From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Insights: Activity Drops Amid Legal Turmoil and Supply Concerns

Recent developments in the European steel market indicate a very negative sentiment, primarily driven by the legal disputes surrounding ArcelorMittal and its operations at the Acciaierie d’Italia (ADI), as highlighted in “ArcelorMittal rejects Italy’s claims regarding Acciaierie d’Italia“ and further detailed in “ArcelorMittal denied all allegations in the case related to its Ilva plants in Italy.” As these legal challenges persist, satellite-observed activity data reveals a notable decline in production, particularly impacting several key steel plants in Europe.

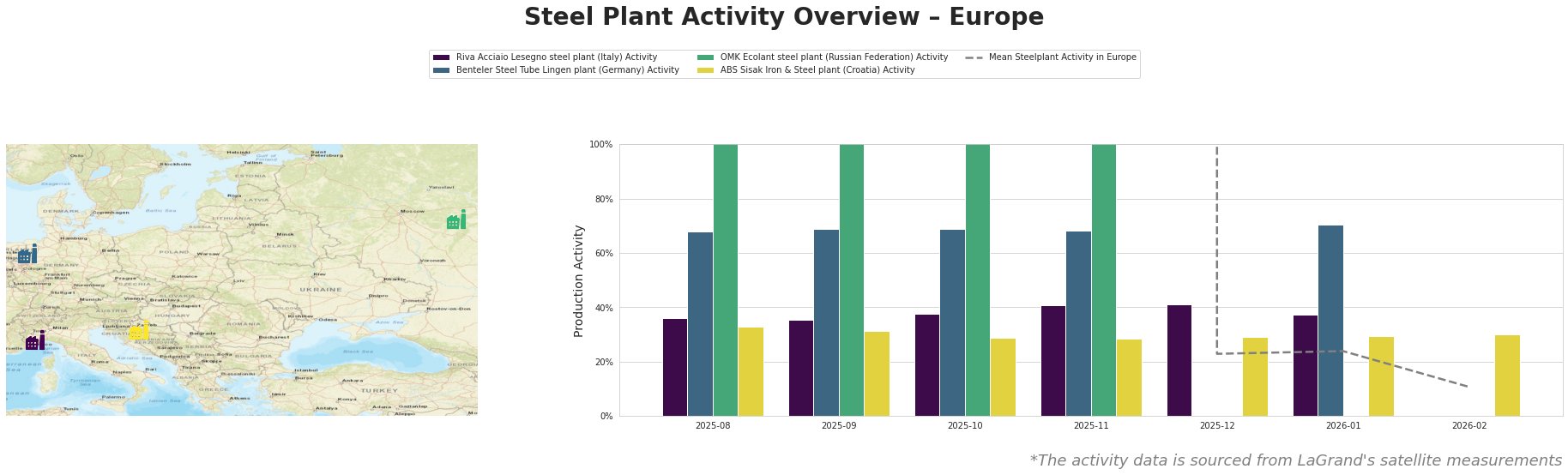

In recent months, activity at the Riva Acciaio Lesegno plant has shown a gradual increase peaking at 41% in December 2025, yet this is overshadowed by the overall market decline, especially as activity fell to just 37% in January 2026. This trend aligns with concerns from ArcelorMittal regarding operational challenges noted in articles like “ArcelorMittal rejects €7bn Ilva claim, confirms court summon,” reflecting broader industry instability due to the legal environment. Meanwhile, the Benteler Steel Tube Lingen plant showed slight variations but maintained higher activity levels around 68-70%, though its context remains fragile against these overarching legal challenges.

The OMK Ecolant and ABS Sisak plants displayed concerning activity levels, with drops recorded in the past few months. Notably, the activity level at ABS Sisak has steadily decreased, indicating potential supply disruptions as it currently hovers around 30%, causing further alarm among steel buyers.

Given these insights, procurement professionals should be aware of potential supply disruptions, particularly concerning the Riva Acciaio Lesegno and ABS Sisak plants, linked to the legal disputes impacting operational security and market confidence. Immediate recommendations include:

- Diversifying Supply Chains: Steel buyers should consider sourcing from more stable options such as the Benteler Steel Tube Lingen plant, which has shown more consistent activity levels.

- Proactive Contracts: Engage in renegotiating terms with suppliers to account for potential volatility, particularly for products stemming from Riva Acciaio or ABS Sisak, where declines could threaten supply fulfillment.

- Monitoring Legal Developments: Keeping a close watch on ongoing legal proceedings faced by ArcelorMittal will be crucial for anticipating market shifts and supply availability.

Buyers are urged to act swiftly and strategically, leveraging these insights to navigate the current market landscape effectively.