From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Green Steel Expansion Drives Positive Outlook Amidst EAF Investments

Europe’s steel market exhibits a very positive sentiment, fueled by expanding low-emission steel initiatives and strategic investments in electric arc furnace (EAF) technology. This trend is directly supported by news regarding ArcelorMittal’s commitment to the Low Emission Steel Standard (LESS), as highlighted in “ArcelorMittal Increases Low Emission Steel Standard Support,” “ArcelorMittal expands commitment to low-carbon steel with LESS membership across Europe,” and “ArcelorMittal expands support for the LESS green steel standard“. Furthermore, the investment in EAF capacity at Tata Steel UK’s Port Talbot plant, as reported in “Tata Steel UK orders electrification package for Port Talbot from ABB” and “Tata Steel UK orders electrification package for Port Talbot from ABB” reinforces this positive trajectory. While a direct correlation between these news announcements and the observed satellite data cannot be definitively established, the concurrent investments and market developments suggest a strong positive relationship.

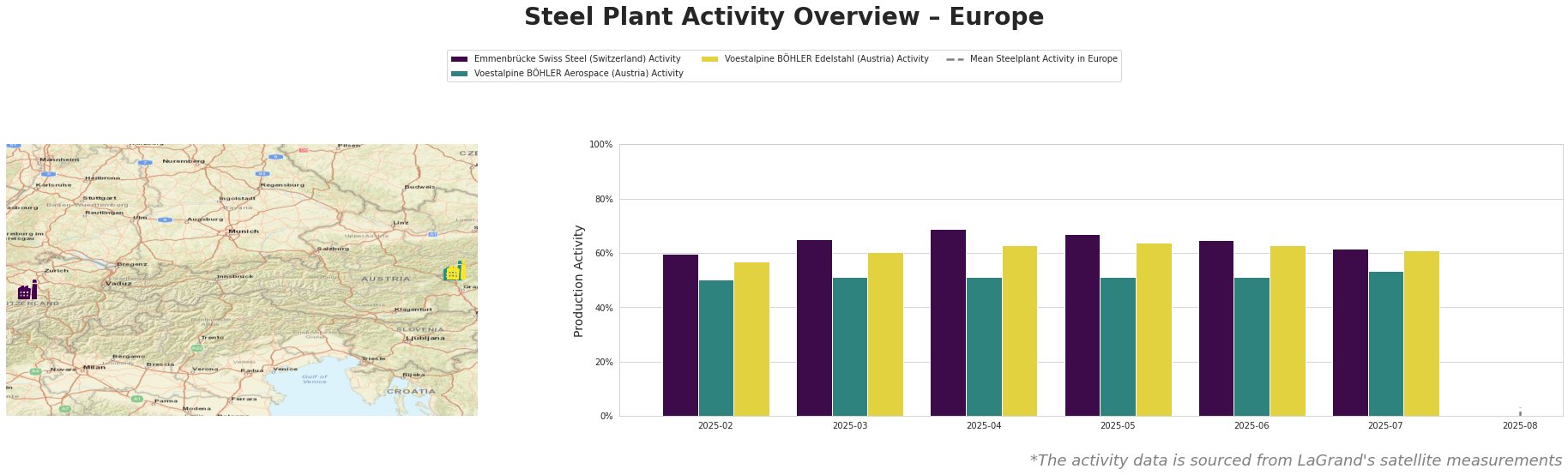

Observed steel plant activity, aggregated across Europe, is presented below:

Activity at Emmenbrücke Swiss Steel in Switzerland saw a peak in April 2025 at 69%, followed by a gradual decline to 62% by July 2025. Voestalpine BÖHLER Aerospace in Austria demonstrated stable activity around 51% until July 2025, when it slightly increased to 53%. Voestalpine BÖHLER Edelstahl in Austria experienced an increase from 57% in February 2025 to 64% in May 2025, then declined to 61% by July 2025. The mean steel plant activity in Europe remains erratic and not suitable as a reliable reference. No direct connections between these plant-specific activity changes and the aforementioned news articles can be established.

Emmenbrücke Swiss Steel, an EAF-based plant with ResponsibleSteelCertification, exhibited a fluctuating activity trend, peaking in April 2025. Voestalpine BÖHLER Aerospace, also relying on EAF technology, maintained relatively stable activity levels, with a slight uptick in July. Voestalpine BÖHLER Edelstahl, another EAF-based facility, experienced a period of increased activity followed by a decrease. Given their reliance on EAF technology, it’s plausible that these plants could indirectly benefit from the broader push towards low-carbon steel production highlighted in the ArcelorMittal and Tata Steel news, but no direct link is visible in the data.

The commitment to expanding low-emission steel production, particularly through EAF technology, signals a potential shift in supply dynamics. For steel buyers and market analysts, the increasing adoption of the LESS standard by ArcelorMittal, coupled with investments in EAF technology at Tata Steel UK, indicates a growing availability of low-emission steel products.

Recommended Procurement Action: Steel buyers should proactively engage with suppliers like ArcelorMittal to secure contracts for XCarb® steel, leveraging the company’s expanded LESS membership and growing production capacity. Procurement professionals should also monitor the progress of Tata Steel UK’s Port Talbot EAF project, anticipating increased availability of low-emission steel from this source by 2028. It is crucial to emphasize sustainability requirements in upcoming tenders to capitalize on the increasing supply of green steel and to further accelerate the decarbonization of the industry.