revenues by 2027”, the effects on the steel market in Europe are currently uncertain. A diversified approach to supplier selection remains crucial. Further monitoring of raw material pricing and detailed European import data is advised. The lack of direct correlation between the news articles and plant activity suggests that factors internal to Europe or other global events may be more influential at this time.